Not all “Crowdfunding” is Created Equal: Navigating a Terminology Maze and the Oculus Case Study

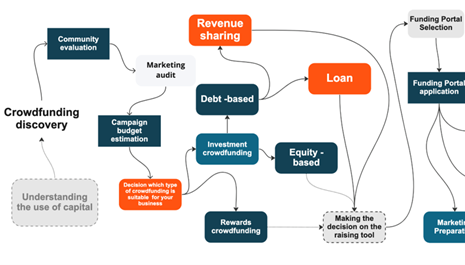

In the dynamic realm of crowdfunding, different models have emerged to cater to different fundraising needs. However, a common pitfall lies in the tendency to conflate "donations crowdfunding," "rewards crowdfunding," and "regulated investment crowdfunding." While these models share a common term - “crowdfunding” - they are very different and serve distinct purposes.

Donations Crowdfunding is typified by platforms like GoFundMe and involves raising funds for personal causes without an obligation to provide a product. Someone has a hospital bill and they appeal to donors. “Donors” not “Investors.” In other words, there is not the expectation or obligation of a “return” of any kind with donations crowdfunding.

Rewards Crowdfunding is a popular model exemplified by platforms like Kickstarter and Indiegogo and it allows creators to pre-sell a product or service to backers. “Backers” not “Investors.” In other words, contributors or backers receive tangible rewards in return for ...more

The Story of Tampon Tribe From Endometriosis to Crowdfunding

Discover the incredible journey of Jennifer Eden, co-founder and CEO of Tampon Tribe, as she turned her personal experience into a mission to provide healthier and eco-friendly period products. Their growth and success are a testament to their commitment. Let's support this fantastic initiative!

https://www.superpowers4good.com/p/the-story-of-tampon-tribe-from-endometriosis#details

...moreJoin me in the Inaugural Cohort for the Qualified Accredited Investor Certification

Posted at 9/27/2023

I wanted to share an interesting new program that I recently learned about - the Qualified Accredited Investor (QAI) certification from Doriot Venture Labs and IU Kelley School of Business.

The goal of this new certification is to evaluate an individual's expertise in venture capital and startup investing. It involves passing a FINRA exam and completing an investment simulation. Notably, this program is under review by the SEC to establish itself as a viable alternative to the traditional wealth-based Accredited Investor standard.

QAI has the potential to help level the playing field in the venture world. As the program materials mention, currently the top 20% most knowledgeable investors receive 80% of the gains. QAI could help provide a way for more people to demonstrate their sophistication.

I'm such a strong believer in what Doriot Venture Labs is doing that I invested in the company, and I'll also be participating in the first cohort for the new QAI certif...more

Unlocking Growth: How Customer-Shareholders from Crowdfunding Can Boost Lifetime Value and Enterprise Value

Increasingly, companies are turning to Regulated Investment Crowdfunding as a strategy to raise capital and convert their customers into investors or “investomers” as many have coined the phrase. As companies consider this business strategy, it’s important they understand the concept of Lifetime Value (LTV) and its impact on Enterprise Value (EV). LTV, short for Lifetime Value of a Customer, quantifies the total revenue a business can expect to earn from a single customer throughout their entire relationship with the company. EV, on the other hand, represents the total value of a business, including its debt and equity. These crucial metrics help businesses assess their long-term profitability and overall worth.

Investment Crowdfunding is not only a way to enhance LTV but also a way to drive up EV. I recently read a white paper by the company Dealmaker entitled “The Bottom-Line Value of Turning Customers into Shareholders” which cited research and s...more

Accounting for Revenue-Based Financing

I'm working to better understand both U.S. tax and GAAP accounting for revenue-based financing transactions. Below, I'll post the exchange I had with ChatGPT. I was impressed by what it understood (Bing's answer suggests it couldn't understand the question.) Still, ChatGPT ultimately got couldn't cogently explain the accounting rules.

Do you know how to account for the cash flows for both lender and borrower for both tax and GAAP purposes?

Certainly, I can provide you with an overview of the Generally Accepted Accounting Principles (GAAP) and tax accounting considerations for revenue-based financing transactions.

GAAP Account

DeRosa Group: CfPA Crowdfunding Issuer Interview Series

The DeRosa Group is a family-owned business that invests in residential and commercial properties, with a mission of "Transforming Lives Through Real Estate." It was founded by Matt and Liz Faircloth in 2004. Their journey began with the purchase of a modest duplex just outside of Philadelphia, fueled by a $30,000 private loan. Since then, they have mastered the art of optimizing properties for their highest and best use, revolutionizing single-family homes, multi-family residences, apartments, mixed-use spaces, and retail outlets, as well as offices. This interview was conducted with Herve Francois.

INTERVIEW

CFPA: Can you tell us a little bit about your company? What does your company do and at what stage is it?

Herve Francois: DeRosa Group is a real estate investment company that invests in large multifamily apartment complexes. Our motto, "Transforming Lives Through Real Estate" is all about improving the living situation of our tenants by providing them an attractive plac

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

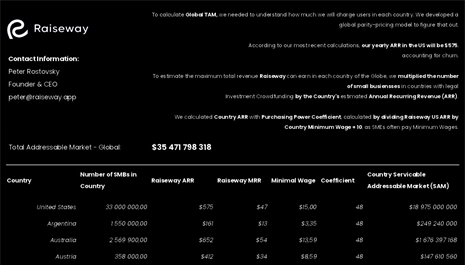

How we calculated Raiseway's Global Total Addressable Market

Disclaimer: (1) the issuer is considering an exempt offering, but has not decided upon any particular exemption; (2) the issuer is not soliciting any money or other consideration and, if sent, will not be accepted by the issuer; (3) the issuer will not sell securities or accept commitments to purchase securities until the issuer decides on which exemption it will pursue and satisfies any required filing, disclosure or qualification requirements; and (4) all indications of interest made by solicitees are non-binding.

To calculate Global #TotalAddressableMarket, we needed to understand how much Raiseway will charge users in each country.

We developed a global parity-pricing model to figure that out.

According to our most recent calculations, our yearly Annual Recurring Revenue (ARR) in the US will be $575, accounting for churn.

(^This isn't exactly right, we need to update the model. When we do, the TAM numbers will move by a n million, not sure which direction. 🤡 )

...more

Devin Thorpe

Devin Thorpe

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Raiseway

Raiseway