Why Is Blockchain Technology Popular?

Global spending on blockchain solutions is estimated to have reached $11.7 billion by the end of 2022, and the industry is expected to be worth over $163 billion by 2029. There are several reasons for this growth in popularity. Some of this popularity is the adoption of a trendy new buzzword. And, for some applications, blockchain may be a short-lived fad, like fins on 1950’s cars. But for others, blockchain is absolutely the right tool for the job.

Benefits of Decentralization

One of the major draws to blockchain technology is its decentralized nature. According to NASDAQ, decentralization means that there is no single entity with exclusive control of data or processes, allowing for secure transactions without the need for a third party or intermediary. Decentralization adds security since it is tough for hackers to target one single entity in a decentralized and transparent system. This is because there are many different nodes that act as validators of transactions, adding...more

Do you understand blockchain?

There is a general understanding that crowdfunding, tokenization, and some other concepts are tightly connected. But do you understand what blockchain is? It is important to understand how it works to help us all understand Online Capital Formation.

Follow our Spotify Channel and welcome aboard.

...moreNFTs: What constitutes a bubble bursting?

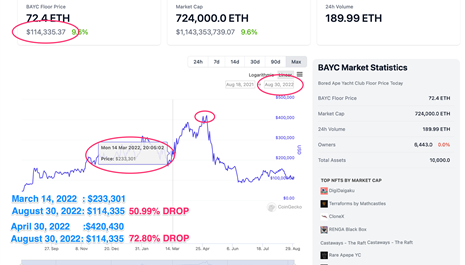

On March 14, 2022 I wrote about putting a 4k Bored Ape Yacht Club NFT up for sale (all proceeds to charity) on OpenSea to point out structural deficiencies in "NFTs 1.0" and concluded that it was "exhibit #1 that these 'digital art' NFTs represent a bubble about to burst." (Note: It didn't sell) https://crowdfundingecosystem.com/kb/article/psychedelic-safari-bored-ape-nft-for-sale-proceeds-to-charity

On that day, the floor trading price of a BAYC NFT was $233,301. The bubble continued to inflate for another six weeks until April 30 when it reached $420,430. But as of this writing, August 30, it's down to $114,335 which is a 50.99% DROP from my March 14th posting and a 72.80% drop from the peak.

Now for Exhibit B: NFT trading on OpenSea is crashing. See: "Trading volume on top NFT marketplace OpenSea down 99% since May" https://fortune.com/2022/08/29/nfts-opensea-crypto-winter-bubble-blockchain-web3

It appears all those OpenSea wash traders are spending the summer months w...more

The Truth About NFTs and DAOs

Non-fungible Tokens (NFTs) are all the rage these days. But what are they exactly? On this podcast, listen to Samson Williams, the President of the Crowdfunding Professional Association, as he explains in simple terms everything you need to know about NFTs and Distributed Autonomous Organization (DAOs). Whatever your background knowledge is of crowdfunding, tokenization, blockchain, or technology, you’ll get all the info you’ll need to understand why there’s so much hype around it all, and learn some pointers on how to protect yourself from possible fraud as well. Be warned: you may be floored by the truth bombs being presented on this podcast!

LISTEN ON SPREAKER HERE >>>

NFT marketplaces such as Open Sea allow you to create and sell non-fungible tokens of just about anything you can imagine. But when you buy an NFT, what are you actually paying for? What do you really own? Where is the value in your “investment”? What does proof of authenticity exactly mean? How is the NFT cre...more

Why Blockchain Advocates should join the CfPA

TLDR;

- Blockchain is a technology

- Crowdfunding is a) asking strangers b) for money c) over the internet

- When “Blockchain Businesses” use DLT to create tokens, coins, and various digital thingamajiggies 99% of the time they do so for the express purpose of raising capital by creating a security, a la ICOs, TGE, IEOs, NFTs, etc...

- The other 1% they’re creating derivatives but we’ll talk about that later.

- Otherwise DLTs would be digital products or services, with set firm, fixed prices, that Businesses could sell to users/consumers and pay appropriate State, Local and Federal sales and income taxes on.

- Blockchain advocacy groups should partner with the Crowdfunding Professional Association because raising capital isn’t the domain of “Blockchain” businesses nor Blockchain advocacy groups.

Hello Beautiful Blockchain and Cryptocurrency People!

I wrote a longer article on why everyone in the Blockchain Advocacy space should join the Crowdfunding Professional Association....more

10 Observations about Facebook's Libra Coin.

In June, Facebook released its much-anticipated whitepaper for its cryptocurrency Libra Coin. What follows is my first impressions of what this means and why Facebook’s move is so interesting. I will admit I was betting on Amazon releasing a token before anyone else. Alas, they did not and instead Amazon has gone full on into the money transfer business in a tiny market called India. That though is a story for another time. Here are some of my initial thoughts regarding Facebook’s Libra Coin:

- Hedge Fund? Upon my initial reading of the Libra Coin white paper, I had a distinct feeling that the Libra Reserve was just a hedge fund. I felt this way because of the language of how the reserve works and the assets it would manage on behalf of the Libra Coin. Too, because the “nodes” of the network had to contribute $10M to be a validator or part of the network. To me that sounded like 70 entities and counting that each invested $10M into a fund. What does this fund do? Hedges risk assoc

How J.P. Morgan’s fake cryptocurrency threatens SWIFT, Western Union and Deutsche Bank’s real business.

Last week JP Morgan announced that it had developed its own cryptocurrency, the“JPMCoin”. Lost in the much of the noise about whether or not the JPMCoin is a real blockchain or cryptocurrency is the fact that, for mainstream blockchain adoption, the announcement is a big deal. Don’t get me wrong. The JPMCoin is no more a cryptocurrency than say Fortnight’s V-Bucks or your airline miles are. However, for blockchain the technology (even if JPMorgan isn’t actually using a blockchain) the mere mention of the possibility that blockchain like tech is being adopted by the 6th largest bank in the world, a meaningful way, is a big step towards mainstream adoption.

As you consider this here are a few points you can confidently share with your colleagues and friends:

- The #JPMCoin isn’t a #blockchain or a #cryptocurrency

- That doesn’t matter because JPMorgan’s modern day #DigitalAbacus does solve real business problems and proposes real operational cost savings,

Virtual Currencies are as old as favors.

I owe Jack Shaw a favor. It’s one of those, “This one time in Cambodia...” type of favors. We won’t speak of it beyond perhaps a nod and wink. It’s not written down anywhere; the details of such are so vague as to be almost non existent, while encompassing the known universe. It expires upon death, of the sun; and can be redeemed whenever and by another person who need only walk up to me and say, “Jack Shaw sent me. He says to tell you ________”. And tada, that favor has been redeemed for value.

Jack would call this favor a “marker.” It’s more valuable than your house, the Empire State Building & 100k Bitcoins combined. It can even be redeemed for something even more precious, my time or an opportunity or access to my network. You know, those things that money can’t buy. Well, you can lease my time from time to time.

Favors, markers and promises are humanities’ first virtual currencies.

They’ve gone digital recently, as Jack might redeem his marker via a Wh...more

KoreConX

KoreConX