BAMM! In the Age of AI: Capital Formation Beats Universal Basic Income

In January alone, U.S. employers announced 108,435 layoffs - up 118% year-over-year and 205% from December. It marked the highest January total since 2009. For millions of workers, the signal is clear: AI-driven disruption is no longer theoretical. It’s here, and it’s accelerating faster than our labor institutions can respond.

And yet - here’s the paradox - this may be one of the best moments in history to be an entrepreneur, even a solo-preneur.

AI has collapsed the cost of starting and scaling a business. One person, equipped with modern tools, can now do the work of a small team: build products, automate operations, market globally, and reach customers directly. Capital efficiency has never been higher. What’s missing isn’t talent or ambition - it’s access to capital.

The Wrong Response: Universal Basic Income

Universal Basic Income is often proposed as the humane response to job displacement. The intent is understandable. The mechanism is flawed.

Broad cash transfers do not expand...more

Patient Capital Takes Flight

What If We Designed Revenue Sharing Notes That Gives Companies Runway?

Picture this: A company raises $500,000 with a 5x return target.

In the first 3 years, they pay nothing. Zero revenue share. All capital goes to building, hiring, and developing products. Us investors signed up knowing this, we’re intentionally providing patient capital.

By the 4th year, the company hit its stride. They start sharing 3% of revenue. Not enough to constrain growth, but investors see the first returns tied to actual performance.

Years 5-6, the percentage increases gradually - 5%, then 7%. Company's still keeping the vast majority for growth, but the returns are accelerating.

After 7 years, full revenue share kicks in. Maybe 10-12% of revenue flows to investors until we hit that 5x multiple - $2.5M total. Then the agreement completes and the company is free and clear.

This is what patient capital actually looks like.

The company got a runway without payment pressure. Investors got 5x over roughly 10 yea...more

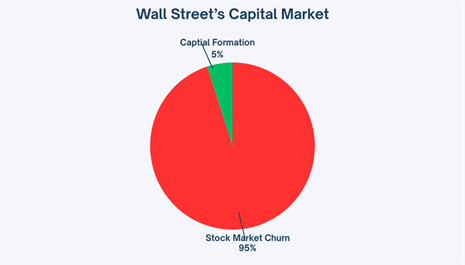

Wall Street's Capital Market

We Call The Stock Market A "Capital Market" When Only 5% Of Activity Is Actual Capital Formation.

The other 95%? Just churn. Trading that funds nothing.

$43 trillion in retirement accounts circulating through secondary markets. Zero dollars flowing to companies.

Take a look at Reg CF, the only public market where 100% of invested capital actually funds businesses creating value.

And what are we doing?

95% equity.

We're importing Wall Street's structure into the only market that's actually about capital formation.

Think about what equity actually is - it's perpetual:

▪️No lifecycle (exists forever)

▪️No return mechanism without exit or trading

▪️Becomes speculative the moment secondary markets open

▪️Drives perpetual growth pressure

Perpetual equity wasn't designed for our Reg CF productive market. It was designed for speculation.

Speculation combined with perpetual growth creates the conditions for algorithmic optimization and portfolio concentration. It's how we got the 'Magnificent S...more

Research on Crowdfunding Annual Reporting Compliance

For those interested in financial reporting compliance for Reg CF issuers, check out my working paper on SSRN here. The paper has been discussed with SEC Commissioners Peirce and Uyeda as well as featured on various podcasts/shows, including some from CfPA members. Podcasts/shows include: SuperPowers for Good, Test. Optimize. Scale., and Business Scholarship Podcast.

