Alpine-X: CfPA Crowdfunding Issuer Interview Series

Alpine X Inc. is a holding company with its headquarters in Virginia, whose mission is to develop family-centric active lifestyle communities and experience-based sports entertainment venues throughout the United States. In partnership with world-class engineering and development firms, the company conceives and creates one-of-a-kind recreational destination properties that integrate harmoniously with their surroundings. Through innovative use of land and architecture, collaboration with local organizations, and environmental responsibility, Alpine-X strives to create properties that are financially and environmentally sustainable.

INTERVIEW:

CfPA: Can you tell us a little bit about your company? What does your company do and at what stage is it?

Jeff Hokenson: Alpine-X is developing Indoor Snowsports Resorts in major metropolitan areas across North America. Our initial target markets are Washington DC, Dallas, and Austin, and we are assessing several other potent...more

Overdue Diligence: Examining the Cryptocurrency Industry’s Billion-Dollar Scandal

What would happen if inexpensive flying cars hit the market tomorrow? Wouldn’t it be great if you could just fly right over stop signs and red lights on the ground or avoid traffic jams? But soon there would be a disastrous crash, and authorities would ground everyone while they figured out what to do. Meanwhile, flying car owners would quickly learn that new technologies don’t make them magically immune to liability in tort and criminal negligence. In this scenario, flying car owners and the companies that manufactured them should have looked into air traffic laws that have always applied.

Something like this has happened in the cryptocurrency industry. Because cryptocurrency is so new, many people have assumed they were not subject to the traditional rules, a rich new area to be quickly exploited before the authorities showed up to rein things in. But there have always been laws to regulate it, which have gone ignored by those treating crypto like a modern-day gold rush. Many people ...more

Would you like to learn more about safely online investing?

The year of trust and compliance is here and we, at KoreConX, are more than happy to share with you what innovations we bring to the market. We will walk you through topics such as cybersecurity, investing online, and how to be sure you are doing it safely and compliantly inside a regulated environment.

Our CRO, Peter Daneyko, has a lot to share about KoreID - with some surprises coming up, with our communications coordinator, Rafael Gonçalves.

KoreTalkX #18: Passport for online investing

The year of trust and compliance is here and we, at KoreConX, are more than happy to share with you what innovations we bring to the market. We will walk you through topics such as cybersecurity, investing online, and how to be sure you are doing it safely and compliantly inside a regulated environment.

Our CRO, Peter Daneyko, has a lot to share about KoreID - with some surprises coming up, with our communications coordinator, Rafael Gonçalves.

https://www.linkedin.com/video/event/urn:li:ugcPost:7019369734613667840/

...moreHere's an Easy New Year's Resolution to Change the World

There has been no shortage of articles about new year’s resolutions. I’d be reluctant to join the chorus if this one didn’t have the potential to yield so much good for so little effort.

Many people recommend focusing your 2023 goals on a single objective. If you’re struggling to find one, look no further! This one is easy.

If you are taking a portfolio approach to your self-improvement this year, here’s an idea that will be easy to add into the mix as it will take less time and money than most.

For 2023, set a goal to make an impact investment via crowdfunding.

To be clear, I’m not talking about donating to charity or helping someone in need on GoFundMe. Those are good and noble things to do, but I’m talking about something similarly easy but fundamentally different.

The biggest difference is that you could get your money back—with interest!

Mindset

The biggest challenge to making your first investment is your mindset. For about 90 years following the Great Depressio...more

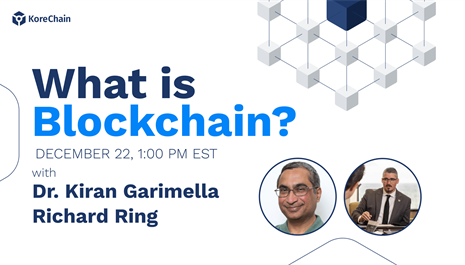

Do you understand blockchain?

There is a general understanding that crowdfunding, tokenization, and some other concepts are tightly connected. But do you understand what blockchain is? It is important to understand how it works to help us all understand Online Capital Formation.

Follow our Spotify Channel and welcome aboard.

...moreChange the zoning codes. Open up solutions for everyone.

Remember the “starter home?” It was a bungalow. Or a cottage? No, a rambler! I’m writing wistfully in the past tense because the starter home has largely disappeared.

This at a time when experts widely agree we need at least 6 million new homes to house all Americans? Yep. Because many cities and boroughs have made building small homes all but impossible.

The hardest project of my life was a 235 SQF “tiny home” on a 1500 SQF lot in Pittsburgh’s Garfield neighborhood.

I was attempting to build a single-family, detached home in a neighborhood with existing amenities and infrastructure. But the zoning codes as written originally left me with only 50 SQF to build on. 50!

I had to fight the zoning board and building inspector. I had to crowdfund the project (on www.SmallChange.co of course) because I couldn’t get a bank loan since there were no comps. It was as if the city had intentionally designed the codes to make the unit economics of building a starter completely unaffordable.

Communit...more

What’s the Differences Between Regulations A, CF, D, and S?

When it comes to raising capital, there are various ways you can raise money from investors. And while they all have their own specific compliance requirements, they all share one common goal: to protect investors while still providing them with opportunities to invest in private companies. Let’s look at the four most popular types of equity crowdfunding; through Regulation A, CF, D, or S.

Regulation A+ (RegA+)

Offering size per year: Up to $75 million

Number of investors allowed: Unlimited, as long as the issuer meets certain conditions.

Type of investor allowed: Both accredited and non-accredited investors.

SEC qualification required: Reg A+ offerings must be qualified by the SEC and certain state securities regulators and must also file a “Form 1-A”. Audited financials are required for Tier II offerings.

This type of crowdfunding is popular because it allows companies to raise up to $75 million per year in capital and is open to accredited and non-accredited investors. Offering...more

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

KoreConX

KoreConX