Dear colleagues at Crowdfunding Professional Association and beyond. We all love saying that the industry is doing great.

Math says "that's bs; CF industry is broke and dealflow is the problem." I am using funding portal data because transparency is forced upon these intermediaries.

Please don't shoot the messenger. I would like to be proven otherwise.

There are 70,000 startups in the United States within 33,000,000 small businesses. How many active Regulation Crowdfunding deals are there right now? 450.

Let's say that the average salary for a portal employee is $75,000 ($6 250 per month). Sounds like an OK living in the U.S. (unless you are in New York, San Francisco, Los Angeles, etc).

I went onto each of their LinkedIn pages and counted the number of employees. I assumed - rather generously - on average, only 50% of these "employees" are paid. The rest are advisors, investors, partners, etc.

I tried to count how much money each of the platforms will have left after receiving their portal fees, after paying monthly salaries.

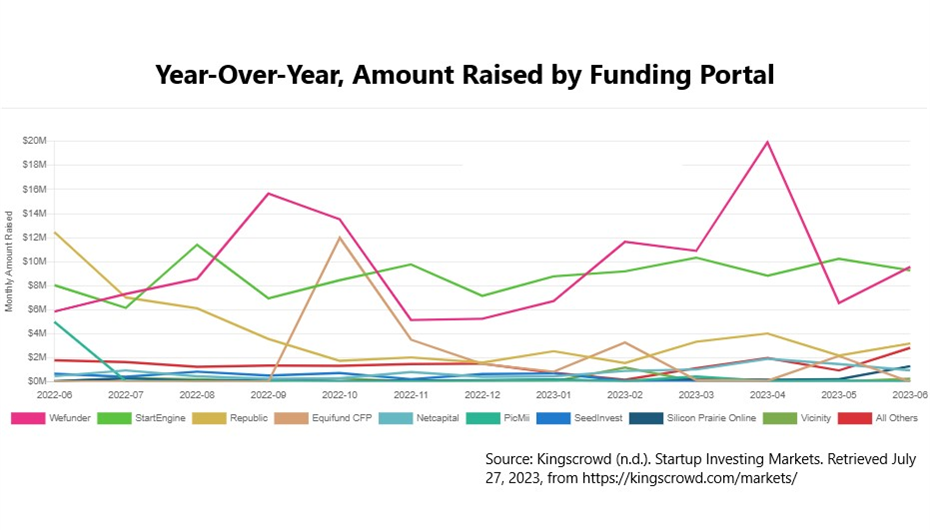

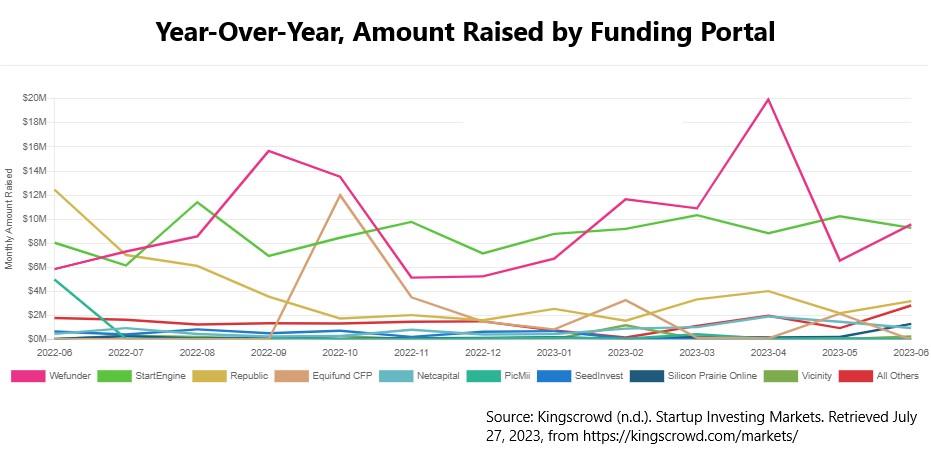

Per KINGSCROWD: "the top four Reg CF platforms in June 2023 were Wefunder ($9.5 million), StartEngine ($9.3 million), Republic ($3.2 million), and Silicon Prairie ($1.3 million). These four platforms accounted for 85.5% of all capital raised in June".

Per Crowdfund Capital Advisors, these platforms' fees are 6.7%, 7.5%, 6.9%, 5.3%, respectively.

DISCLAIMER:

- These are not profits.

- This was not a good month for the industry.

- THIS IS ME SHOOTING FROM THE HIP. I have no idea about the internal workings of these funding portals.

- This is data on the 4 funding portals with 85% of market share. There are 60+ more FINRA-registered funding portals.

- Funding portals doing poorly is indicative of how every other service provider in the industry are doing. This is all very alarming.

Earnings left after paying salares for June per portal:

Wefunder= ($9.5 million * 6.7%) - (150 employees * .5 * $6250) = $167,750

StartEngine= ($9.3 million * 7.5%) - (183 employees * .5 * $6250) = $125,625

Republic = ($3.2 million * 6.9%) - (676 employees * .5 * $6250) = $-1,891,700

Silicon Prairie = ($1.3 million * 5.3%) - (11 employees * .5 * $6250) = $34,525

Summing this up:

In the month of June, the top 4 funding portals holding 85% of the U.S. Regulation Crowdfunding market share, after paying the salaries, collectively had made $-1,563,800... Ok, something weird is happening with Republic's employee count. Perhaps we are not counting a stream of revenue, or maybe a lot of non-employees to tag themselves as employees. Let's say that they had $50k leftover.

So... the 4 most successful companies in the entire industry that is serving 33,000,000 businesses, collectively have less than $376k left over after paying salaries for the month of June.

There are over 65+ funding portals, besides these 4, holding 15% of the market.

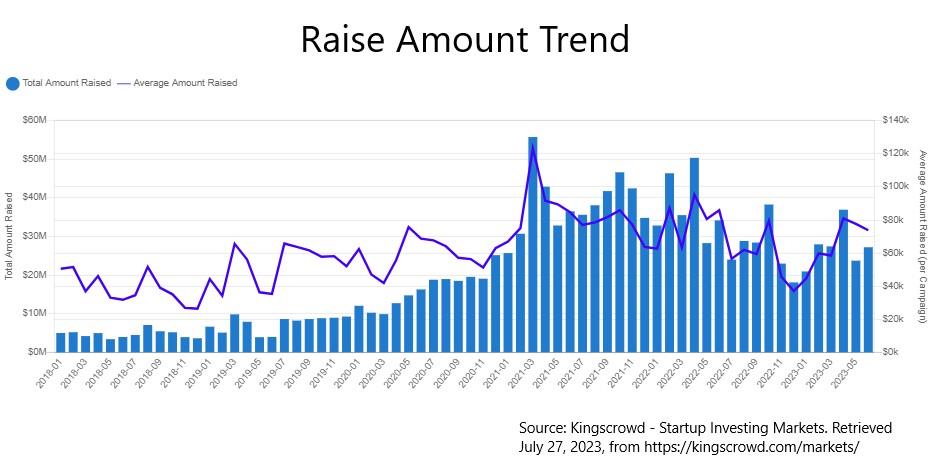

The 450 active deals raising on average $77k, supposedly, are feeding our entire professional community.

95% of investors come from the community of the business owner.

In order for the industry to suceed, we must lower the execution cost on the business owner. The barrier of entry to investment crowdfunding must drop.

Thank you for your attention,

CEO of Raiseway - we are a subscription as a service, making investment crowdfunding easy on any reputable funding portal.

Member of CfPA BoD

Register for FREE to comment or continue reading this article. Already registered? Login here.

0