Abstract: Using the regulated, but largely unenforced setting of U.S. equity crowdfunding (ECF) we consider why managers comply with ongoing financial reporting regulations beyond enforcement and litigation risk. In a market with billions of dollars invested by millions of investors, over half of ECF issuers fail to file their mandated annual report, with only a third issuing timely. Using rich offering-level data, we show compliance is negatively associated with compliance costs and tardy filings are partially explained by the desire to issue additional securities. However, despite our rich data, the overall explanatory p...more

Why Language Matters (Part 1 of 3): When “Crowdfunding” Becomes a Four-Letter Word

On October 8, 2025, Fox19 Cincinnati ran a headline that could make anyone in the regulated investment crowdfunding world spit out their morning coffee:

“Ohio lawmakers introduce legislation to prevent crowdfunding for violent crimes.” (Read it here)

That’s one of those headlines that does collateral damage just by existing. It’s splashy, moralistic, and guaranteed to travel faster than nuance ever could.

But here’s the problem: every time “crowdfunding” makes the news in a criminal, political, or emotional context, it drags the entire ecosystem into the mud - including the legitimate, SEC-regulated platforms that have nothing to do with bail funds or bad behavior.

That’s what professionals call headline risk.

It’s what philosophers call guilt by association.

And it’s what the rest of us call a branding nightmare.

Regulated Investment Crowdfunding: The grown-up in the room

The Crowdfunding Professional Association (CfPA) has repeatedly urged everyone - media, policymakers, platforms ...more

We're excited about the summit on Wednesday!

On behalf of the entire CfPA Summit team, we can’t wait to see you at the Summit on Wednesday!

We're welcoming investors, issuers, regulators, and industry leaders. This is THE place to be if you are interested in Regulated Investment Crowdfunding!

For all attendees, please arrive a few minutes EARLY to avoid lines and grab a good seat.

Doors open at 8:15!!

Grab breakfast and find a seat so you don’t miss any of our awesome content!

We’ll be at the National Union Building (918 F St NW, 6th Floor)

1 block from Gallery Place–Chinatown Metro.

2 blocks from Metro Center.

Nearby parking garages: Atlantic Parking (610 9th St NW) or Colonial Parking (555 11th St NW).

CHECK YOUR EMAIL

If you're registered, check your email for all the details.

If you don’t have your ticket yet, it’s not too late! Here is the link to register: https://events.humanitix.com/regulated-investment-crowdfunding-summit-2025

2025 Regulated Investment Crowdfunding Summit - Detailed Agenda

2025 Regulated Investment Crowdfunding Summit

Overview

Day 1 – Tuesday, October 21, 2025: Advocacy Visits & Pre-event Reception

- AM & Afternoon: Constituent drop-ins (Capitol Hill) and regulator visits (DC)

- 5:30 – 7:30 PM: Cocktail Reception (@ National Union Building, 918 F St NW, Washington, DC 20004)

Day 2 – Wednesday, October 22, 2025: Summit Conference

- 8:30 AM–5:30 PM: Detailed agenda below. (@ National Union Building, 918 F St NW, Washington, DC 20004)

- ~6:00 – 8:00 PM: No-host happy hour / dinner (nearby venue TBD)

Day 1 · Tuesday, Oct 21 — Advocacy & Reception

CfPA's Statement Opposing the Offering of Republic Mirror Tokens under Regulation Crowdfunding

In recent months, investment platform Republic has announced plans to offer “Mirror Tokens” - digital instruments that track the economic performance of private companies such as SpaceX, Anthropic, Epic Games, Ramp, Canva, and Databricks. These tokens, like rSpaceX, do not provide ownership or voting rights, but instead offer a contractual claim tied to future liquidity events (e.g., IPOs or acquisitions). Marketed under Regulation Crowdfunding (Reg CF) with minimum investments starting at $50, Mirror Tokens enable retail investors to gain "exposure" to companies that are typically off-limits. As of early August 2025, Republic has listed 24 Mirror Tokens, with four currently open for reservations - raising pressing questions about how such synthetic products align with Reg CF’s purpose and its framework for investor protections (Crowdfund Insider, Axios).

Industry reporting and analysis offer a mixed yet critical picture:

-

ValueTheMarkets emphasizes that while Mi

CfPA 2025 Summit

CfPA 2025 Summit

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)