BAMM! In the Age of AI: Capital Formation Beats Universal Basic Income

In January alone, U.S. employers announced 108,435 layoffs - up 118% year-over-year and 205% from December. It marked the highest January total since 2009. For millions of workers, the signal is clear: AI-driven disruption is no longer theoretical. It’s here, and it’s accelerating faster than our labor institutions can respond.

And yet - here’s the paradox - this may be one of the best moments in history to be an entrepreneur, even a solo-preneur.

AI has collapsed the cost of starting and scaling a business. One person, equipped with modern tools, can now do the work of a small team: build products, automate operations, market globally, and reach customers directly. Capital efficiency has never been higher. What’s missing isn’t talent or ambition - it’s access to capital.

The Wrong Response: Universal Basic Income

Universal Basic Income is often proposed as the humane response to job displacement. The intent is understandable. The mechanism is flawed.

Broad cash transfers do not expand...more

Research on Crowdfunding Annual Reporting Compliance

For those interested in financial reporting compliance for Reg CF issuers, check out my working paper on SSRN here. The paper has been discussed with SEC Commissioners Peirce and Uyeda as well as featured on various podcasts/shows, including some from CfPA members. Podcasts/shows include: SuperPowers for Good, Test. Optimize. Scale., and Business Scholarship Podcast.

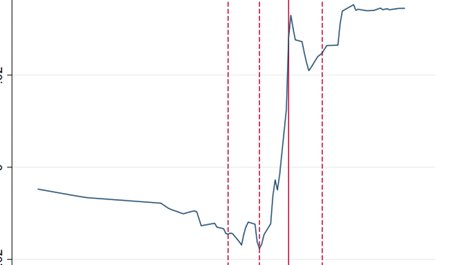

Abstract: Using the regulated, but largely unenforced setting of U.S. equity crowdfunding (ECF) we consider why managers comply with ongoing financial reporting regulations beyond enforcement and litigation risk. In a market with billions of dollars invested by millions of investors, over half of ECF issuers fail to file their mandated annual report, with only a third issuing timely. Using rich offering-level data, we show compliance is negatively associated with compliance costs and tardy filings are partially explained by the desire to issue additional securities. However, despite our rich data, the overall explanatory p...more

Why Language Matters (Part 1 of 3): When “Crowdfunding” Becomes a Four-Letter Word

On October 8, 2025, Fox19 Cincinnati ran a headline that could make anyone in the regulated investment crowdfunding world spit out their morning coffee:

“Ohio lawmakers introduce legislation to prevent crowdfunding for violent crimes.” (Read it here)

That’s one of those headlines that does collateral damage just by existing. It’s splashy, moralistic, and guaranteed to travel faster than nuance ever could.

But here’s the problem: every time “crowdfunding” makes the news in a criminal, political, or emotional context, it drags the entire ecosystem into the mud - including the legitimate, SEC-regulated platforms that have nothing to do with bail funds or bad behavior.

That’s what professionals call headline risk.

It’s what philosophers call guilt by association.

And it’s what the rest of us call a branding nightmare.

Regulated Investment Crowdfunding: The grown-up in the room

The Crowdfunding Professional Association (CfPA) has repeatedly urged everyone - media, policymakers, platforms ...more

2025 Regulated Investment Crowdfunding Summit - Detailed Agenda

2025 Regulated Investment Crowdfunding Summit

Overview

Day 1 – Tuesday, October 21, 2025: Advocacy Visits & Pre-event Reception

- AM & Afternoon: Constituent drop-ins (Capitol Hill) and regulator visits (DC)

- 5:30 – 7:30 PM: Cocktail Reception (@ National Union Building, 918 F St NW, Washington, DC 20004)

Day 2 – Wednesday, October 22, 2025: Summit Conference

- 8:30 AM–5:30 PM: Detailed agenda below. (@ National Union Building, 918 F St NW, Washington, DC 20004)

- ~6:00 – 8:00 PM: No-host happy hour / dinner (nearby venue TBD)

Day 1 · Tuesday, Oct 21 — Advocacy & Reception

CfPA's Statement Opposing the Offering of Republic Mirror Tokens under Regulation Crowdfunding

