Request for Comment: Crowdfunding Task Database

Posted at 4/8/2023

Dear members of CfPA community,

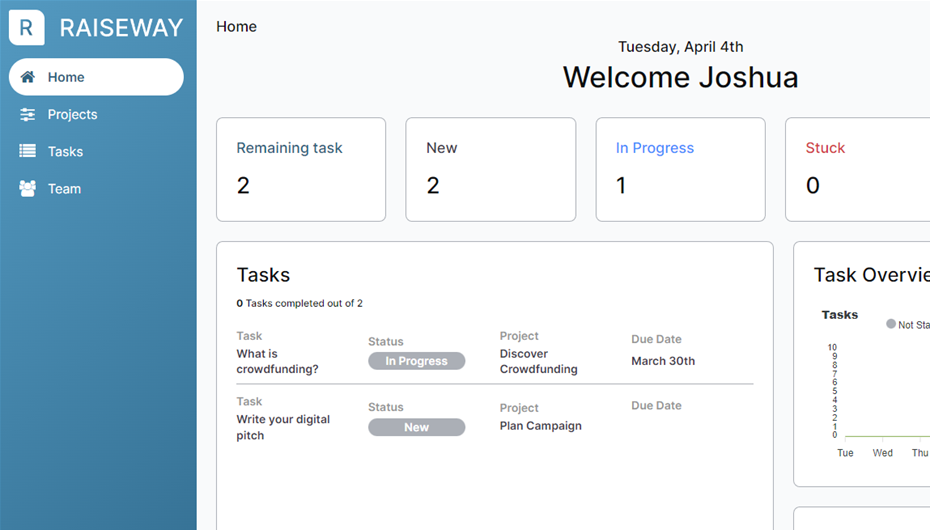

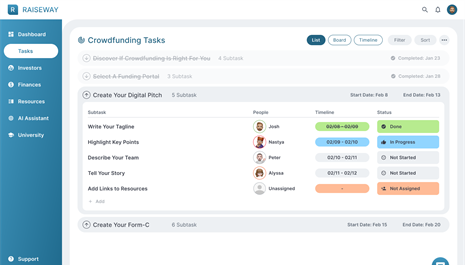

What you see above is a screenshot from the pre-release draft of our system for entrepreneurs that want to go through the crowdfunding process.

We'd love to hear your feedback on it & the data sheet below, with a list of tasks involved in the Equity Crowdfunding Process. Would you be open to scheduling a time to speak to us and share your thoughts?

We'd love to hear your thoughts about & chat about potentially working together - here's the Calendly link to meet. During the call I'll show you the database. Will gladly hear your thoughts about how to make the tool better.

Best,

Peter

CfPA BoD

CEO & Co-Founder of RaiseWay

...moreYou can't stop progress. Could an industry self-regulating organization (SRO) to govern the use of AI be funded through regulated investment crowdfunding?

Part 1:

You can't stop progress. Just like our ancestors couldn't put the genie back in the bottle once they learned how to use fire, we can't slow down the adoption of Artificial Intelligence (AI). It's like trying to hold back a tidal wave with a single sandbag.

Sure, some folks might be scared of AI, just like they were scared of fire. And you can't blame them even if they ironically call themselves the "Future of Life." New things can be scary. But the truth is, we're living in a world where AI is already all around us. From our phones to our cars to our homes, it's already a part of our daily lives. And with NLP becoming more accessible every day, entrepreneurs are seeking ways to deploy it in every aspect of their businesses.

And let's face it, AI has the potential to do a lot of good. It can help us solve problems, make our lives easier, and even save lives. While some billionaires make claims that “population collapse” is a greater threat to humanity than even climate chan...more

Investment Crowdfunding Is a Powerful Tool for Building Local Capital

This post was originally shared on Superpowers for Good.

Regulated investment crowdfunding is a powerful tool for building local capital in your neighborhood or town.

There are three perspectives I’ll discuss here:

-

Investor perspective

-

Entrepreneur perspective

-

Community leader perspective

For clarity, whenever I talk about crowdfunding today, I’ll be referring to the regulated investment crowdfunding on websites like Wefunder, Republic and Start Engine—and dozens of others. I’m not talking about GoFundMe or even the popular rewards crowdfunding sites Kickstarter and Indiegogo.

