Here's an Easy New Year's Resolution to Change the World

There has been no shortage of articles about new year’s resolutions. I’d be reluctant to join the chorus if this one didn’t have the potential to yield so much good for so little effort.

Many people recommend focusing your 2023 goals on a single objective. If you’re struggling to find one, look no further! This one is easy.

If you are taking a portfolio approach to your self-improvement this year, here’s an idea that will be easy to add into the mix as it will take less time and money than most.

For 2023, set a goal to make an impact investment via crowdfunding.

To be clear, I’m not talking about donating to charity or helping someone in need on GoFundMe. Those are good and noble things to do, but I’m talking about something similarly easy but fundamentally different.

The biggest difference is that you could get your money back—with interest!

Mindset

The biggest challenge to making your first investment is your mindset. For about 90 years following the Great Depressio...more

Do you understand blockchain?

There is a general understanding that crowdfunding, tokenization, and some other concepts are tightly connected. But do you understand what blockchain is? It is important to understand how it works to help us all understand Online Capital Formation.

Follow our Spotify Channel and welcome aboard.

...moreChange the zoning codes. Open up solutions for everyone.

Remember the “starter home?” It was a bungalow. Or a cottage? No, a rambler! I’m writing wistfully in the past tense because the starter home has largely disappeared.

This at a time when experts widely agree we need at least 6 million new homes to house all Americans? Yep. Because many cities and boroughs have made building small homes all but impossible.

The hardest project of my life was a 235 SQF “tiny home” on a 1500 SQF lot in Pittsburgh’s Garfield neighborhood.

I was attempting to build a single-family, detached home in a neighborhood with existing amenities and infrastructure. But the zoning codes as written originally left me with only 50 SQF to build on. 50!

I had to fight the zoning board and building inspector. I had to crowdfund the project (on www.SmallChange.co of course) because I couldn’t get a bank loan since there were no comps. It was as if the city had intentionally designed the codes to make the unit economics of building a starter completely unaffordable.

Communit...more

What’s the Differences Between Regulations A, CF, D, and S?

When it comes to raising capital, there are various ways you can raise money from investors. And while they all have their own specific compliance requirements, they all share one common goal: to protect investors while still providing them with opportunities to invest in private companies. Let’s look at the four most popular types of equity crowdfunding; through Regulation A, CF, D, or S.

Regulation A+ (RegA+)

Offering size per year: Up to $75 million

Number of investors allowed: Unlimited, as long as the issuer meets certain conditions.

Type of investor allowed: Both accredited and non-accredited investors.

SEC qualification required: Reg A+ offerings must be qualified by the SEC and certain state securities regulators and must also file a “Form 1-A”. Audited financials are required for Tier II offerings.

This type of crowdfunding is popular because it allows companies to raise up to $75 million per year in capital and is open to accredited and non-accredited investors. Offering...more

Online Capital Formation

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes Kickstarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online and people can contribute based on a variety of rewards listed on a website. But that is far from being a regulated entity.

RegCF helps companies turn investors into shareholders. Companies and product makers are not selling their stories anymore. They are selling their stock. And that is why we feel the word “crowdfunding” doesn’t encompass the whole idea behind it.

That is why we put together our KorePartners, like Sara Hanks (CEO...more

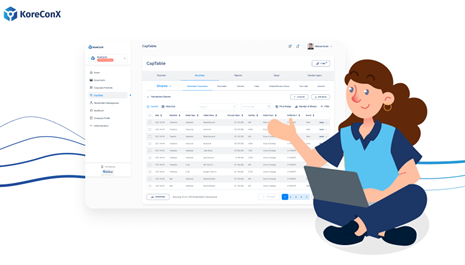

What You Need to Know About Cap Table Management

More than a simple spreadsheet, a cap table (short for capitalization table) records detailed data regarding the equity owned by shareholders. When it comes to raising capital, your cap table will help you make sound decisions regarding your offering. So, what exactly is cap table management?

A clear and well-managed cap table paints a detailed picture of exactly who owns what in the company. Whether a founder is looking to raise additional capital or offer incentives to employees, a correctly-managed cap table will show the exact breakdown of shares, digital securities, options, warrants, loans, SAFE, Debenture, etc. This information enables founders to understand how equity distribution is impacted by business decisions.

Proper cap table management ensures that all transactions are accounted for and that potential investors are easily able to see the equity structure during funding rounds. Founders are also able to better negotiate the terms of a deal when they have the entire pictur...more

What is Tokenization in Real Estate?

The real estate market has seen a substantial uptick in value, with more and more people looking to invest in this asset class. However, the high barrier to entry – requiring significant capital – has traditionally limited participation to only those with deep pockets. But with tokenization and the blockchain technology that supports it, anyone can get in on the action.

What is Tokenization?

In simple terms, tokenization is the process of converting something of value – in this case, real estate – into digital tokens that can be bought and sold on a blockchain platform. This allows for fractional ownership of assets, which opens up investment opportunities to a much wider pool of people. Tokenization is a process that can facilitate investment in fractional portions of real property, thus lowering the barrier to entry for retail investors. By digitizing real estate ownership and using blockchain technology to track transactions, tokenization makes it easier and faster to buy and sell p...more

How Does Technology Improve Transparency and Sustainability?

Technology has significantly impacted many different aspects of our lives, and the world of capital raising is no exception. With the help of technology, we can more efficiently raise capital and improve transparency and sustainability in the process. Here is a closer look at how technology is helping to improve transparency and sustainability in the world of capital raising and investment:

Improving Transparency

One of the biggest ways technology improves transparency in capital raising is by providing more information to investors. In the past, it was often difficult for investors to get a clear picture of where their money was going and how it was being used. However, thanks to technology, there are now a number of platforms and tools that provide investors with real-time updates and insights into how their money is being used. This increased transparency gives investors more confidence in the process and helps build trust between them and the companies they invest in.

Another way t...more

KoreConX

KoreConX