DeRosa Group: CfPA Crowdfunding Issuer Interview Series

The DeRosa Group is a family-owned business that invests in residential and commercial properties, with a mission of "Transforming Lives Through Real Estate." It was founded by Matt and Liz Faircloth in 2004. Their journey began with the purchase of a modest duplex just outside of Philadelphia, fueled by a $30,000 private loan. Since then, they have mastered the art of optimizing properties for their highest and best use, revolutionizing single-family homes, multi-family residences, apartments, mixed-use spaces, and retail outlets, as well as offices. This interview was conducted with Herve Francois.

INTERVIEW

CFPA: Can you tell us a little bit about your company? What does your company do and at what stage is it?

Herve Francois: DeRosa Group is a real estate investment company that invests in large multifamily apartment complexes. Our motto, "Transforming Lives Through Real Estate" is all about improving the living situation of our tenants by providing them an attractive plac

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

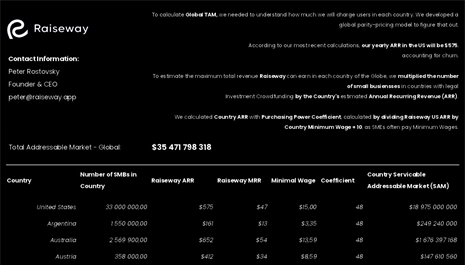

How we calculated Raiseway's Global Total Addressable Market

Disclaimer: (1) the issuer is considering an exempt offering, but has not decided upon any particular exemption; (2) the issuer is not soliciting any money or other consideration and, if sent, will not be accepted by the issuer; (3) the issuer will not sell securities or accept commitments to purchase securities until the issuer decides on which exemption it will pursue and satisfies any required filing, disclosure or qualification requirements; and (4) all indications of interest made by solicitees are non-binding.

To calculate Global #TotalAddressableMarket, we needed to understand how much Raiseway will charge users in each country.

We developed a global parity-pricing model to figure that out.

According to our most recent calculations, our yearly Annual Recurring Revenue (ARR) in the US will be $575, accounting for churn.

(^This isn't exactly right, we need to update the model. When we do, the TAM numbers will move by a n million, not sure which direction. 🤡 )

...more

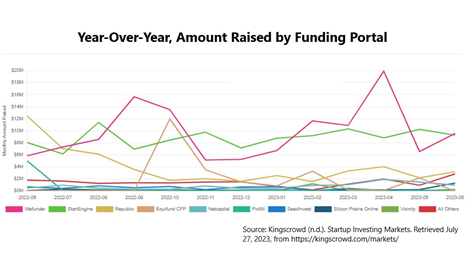

Our industry is broke

Dear colleagues at Crowdfunding Professional Association and beyond. We all love saying that the industry is doing great.

Math says "that's bs; CF industry is broke and dealflow is the problem." I am using funding portal data because transparency is forced upon these intermediaries.

Please don't shoot the messenger. I would like to be proven otherwise.

There are 70,000 startups in the United States within 33,000,000 small businesses. How many active Regulation Crowdfunding deals are there right now? 450.

Let's say that the average salary for a portal employee is $75,000 ($6 250 per month). Sounds like an OK living in the U.S. (unless you are in New York, San Francisco, Los Angeles, etc).

I went onto each of their LinkedIn pages and counted the number of employees. I assumed - rather generously - on average, only 50% of these "employees" are paid. The rest are advisors, investors, partners, etc.

I tried to count how much money each of the platforms will have left after receivi...more

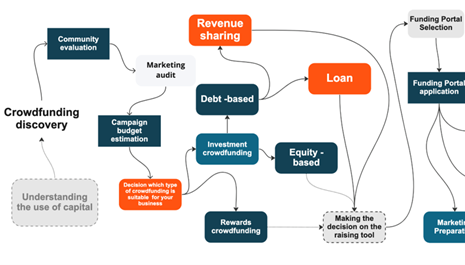

Crowdfunding 102

Are you thinking about crowdfunding to raise money for your business venture? If so, we have some exciting news for you! On June 14 at 2:00 PM Eastern, the CfPA is hosting a free webinar that is specifically designed to help you avoid any legal issues that may arise during or following your crowdfunding offering.

During this webinar, you'll have the opportunity to learn from industry experts about the ins and outs of crowdfunding. With their guidance, you'll be able to navigate the complex legal landscape that comes with crowdfunding and avoid any potential legal pitfalls that could derail your efforts.

And the best part? This webinar is completely free! All you need to do is register by clicking on the following link: http://bit.ly/CfPAwebinar. By doing so, you'll be taking the first step toward making your crowdfunding dreams a reality.

So what are you waiting for? Don't miss out on this amazing opportunity to learn from the best in the business. Register now and get ready to

Decoding the Alphabet Soup of Investment Crowdfunding

Posted at 6/6/2023

The investment crowdfunding landscape can be confusing.

And one of the main reasons it's so confusing is because many of the key terms and labels were created by lawyers and legislators, who aren't really known for their ability to keep things simple.

That means navigating and deciphering the nearly inscrutable alphabet soup of the relevant crowdfunding regulations, rules, laws, and requirements is about as much fun as …. well, navigating and deciphering an alphabet soup of laws, rules, and regulations.

So before trying to parse the fine print of crowdfunding regulations, here’s some overall context that should help.

In 2012, the Jumpstart Our Business Startups Act (get it? “JOBS”? Isn’t that clever…) was signed into law, and it did two important things:

- Amended the Securities Act of 1933 (that's the set of laws passed after the 1929 stock market crash)

- Required the SEC to update several of its Regulations

It’s helpful to think about crowdfunding regulations...more

Why Is Blockchain Technology Popular?

Global spending on blockchain solutions is estimated to have reached $11.7 billion by the end of 2022, and the industry is expected to be worth over $163 billion by 2029. There are several reasons for this growth in popularity. Some of this popularity is the adoption of a trendy new buzzword. And, for some applications, blockchain may be a short-lived fad, like fins on 1950’s cars. But for others, blockchain is absolutely the right tool for the job.

Benefits of Decentralization

One of the major draws to blockchain technology is its decentralized nature. According to NASDAQ, decentralization means that there is no single entity with exclusive control of data or processes, allowing for secure transactions without the need for a third party or intermediary. Decentralization adds security since it is tough for hackers to target one single entity in a decentralized and transparent system. This is because there are many different nodes that act as validators of transactions, adding...more

Marketing Strategies for Raising Capital

When a company is looking to raise capital, there are many marketing strategies to get the word out. With any method, the primary goal is to convey what your company does and inform investors about the potential opportunities that their investment will create. Marketing strategies for raising capital are important to all companies and issuers.

Creating a Compelling Opportunity Set

The first step in any marketing strategy is creating a compelling opportunity set, which should position the company as a subject matter expert. A white paper can do it, which should answer all the “whys” for potential investors. It’s important to provide this information clearly and concisely, as potential investors will likely have a lot of questions. This document can serve as a launching pad for further content like blogs or videos. By providing all the relevant information upfront, companies can set themselves apart from the competition and make it more likely that potential investors will take the time ...more

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Raiseway

Raiseway

Devin Thorpe

Devin Thorpe

KoreConX

KoreConX