In recent months, I've been giving thought to the best way to do a $5 million Reg CF campaign, starting with very little upfront spend. It seems to me, there are two possible paths. Path one is to begin with a small (under $124,000) raise with a low initial closing threshold, say, $25,000, and later amend the Form C, using funds from the initial raise to fund legal, accounting and marketing expenses for rolling forward. The alternative path would be to do a series of independent raises, the first one very small and building, still with the goal of raising $5 million in 12 months.

I tasked Google Gemini with a deep research project to compare and contrast the regulatory and best practices for the two approaches. Here is the full report. Below is an executive summary. I'm curious now to get the opinions of experts like @Brian Christie, @Jenny Kassan, @Craig Denlinger and @Sara Hanks on this topic, but eagerly welcome feedback from everyone.

Executive Summary

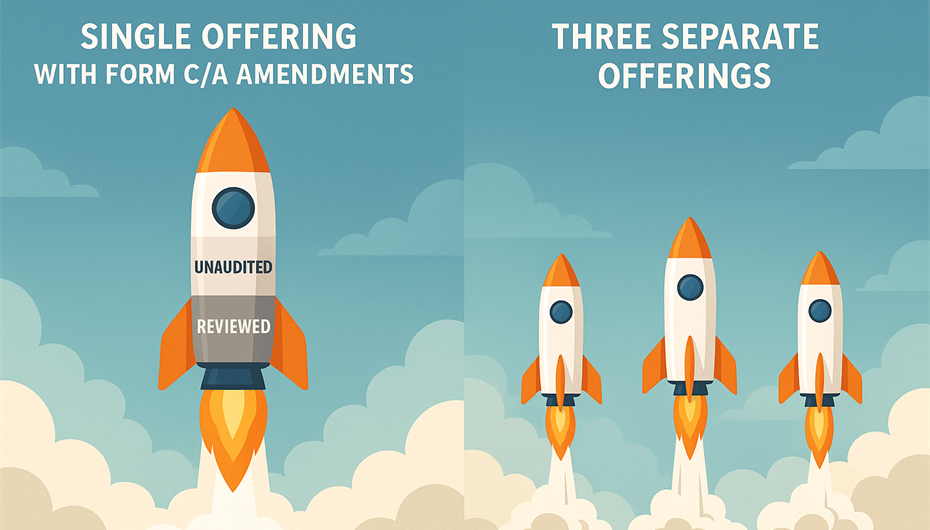

This report evaluates two distinct approaches for conducting a multi-stage Regulation Crowdfunding (Reg CF) capital raise, comparing their regulatory and operational implications. The two strategies under scrutiny are: (A) a single Reg CF offering with progressive financial disclosures via Form C/A amendments, and (B) three separate Reg CF offerings launched sequentially to reach a $5 million funding target.

Strategy A: Single Multi-Stage Offering via Form C/A Amendments

This strategy involves a unified offering progressing in three stages:

-

Raise up to $124,000 with unaudited financials.

-

File a Form C/A to upgrade to reviewed financials and increase the target to $1.235 million.

-

File another Form C/A with audited financials to raise up to the $5 million cap.

This structure enables the issuer to manage costs by phasing in accounting and legal expenses as funds are raised. Reconfirmation of investment commitments is required only when the offering undergoes a “material change,” such as an increase in financial statement rigor or offering size. Crucially, reconfirmation applies only to undisbursed funds; funds disbursed through earlier rolling closes remain unaffected.

Strategy B: Separate Sequential Reg CF Offerings

Here, the issuer launches three distinct offerings within a 12-month period:

-

Raise $124,000 (unaudited financials).

-

Launch a second offering for $1.2 million.

-

Launch a third offering to reach the $5 million target.

While this strategy may initially appear to avoid reconfirmation complexities, it quickly becomes cost-prohibitive. Due to SEC rules (17 CFR § 227.201(t)(1)), financial disclosure thresholds are determined by the aggregate amount raised by the issuer in any 12-month period. Consequently, the second offering immediately triggers the need for audited financials, even though it targets less than $1.235 million individually. Each offering requires its own Form C filing, increasing legal and administrative burdens. Portal fees may also be higher.

Key Findings

-

Cost Efficiency: Strategy A enables controlled, staged increases in compliance costs, aligning with capital raised. Strategy B forces premature audit expenses due to aggregation rules.

-

Compliance Burden: A single evolving offering under Strategy A demands fewer total filings, although reconfirmation is necessary with each material change. Strategy B avoids reconfirmation but increases legal and accounting workload.

-

Reconfirmation Risk: In Strategy A, reconfirmation applies only to undisbursed funds and can be mitigated by strategic timing of rolling closes.

-

Regulatory Preference: The SEC’s aggregation rule effectively discourages Strategy B. Leading portals interpret significant financial upgrades as “material changes,” reinforcing the appropriateness of Strategy A.

Recommendations

-

Adopt Strategy A: This phased, single-offering approach is the most practical and compliant model.

-

Plan for Reconfirmation: Build clear investor communication and timing strategies to minimize disruption.

-

Use Portal Expertise: Work closely with intermediaries to ensure transparency and alignment with regulatory best practices.

Conclusion

The single multi-stage offering using Form C/A amendments (Strategy A) is the superior approach for startups seeking to raise capital under Reg CF in stages. It balances cost control, compliance, and strategic flexibility. Attempting to sidestep financial disclosure tiers via separate offerings is both legally and financially inefficient.

Register for FREE to comment or continue reading this article. Already registered? Login here.

2

It seems the success of this sequential / staged approach depends on whether or not the company hits their financial targets and can keep customers engaged throughout the Reg CF raise. Each stage could be an opportunity to highlight milestones, demonstrate traction, and invite broader participation - and turn investors into brand ambassadors (or customer-investors/ "investomers"). The downside to this approach is that without sustained engagement, momentum could stall the campaign could risk losing some credibility. But definitely an innovative way to stair-step to greater raise amounts.

It is tricky to think about how to raise $5 million starting with nothing. You can raise a little on virtually nothing, but you need a real marketing budget for $5 million. Some sort of step function raise seems to be the only path. Of course, maintaining interest, as you say, is a big marketing challenge--and one of the reasons issuers would need a marketing budget.