In recent months, investment platform Republic has announced plans to offer “Mirror Tokens” - digital instruments that track the economic performance of private companies such as SpaceX, Anthropic, Epic Games, Ramp, Canva, and Databricks. These tokens, like rSpaceX, do not provide ownership or voting rights, but instead offer a contractual claim tied to future liquidity events (e.g., IPOs or acquisitions). Marketed under Regulation Crowdfunding (Reg CF) with minimum investments starting at $50, Mirror Tokens enable retail investors to gain "exposure" to companies that are typically off-limits. As of early August 2025, Republic has listed 24 Mirror Tokens, with four currently open for reservations - raising pressing questions about how such synthetic products align with Reg CF’s purpose and its framework for investor protections (Crowdfund Insider, Axios).

Industry reporting and analysis offer a mixed yet critical picture:

-

ValueTheMarkets emphasizes that while Mi

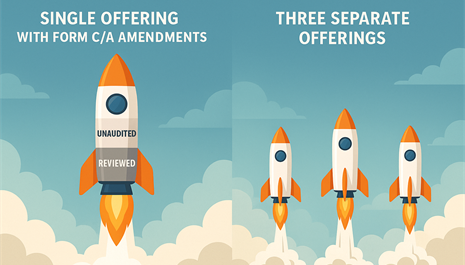

The Best Way to Raise $5M Under Reg CF in 12 Months Starting with Virtually Nothing

In recent months, I've been giving thought to the best way to do a $5 million Reg CF campaign, starting with very little upfront spend. It seems to me, there are two possible paths. Path one is to begin with a small (under $124,000) raise with a low initial closing threshold, say, $25,000, and later amend the Form C, using funds from the initial raise to fund legal, accounting and marketing expenses for rolling forward. The alternative path would be to do a series of independent raises, the first one very small and building, still with the goal of raising $5 million in 12 months.

I tasked Google Gemini with a deep research project to compare and contrast the regulatory and best practices for the two approaches. Here is the full report. Below is an executive summary. I'm curious now to get the opinions of experts like @Brian Christie, @Jenny Kassan, @Craig Denlinger and @Sara Hanks on this topic, but eagerly welcome feedback from everyone.

Executive Summary

This report evaluates tw...more

Meet The Member Interview Series: A Conversation with Andrew Field

As a venue for industry networking, the Crowdfunding Professional Association (CfPA) occasionally highlights the participation or biography of our association members. CfPA membership is designed to be inclusive and open to individuals and organizations sharing a professional interest in the field of Regulated Investment Crowdfunding.

Interview With Andrew Field

CfPA: Can you tell us a little about your background and your interest in the field of regulated investment crowdfunding?

Andrew: I’ve spent much of my career at the intersection of innovation, entrepreneurship, and finance - with a particular focus on how technology can democratize access to capital. My current role is with a crowdfunding technology provider (Dacxi Chain) but I have joined the CfPA in my capacity as Steering Committee Lead for the Global Equity Crowdfunding Alliance (GECA) which brings that all together. GECA exists to connect stakeholders across borders and drive ...more

25 Reasons to Invest Through Regulated Investment Crowdfunding for Social Impact

I’ve spent years immersed in the world of impact investing, and if I sound a little fired up today, it’s because I am. The traditional capital markets continue to overlook brilliant, diverse entrepreneurs—especially those working in and for their communities. That’s why I’m passionate about regulated investment crowdfunding (Regulation Crowdfunding or Reg CF, particularly). It’s not perfect, but it’s the most promising tool we have to democratize access to capital, empower underrepresented founders, and reshape our economy from the ground up. Here are just a few of the reasons I believe so deeply in this movement:

-

Democratization of Capital

Reg CF breaks down barriers that historically excluded all but the wealthy from investing in private ventures. -

Access to Overlooked Founders

Traditional VC overlooks diverse founders; Reg CF helps level the playing field by allowing the crowd to support talent the system ignores. -

Rooted in Community

Reg CF enables investment in local businesses a

CfPA 2025 Summit

CfPA 2025 Summit

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)