Research on Crowdfunding Annual Reporting Compliance

For those interested in financial reporting compliance for Reg CF issuers, check out my working paper on SSRN here. The paper has been discussed with SEC Commissioners Peirce and Uyeda as well as featured on various podcasts/shows, including some from CfPA members. Podcasts/shows include: SuperPowers for Good, Test. Optimize. Scale., and Business Scholarship Podcast.

Abstract: Using the regulated, but largely unenforced setting of U.S. equity crowdfunding (ECF) we consider why managers comply with ongoing financial reporting regulations beyond enforcement and litigation risk. In a market with billions of dollars invested by millions of investors, over half of ECF issuers fail to file their mandated annual report, with only a third issuing timely. Using rich offering-level data, we show compliance is negatively associated with compliance costs and tardy filings are partially explained by the desire to issue additional securities. However, despite our rich data, the overall explanatory p...more

2025 Regulated Investment Crowdfunding Summit - Detailed Agenda

2025 Regulated Investment Crowdfunding Summit

Overview

Day 1 – Tuesday, October 21, 2025: Advocacy Visits & Pre-event Reception

- AM & Afternoon: Constituent drop-ins (Capitol Hill) and regulator visits (DC)

- 5:30 – 7:30 PM: Cocktail Reception (@ National Union Building, 918 F St NW, Washington, DC 20004)

Day 2 – Wednesday, October 22, 2025: Summit Conference

- 8:30 AM–5:30 PM: Detailed agenda below. (@ National Union Building, 918 F St NW, Washington, DC 20004)

- ~6:00 – 8:00 PM: No-host happy hour / dinner (nearby venue TBD)

Day 1 · Tuesday, Oct 21 — Advocacy & Reception

25 Reasons to Invest Through Regulated Investment Crowdfunding for Social Impact

I’ve spent years immersed in the world of impact investing, and if I sound a little fired up today, it’s because I am. The traditional capital markets continue to overlook brilliant, diverse entrepreneurs—especially those working in and for their communities. That’s why I’m passionate about regulated investment crowdfunding (Regulation Crowdfunding or Reg CF, particularly). It’s not perfect, but it’s the most promising tool we have to democratize access to capital, empower underrepresented founders, and reshape our economy from the ground up. Here are just a few of the reasons I believe so deeply in this movement:

-

Democratization of Capital

Reg CF breaks down barriers that historically excluded all but the wealthy from investing in private ventures. -

Access to Overlooked Founders

Traditional VC overlooks diverse founders; Reg CF helps level the playing field by allowing the crowd to support talent the system ignores. -

Rooted in Community

Reg CF enables investment in local businesses a

Why I love Crowdfunding Portals

I love regulated investment crowdfunding and the portals that participate in the space. I’ve got gripes and complaints, but overall, I’m their biggest fan. They are fundamentally essential to the ongoing success of the industry—and its future growth.

Today, I’d like to enumerate some of my favorite things about portals operating under Regulation Crowdfunding:

9 Things I Love About Portals

-

Pre-Screening Investments: We all rely on portals to screen the offerings they host. They all use different criteria, but they are all required to exclude companies associated with “bad actors”—people who have been in trouble with the SEC in the past.

-

Regulatory Compliance: Having run a FINRA-member, SEC-registered broker-dealer, I know how hard it is to comply with the regulations. That is a big reason I don’t run a portal today! I’m grateful that they have made the effort to comply with the rules. These sometimes impose on us minor inconveniences, but the net effect is a safe and

CfPA Highlights Achievement and Innovation at Inaugural Industry Awards Ceremony

FOR IMMEDIATE RELEASE

Contact: Rose Kauzeni

Community Coordinator

Crowdfunding Professional Association (CfPA)

Email: coordinator@cfpa.org

Website: https://CfPA.org

CfPA Highlights Achievement and Innovation at Inaugural Industry Awards Ceremony

Leading voice of the Regulated Investment Crowdfunding industry announces winners of industry awards following a successful 2024 Washington D.C. Summit

Washington, D.C. (October 24, 2024) The Crowdfunding Professional Association (CfPA) is pleased to announce the winners of the inaugural CfPA Industry Awards, presented at the end of the CfPA hosted and organized Regulated Investment Crowdfunding Summit 2024. This prestigious event celebrated the most innovative minds and impactful projects shaping the future of the regulated investment crowdfunding industry.

The awards honor excellence across five key categories, highlighting success stories and pioneers driving positive change in the sector.

1: Social Impact Award (Ti...more

CfPA Regulated Investment Crowdfunding and Leadership Summit 2024 - Detailed Agenda

Day 1 (10/22: Tues.) : Advocacy Visits & Pre-event Reception

|

10:00 AM - 5:30 Advocacy Meetings

|

Capitol Hill + Regulator visits CfPA members registered for the Summit may be eligible to attend some of the advocacy meetings. |

|

5:30-8:00 PM Cocktail Reception |

Sunset Cocktail Reception Top of the Town - Top Floor and Rooftop (1400 14th Street North, Arlington, VA) (Streaming Music by DJ Scott McIntyre)

|

Day 2 (10/23: Wed.) : Conference and Summit

Venue: Top of the Town (Top Floor 1400 14th Street North, Arlington, VA)

“One of the most magnificent views in Washington”

...more

Grateful for the super people at SuperCrowd24

On behalf of the Crowdfunding Professional Association (CfPA), I would like to express gratitude to @Devin Thorpe and @Chandan Saha for providing CfPA with the opportunity to co-host SuperCrowd24 and for giving the CfPA board and members the opportunity to share their perspectives and expertise and to connect with a community of attendees from all over the world. The event was highly engaging and informative (-- and provided a welcome diversion following the end of this year’s tax season).

The agenda was packed, the speakers were amazing, and the topics were relevant across a wide range of themes. Personally, I was pleased to hear numerous discussions about the possible integration of regulated investment crowdfunding into the full capital stack of various businesses -- from small enterprises seeking SBA loans to major corporations managing complex divestitures – as it points to a future where crowdfunding and community-ownership could be an important pro-social subs...more

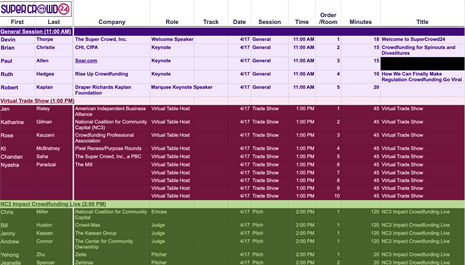

Get Ready for SuperCrowd24 - The Ultimate Virtual Crowdfunding Experience!

We hope this message finds you well and thriving! We are thrilled to bring you the latest update on an event that promises to revolutionize your understanding of crowdfunding and investment – introducing SuperCrowd24!

📅 Save the Date: April 17-18

📍 Location: Your Screen - It's a Virtual Event!

Get ready for an immersive experience at the impact crowdfunding event of the year! SuperCrowd24 is designed to connect investors, entrepreneurs, and enthusiasts from around the world, all from the comfort of your home.

What to Expect: ✨ 100 Expert Speakers: Learn from the best in the business as 100 industry leaders share their insights and strategies for successful crowdfunding and investment.

🎙️ Live Pitch Sessions: Witness entrepreneurs pitch their groundbreaking ideas in real-time! Who knows, you might discover the next big thing to add to your portfolio.

💡 Learn to Invest Like a Pro: Whether you're a seasoned investor or just starting, SuperCrowd24 offers valuable tips and techniques ...more

CfPA 2025 Summit

CfPA 2025 Summit

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)