Research on Crowdfunding Annual Reporting Compliance

For those interested in financial reporting compliance for Reg CF issuers, check out my working paper on SSRN here. The paper has been discussed with SEC Commissioners Peirce and Uyeda as well as featured on various podcasts/shows, including some from CfPA members. Podcasts/shows include: SuperPowers for Good, Test. Optimize. Scale., and Business Scholarship Podcast.

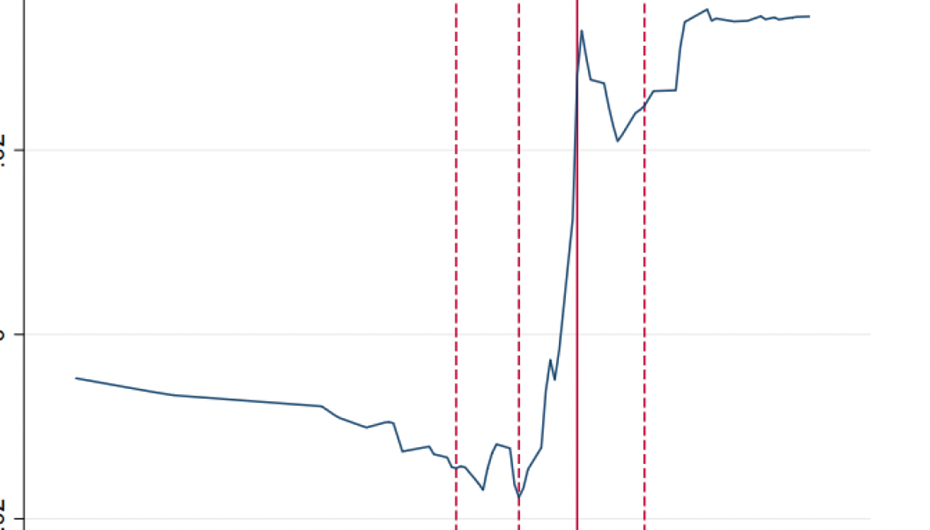

Abstract: Using the regulated, but largely unenforced setting of U.S. equity crowdfunding (ECF) we consider why managers comply with ongoing financial reporting regulations beyond enforcement and litigation risk. In a market with billions of dollars invested by millions of investors, over half of ECF issuers fail to file their mandated annual report, with only a third issuing timely. Using rich offering-level data, we show compliance is negatively associated with compliance costs and tardy filings are partially explained by the desire to issue additional securities. However, despite our rich data, the overall explanatory p...more

2025 Regulated Investment Crowdfunding Summit - Detailed Agenda

2025 Regulated Investment Crowdfunding Summit

Overview

Day 1 – Tuesday, October 21, 2025: Advocacy Visits & Pre-event Reception

- AM & Afternoon: Constituent drop-ins (Capitol Hill) and regulator visits (DC)

- 5:30 – 7:30 PM: Cocktail Reception (@ National Union Building, 918 F St NW, Washington, DC 20004)

Day 2 – Wednesday, October 22, 2025: Summit Conference

- 8:30 AM–5:30 PM: Detailed agenda below. (@ National Union Building, 918 F St NW, Washington, DC 20004)

- ~6:00 – 8:00 PM: No-host happy hour / dinner (nearby venue TBD)

Day 1 · Tuesday, Oct 21 — Advocacy & Reception

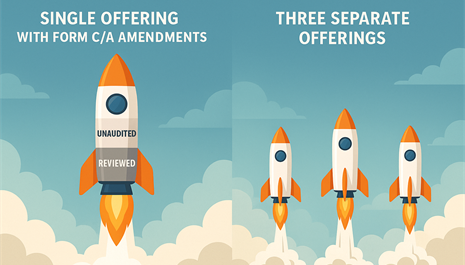

The Best Way to Raise $5M Under Reg CF in 12 Months Starting with Virtually Nothing

In recent months, I've been giving thought to the best way to do a $5 million Reg CF campaign, starting with very little upfront spend. It seems to me, there are two possible paths. Path one is to begin with a small (under $124,000) raise with a low initial closing threshold, say, $25,000, and later amend the Form C, using funds from the initial raise to fund legal, accounting and marketing expenses for rolling forward. The alternative path would be to do a series of independent raises, the first one very small and building, still with the goal of raising $5 million in 12 months.

I tasked Google Gemini with a deep research project to compare and contrast the regulatory and best practices for the two approaches. Here is the full report. Below is an executive summary. I'm curious now to get the opinions of experts like @Brian Christie, @Jenny Kassan, @Craig Denlinger and @Sara Hanks on this topic, but eagerly welcome feedback from everyone.

