Unlocking Growth: How Customer-Shareholders from Crowdfunding Can Boost Lifetime Value and Enterprise Value

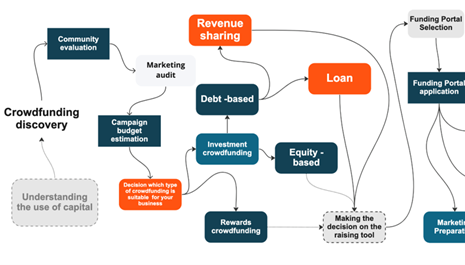

Increasingly, companies are turning to Regulated Investment Crowdfunding as a strategy to raise capital and convert their customers into investors or “investomers” as many have coined the phrase. As companies consider this business strategy, it’s important they understand the concept of Lifetime Value (LTV) and its impact on Enterprise Value (EV). LTV, short for Lifetime Value of a Customer, quantifies the total revenue a business can expect to earn from a single customer throughout their entire relationship with the company. EV, on the other hand, represents the total value of a business, including its debt and equity. These crucial metrics help businesses assess their long-term profitability and overall worth.

Investment Crowdfunding is not only a way to enhance LTV but also a way to drive up EV. I recently read a white paper by the company Dealmaker entitled “The Bottom-Line Value of Turning Customers into Shareholders” which cited research and s...more

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

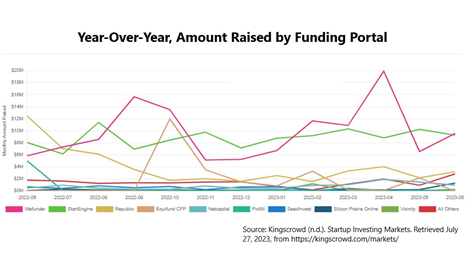

Our industry is broke

Dear colleagues at Crowdfunding Professional Association and beyond. We all love saying that the industry is doing great.

Math says "that's bs; CF industry is broke and dealflow is the problem." I am using funding portal data because transparency is forced upon these intermediaries.

Please don't shoot the messenger. I would like to be proven otherwise.

There are 70,000 startups in the United States within 33,000,000 small businesses. How many active Regulation Crowdfunding deals are there right now? 450.

Let's say that the average salary for a portal employee is $75,000 ($6 250 per month). Sounds like an OK living in the U.S. (unless you are in New York, San Francisco, Los Angeles, etc).

I went onto each of their LinkedIn pages and counted the number of employees. I assumed - rather generously - on average, only 50% of these "employees" are paid. The rest are advisors, investors, partners, etc.

I tried to count how much money each of the platforms will have left after receivi...more

You can't stop progress. Could an industry self-regulating organization (SRO) to govern the use of AI be funded through regulated investment crowdfunding?

Part 1:

You can't stop progress. Just like our ancestors couldn't put the genie back in the bottle once they learned how to use fire, we can't slow down the adoption of Artificial Intelligence (AI). It's like trying to hold back a tidal wave with a single sandbag.

Sure, some folks might be scared of AI, just like they were scared of fire. And you can't blame them even if they ironically call themselves the "Future of Life." New things can be scary. But the truth is, we're living in a world where AI is already all around us. From our phones to our cars to our homes, it's already a part of our daily lives. And with NLP becoming more accessible every day, entrepreneurs are seeking ways to deploy it in every aspect of their businesses.

And let's face it, AI has the potential to do a lot of good. It can help us solve problems, make our lives easier, and even save lives. While some billionaires make claims that “population collapse” is a greater threat to humanity than even climate chan...more

Investment Crowdfunding Is a Powerful Tool for Building Local Capital

This post was originally shared on Superpowers for Good.

Regulated investment crowdfunding is a powerful tool for building local capital in your neighborhood or town.

There are three perspectives I’ll discuss here:

-

Investor perspective

-

Entrepreneur perspective

-

Community leader perspective

For clarity, whenever I talk about crowdfunding today, I’ll be referring to the regulated investment crowdfunding on websites like Wefunder, Republic and Start Engine—and dozens of others. I’m not talking about GoFundMe or even the popular rewards crowdfunding sites Kickstarter and Indiegogo.

That said, there may be no better way for an entrepreneur to prepare for an investment crowdfunding round than to conduct a rewards campaign. We’ll talk about that another day.

Investor Perspective on Building Local Capital Via Crowdfunding

...moreCfPA Commuity's thoughts on RaiseWay's Crowdfunding Campaign Management Toolkit

Posted at 3/28/2023

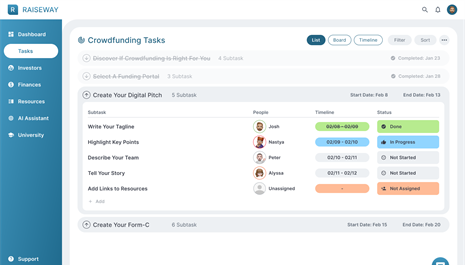

Hi everyone! Together with my co-founder - Josh McSorley - and we are building a tool to make investment crowdfunding easy for businesses raising capital.

In this 3-min Loom Video I cover our task manager view.

What do you think? Thank you so much to everyone who shares their thoughts! In the next videos we can cover:

- AI Campaign Assistant

- Investor Relationship Manager

- Funding Portal Selector

Click here to join the early access waitlist here - alpha version shall be released on April 15th!

I would sincerely appreciate it if you shared this with any business looking to raise capital with crowdfunding on a tight budget.

Thank you,

Co-Founder & CEO of RaiseWay

Member of BoD of CfPA

...more

What are the costs for a RegCF Issuance?

Raising capital is necessary for many companies, but it comes with a price tag. This is why we often receive questions from companies seeking to understand how to budget for the fundraising process. With Regulation Crowdfunding (Reg CF) issuances becoming increasingly popular in the United States, understanding the costs associated with these offerings is essential to successful capital raising.

To shed a light on this topic, we have worked with our KorePartners to research the estimated budget for a Reg CF offering. However, this estimated budget is based on a variety of factors that can influence the total cost of capital raising. Thus, this information will not apply to all companies but is a general guide to the expenses involved in a Reg CF raise.

Visit our blog to learn the end-to-end details.

...moreHere's an Easy New Year's Resolution to Change the World

There has been no shortage of articles about new year’s resolutions. I’d be reluctant to join the chorus if this one didn’t have the potential to yield so much good for so little effort.

Many people recommend focusing your 2023 goals on a single objective. If you’re struggling to find one, look no further! This one is easy.

If you are taking a portfolio approach to your self-improvement this year, here’s an idea that will be easy to add into the mix as it will take less time and money than most.

For 2023, set a goal to make an impact investment via crowdfunding.

To be clear, I’m not talking about donating to charity or helping someone in need on GoFundMe. Those are good and noble things to do, but I’m talking about something similarly easy but fundamentally different.

The biggest difference is that you could get your money back—with interest!

Mindset

The biggest challenge to making your first investment is your mindset. For about 90 years following the Great Depressio...more

Raiseway

Raiseway

KoreConX

KoreConX