Why Reg.A is the Superior Crowdfunding Choice over Reg.D or Reg.CF

Despite being around for years now, there’s still major confusion from issuers regarding the benefits and drawbacks of Regulation A (Reg.A), Regulation CF (Reg.CF), and Regulation D (Reg.D) crowdfunding offerings. What option is right for you? In this podcast, Mike Brette, the CEO and Founder of Small Cap Equity Advisors goes over why he believes Reg.A is the superior choice in most instances, plus provides advice as to what issuers should be doing (and what they shouldn’t be doing as well) in order to achieve a successful capital raise.

Reg.A, Reg.D, Reg.CF… What’s best for you and/or your company? And how much will it all cost you? Based on the reasons Mr. Brette provides in this podcast – both pro and con, he makes a strong case that regardless of the size of your raise, you should strongly consider the Reg.A option right from the start.

Restricted stock, “dead money”, valuation determination, accreditation of investors, liquidity issues, possible advertis...more

Calling All Social Entrepreneurs: Urgent Reminder

COVID Relief Easing Certain Crowdfunding Rules Ends on August 28!

This week, I’m traveling to Puerto Rico to cover the Bluetide Caribbean Investment Summit for Impact Entrepreneur Magazine. (See a related story here.) As a result, I didn’t have time to produce a podcast for today’s newsletter. I’ll also be sharing the podcast I would typically share on Thursday on Friday—it’s a special one.

Share

Big News! I’ve confirmed with the smartest people I know that an important bit of COVID relief expires on August 28, 2022. If you are a social entrepreneur looking to change the world for good, read on!

One of the biggest barriers to investment crowdfunding is the requirement for financial disclosure. Under the rules that return to full effect on August 28, you must provide financial statements reviewed by an auditor if you hope to raise more than $107,000. An auditor must complete a review before the offering can begin. And it is pricy. A review can easily cost $10,000.

If you raise mor...more

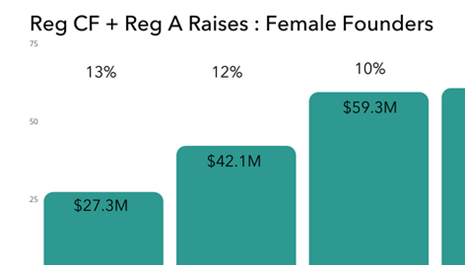

Female Founders still only getting a fraction of funding

The illusion in the start-up world is that anyone can have a great idea and bring it to fruition with grit, determination, and a lot of hard work. A key part of bringing a founder’s vision to life is securing funding in order to build a product, app, or service. Without capital, the founder’s vision will forever remain only a vision.

So raising capital is tantamount to success. It’s never just been about grit and a good idea. Connections, networking, and getting in front of the right people are all key to getting your idea off the ground.

And after you’ve made these connections and gotten in front of the right people - then what? Does the funding go to the best idea or the strongest founder with the most solid plan?

Statistically speaking, the answer to that is a resounding "no."

In 2021, female founders got 2% of all venture capital (VC) dollars - which was the lowest percentage since 2016. And since 2011, the highest that statistic has ever been was 2.7%.

And not only are female foun...more

Expert: Crowdfunding and Venture Capital Markets Will Merge

Frankly, I don’t remember when a guest and I covered so much important ground in so little time. Don’t miss my conversation with Christopher Lustrino, the founder and CEO of KingsCrowd.

SuperCrowd22

Chris will be speaking at SuperCrowd22, our two-day virtual conference on impact crowdfunding and community capital. This event is for you!

“One of the cool things about building our business is that we get to watch how the entire world of equity crowdfunding is forming, what investor sentiment is like, what their behavior is like, what startup founder behavior is like,” Chris says.

“This is an incredible place to be in the world at this moment in time,” Chris continues. “So, it’ll be fun to dive in and tell folks more about what it is that’s happening all around us as this industry develops.”

KingsCrowd is tracking every deal in the sector, so he has a great perspective on the industry. Don’t miss it!

Readers can register now for half price!

Convergence of Crowdfunding and Venture Ca

...moreSecurities Lawyer Explains Why Violating Crowdfunding Regulations Isn't Like Speeding

CrowdCheck CEO Sara Hanks Helps Clients Avoid Problems

CrowdCheck CEO Sara Hanks says securities law enforcement differs dramatically from traffic enforcement. If you speed and don’t get caught in the act, you don’t worry about later being investigated for a traffic violation. Sara says that’s not how it works for securities:

We often have the mom conversation. “Well, if everybody jumped off the Brooklyn Bridge, would you do it?”

Part of the problem here is understanding that it takes the SEC [Securities and Exchange Commission] about two years to think about, well, maybe they really shouldn't have done that. And another year to issue the subpoena and another year to capture the information.

We've got people who are receiving subpoenas for stuff they did in 2017. I mean, the SEC is out there. Just because somebody did something recently doesn't mean, A, that they're going to get away with it and B, that you're going to get away with it if you copy them.

Investment Crowdfunding Allows Impact Investing So Easy a Child Can Understand

William McGuire is the founder and CEO of Incolo, a venture accelerator designed to help entrepreneurs find capital right in their backyard, often via investment crowdfunding. He envisions a world where everyone in the community is invested in its businesses, thereby participating in the upside collectively.

So Easy a Child Can Understand

An intriguing part of our conversation revolved around helping ordinary people understand and value the opportunity to invest in local businesses. To prove that even kids can understand the basics of investing via crowdfunding, Incolo hosted some sessions with “little investors,” some not having even celebrated two-digit birthdays.

Will says, “We just want to see how our kids interact.”

After identifying several companies that would naturally appeal to children, including an app, a film and other opportunities, they held the session with a handful of children. This list also included some boring fare, like an assisted living project.

“We asked all the...more

He's One of the Real OGs of Investment Crowdfunding

A Real OG

Sherwood “Woodie” Neiss is on a short list of those who deserve serious credit for leading Congress to pass and getting then-President Barack Obama to sign the 2012 JOBS Act. He’s earned the title of Real OG in the investment crowdfunding world.

Now a principal at Crowdfund Capital Advisors and a partner in Crowd Capital Ventures, he’s continuing to grow and advocate for the industry he had such a pivotal hand in creating.

Woodie shared some stories about the work of getting the legislation passed. First, he recalls how the legislation came to have a provision prohibiting the sale of crowdfunded securities for twelve months even though there is no market.

I remember sitting in Senator Bennett's office working with one of his staffers on how we prevent pumping and dumping. We didn't have that in there.

And I, being an entrepreneur, having had that background of starting a business, funding it and exiting it, I really looked at him. I was like, “listen, these are long-term...more

Dealmaker

Dealmaker

Devin Thorpe

Devin Thorpe