Executive Summary

This report evaluates tw...more

25 Reasons to Invest Through Regulated Investment Crowdfunding for Social Impact

I’ve spent years immersed in the world of impact investing, and if I sound a little fired up today, it’s because I am. The traditional capital markets continue to overlook brilliant, diverse entrepreneurs—especially those working in and for their communities. That’s why I’m passionate about regulated investment crowdfunding (Regulation Crowdfunding or Reg CF, particularly). It’s not perfect, but it’s the most promising tool we have to democratize access to capital, empower underrepresented founders, and reshape our economy from the ground up. Here are just a few of the reasons I believe so deeply in this movement:

-

Democratization of Capital

Reg CF breaks down barriers that historically excluded all but the wealthy from investing in private ventures. -

Access to Overlooked Founders

Traditional VC overlooks diverse founders; Reg CF helps level the playing field by allowing the crowd to support talent the system ignores. -

Rooted in Community

Reg CF enables investment in local businesses a

Why I love Crowdfunding Portals

I love regulated investment crowdfunding and the portals that participate in the space. I’ve got gripes and complaints, but overall, I’m their biggest fan. They are fundamentally essential to the ongoing success of the industry—and its future growth.

Today, I’d like to enumerate some of my favorite things about portals operating under Regulation Crowdfunding:

9 Things I Love About Portals

-

Pre-Screening Investments: We all rely on portals to screen the offerings they host. They all use different criteria, but they are all required to exclude companies associated with “bad actors”—people who have been in trouble with the SEC in the past.

-

Regulatory Compliance: Having run a FINRA-member, SEC-registered broker-dealer, I know how hard it is to comply with the regulations. That is a big reason I don’t run a portal today! I’m grateful that they have made the effort to comply with the rules. These sometimes impose on us minor inconveniences, but the net effect is a safe and

CfPA Regulated Investment Crowdfunding and Leadership Summit 2024 - Detailed Agenda

Day 1 (10/22: Tues.) : Advocacy Visits & Pre-event Reception

|

10:00 AM - 5:30 Advocacy Meetings

|

Capitol Hill + Regulator visits CfPA members registered for the Summit may be eligible to attend some of the advocacy meetings. |

|

5:30-8:00 PM Cocktail Reception |

Sunset Cocktail Reception Top of the Town - Top Floor and Rooftop (1400 14th Street North, Arlington, VA) (Streaming Music by DJ Scott McIntyre)

|

Day 2 (10/23: Wed.) : Conference and Summit

Venue: Top of the Town (Top Floor 1400 14th Street North, Arlington, VA)

“One of the most magnificent views in Washington”

...more

1031 Exchanges for Regulated Investment Crowdfunding?

What time is it?

It’s time to talk taxes and crowdfunding and to consider how we might take a concept that has been around for over 100 years and apply it to regulated investment #crowdfunding (#RIC).

First, a brief American history lesson.

The Revenue Act of 1921 authorized the first tax-deferred exchange, allowing investors to exchange securities and non-like-kind property. Over time, changes in tax legislation and interpretation by the courts limited the scope of what eventually became known as “Section 1031” of the Internal Revenue Code (IRC) to apply only to like-kind property and more specifically, real estate.

For those unfamiliar with 1031 exchanges, they are a tax-deferred exchange of like-kind property used for investment or business purposes. This type of exchange allows investors to defer paying capital gains taxes on the sale of a property by using the proceeds to purchase a similar property.

The key tenets of a 1031 exchange are:

- Only like-kind properties used for inves...more

Elon Musk and his billionaire buddies showcase why crowdfunding is needed

The saga surrounding the pending acquisition of Twitter and the recent public disclosure of texts between Elon Musk and his network are revealing in a few ways.

1: “Randos” Everywhere: The strategies he and his pals throw around for monetizing and "freeing speech" on social media are totally random or "rando" as he would put it. It reflects the opinion of people operating in the clouds, rather than in the trenches of social media technology or policy. With enough money thrown at the problem, they will likely back into some “right answers” for improving Twitter’s performance -- but it would not be because of any special insight or grit.

2. The Billionaire Insider’s Club: Elon puts together a syndicate of friends / investors to purchase Twitter and it is a club of people willing to toss in a billion here, a billion there -- because it would "be fun" (Reid Hoffman). Oracle founder Larry Ellison agrees to invest a couple billion af...more

CfPA 2025 Summit

CfPA 2025 Summit

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)