That said, there may be no better way for an entrepreneur to prepare for an investment crowdfunding round than to conduct a rewards campaign. We’ll talk about that another day.

Investor Perspective on Building Local Capital Via Crowdfunding

...moreCfPA Commuity's thoughts on RaiseWay's Crowdfunding Campaign Management Toolkit

Posted at 3/28/2023

Hi everyone! Together with my co-founder - Josh McSorley - and we are building a tool to make investment crowdfunding easy for businesses raising capital.

In this 3-min Loom Video I cover our task manager view.

What do you think? Thank you so much to everyone who shares their thoughts! In the next videos we can cover:

- AI Campaign Assistant

- Investor Relationship Manager

- Funding Portal Selector

Click here to join the early access waitlist here - alpha version shall be released on April 15th!

I would sincerely appreciate it if you shared this with any business looking to raise capital with crowdfunding on a tight budget.

Thank you,

Co-Founder & CEO of RaiseWay

Member of BoD of CfPA

...more

Regenerative sustainability video marketing strategies

That statement is generally true. While guerrilla marketing tactics can be effective in specific contexts, crowdfunding has become a highly competitive and complex landscape. Simply relying on grassroots tactics is unlikely to be enough to ensure success.

Crowdfunding campaigns often require a significant amount of planning, strategic thinking, and resources to generate momentum and reach their funding goals. This can include developing a solid brand and messaging, building a compelling story around the project or product being funded, identifying and engaging with potential backers through various channels (such as social media, email marketing, and influencer outreach), and leveraging data and analytics to optimize campaign performance.

In addition, crowdfunding platforms have become more sophisticated. They offer a range of features and tools to help campaigners succeed, such as campaign management dashboards, built-in analytics, and access to third-party marketing services.

Therefo...more

Regenerative sustainability marketing tactics

Regenerative sustainability marketing tactics are varied and can include a range of strategies to promote sustainable practices and regenerative approaches. Here are some examples:

- Highlighting regenerative agriculture: Regenerative agriculture is a farming method that focuses on improving soil health, increasing biodiversity, and sequestering carbon. Brands can showcase their use of regenerative agriculture in their products and educate consumers about the benefits of this approach.

- Communicating carbon neutrality: Brands can use messaging highlighting their commitment to reducing or offsetting their carbon footprint. This can include using renewable energy, reducing emissions through efficient production methods, or supporting carbon offset programs.

- Emphasizing sustainable packaging: Sustainable packaging options such as compostable, biodegradable, and recyclable materials can be highlighted in marketing campaigns. This can also include reducing packaging waste and utilizing reusab

Boxabl: CfPA Crowdfunding Issuer Interview Series

Boxabl is an American housing construction technology company based in Las Vegas, Nevada. It was founded in 2017 by Paolo Tiramani, Galiano Tiramani and Kyle Denman to supply accessory dwelling units (ADUs). It is among the most successful companies to have benefited from regulated investment crowdfunding having raised over $160 million. This interview was conducted with Galiano Tiramani.

INTERVIEW

CfPA: Can you tell us a little bit about your company? What does your company do and at what stage is it?

GALIANO: Boxabl operates factories that produce a new kind of housing. We have technology that we believe will allow us to mass produce housing on a scale and for a cost that was never before possible. Our goal is to dramatically lower housing costs for the world.

CfPA: What's the market in which you see your company operating?

GALIANO: Our initial product is a small studio apartments. After that we will roll out a system of room modules that stack and

Is Reg D Suitable for My Company?

Regulation D (Reg D) is a set of rules established by the U.S. Securities and Exchange Commission (SEC) that allows companies to raise capital without registering their securities for public sale and is related to, but different than other JOBS Act regulations. Reg D also establishes certain disclosure requirements that companies must comply with when selling securities under this type of offering and offers several advantages for companies seeking to raise capital, these include:

- Ability to raise capital from accredited and some nonaccredited investors

- Reduced disclosure requirements, and faster access to capital

- No limits on offering sizes

However, there are also certain drawbacks associated with Reg D. For example, companies must comply with state regulations that may require disclosure of notices of sale or the names of those who receive compensation in connection with the sale. Additionally, the benefits of Reg D only apply to the issuer of the securities, not to affil...more

Digital Marketing Experts

Digital Marketing Experts

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

KoreConX

KoreConX