Crowdfunding in Trinidad - With barrister Brian Mondoh.

In this episode of This Call Is Being Recorded #TCIBR https://lnkd.in/eiMMrnhX we listen to a chat with Crowdfunding Professional Association President, Samson Williams and crowdfunding barrister Brian Sanya Mondoh on the state of investment crowdfunding in the USA and its potential in Trinidad and the Caribbean.

Click here to listen in: https://lnkd.in/eiMMrnhX

In this chat they discuss:

1. Barristers, what does that mean?

2. What happens when you lose $ in a protocol?

3. The state of investment crowdfunding in Trinidad

4. What are DAOs?

Looking forward to learning more about the state of crowdfunding in Trinidad and the Caribbean. In the meantime, don't forget to share and like this recording and join the CfPA.org for more info and insights into crowdfunding, globally.

...more

Problem with Reg CF Testing the Waters

Note - This is an email chain between Jenny Kassan and other CfPA members discussing the challenges of Testing The Water, that has been edited for brevity. While it is chucked full of useful information, it doesn't constitute legal, financial or compliance advise. As always consulting with a qualified lawyer or SME. This post is for educational purposes only. - Samson

Subject: problem with Reg CF Testing the Waters

From: Jenny Kassan

Oct 25, 2021, 10:07 PM

Hello! I don’t know if anyone has discussed this in our group but there is a big problem with Reg CF testing the waters under Rule 206.

If someone decides to publicly advertise the fact that they are considering doing a Reg CF offering under Rule 206 and then later decides not to do a Reg CF offering and that that they want to do a private offering of securities under Rule 506(b) or Rule 504 instead, they will pretty much be precluded from doing so theoretically forever!

This is because of the int...more

RegCF raised $1B dollars, so what?

Greetings Crowdfunding Community!

Two quick notes:

- I bumped into Sean O'Rielly from KingsCrowd yesterday and was telling him about when Kickstarter (launched in 2009) broke $1B dollars in rewards based crowdfunding pledges in 2014. Why that is important is because as of July 2021 Kickstarter has received more than $59B in pledges. You can see their full stats here: https://www.statista.com/statistics/310218/total-kickstarter-funding/

- Which brings us to point number two. As you may have read courtesy of Woodie and Crowdfund Insider, RegCF recently broke the $1B mark for funds raised. You can read about that here: https://www.crowdfundinsider.com/2021/10/182167-reg-cf-investment-crowdfunding-tops-1-billion-on-heals-of-funding-cap-increase/ Meaning that from 2016 to Q3 2021 RegCF has raised over $1B in funding.

Now, this is important for a number of reasons. Not just that because year to date, as of Q3 2021, ~$409M has been raised from 1,177 individual offerings. This is a ...more

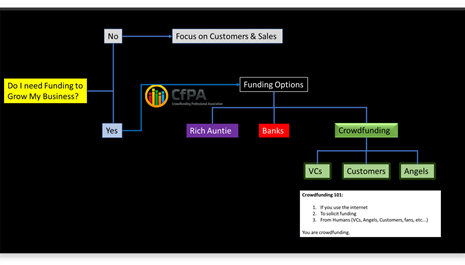

How to determine your funding options

To crowdfund or not to crowdfund?

The biggest paradigm shift in capital formation, post pandemic, is that every level of Investor and Founder has pivoted head on into #crowdfunding.

COVID19 forced Angels, VCs and Institutions online, ushering in a new era of FinTech adoption within capital formation. What was that fintech adoption? Platforms.

While the platforms have different regulatory requirements depending on the type of Crowd they're pursuing, they've all moved to digital platforms to facilitate funding.

GPs crowdfund for Funds from LPs on social media and private platforms, very similar to how Founders crowdfund for startup funds on social media using RegCF funding portals.

As Founders this is important for you to be aware of because regardless of The Crowd you're pursuing (VC, Angels, or Retail Investors) you'll be doing that online. So! If you have to pitch and pitch on online platforms, don't just pitch to a small audience. Pitch to the largest crowd you can get!

And that is t...more

3 Reasons why Going Public is going to clean the Shark’s tank.

TL;DR

- Customers have more money than VCs.

- Going Public empowers Founders to raise up to $75M via RegA+ crowdfunding while setting the investing terms for VCs, Sharks, Whales, Institutions and Customers alike.

- Nothing shows “traction” to Wall Street investors like raising money from 20,000 or 30,000 investomers.

First we should state the obvious thing. If you’re a Founder pitching to Sharks one at a time is the most inefficient way of raising capital. However, before JOBS Act Investment Crowdfunding you didn’t have a choice but to hustle around trying to find so-called “angels” and self-identified sharks and beg them for the opportunity to pitch. Now though, you don’t have to beg. Instead, through investment crowdfunding you have the opportunity to create an investment frenzy specifically for your business. No, this doesn’t make raising capital any easier. Raising capital is very similar to running a marathon. Even if you randomly find yourself at the starting line five mi...more

Why WeFunder, StartEngine and Republic have the most “successful” crowdfunding campaigns

Hello Beautiful People and in particular Founders. Today we’re going to discuss the obvious and the elusive of investment crowdfunding. The obvious things being why WeFunder, StartEngine and Republic have the most “successful” crowdfunding campaigns and then the elusive definition of “successful” when it comes to what that means to you as a Founder. You can read more about their success to date in this KingsCrowd article: https://kingscrowd.com/chart-of-the-week-which-platforms-have-most-successful-deals/

First some quick, obvious, maybe even a little dirty things that you should be aware of:

- It takes money to make money and even more to raise money.

- If you’re considering launching a “successful” crowdfunding campaign you should be planning to spend a minimum of 6 months and $150k planning, launching, and nurturing your “successful” campaign to success.

- Raised money isn’t earned. You’ve got to pay it back. So while your “successful” crowdfunding campaign is definitely some

Reg D - Turns out it still takes money to make money.

A bit ago I was on a webinar for Financial Poise, where I said that startups can expect to have a sunk cost of ~$46k in travel expenses alone and expect to take on average 21 months to raise money using the Reg D exception. On the webinar was “Mark”, the archetypical securities lawyer, who in typical lawyer fashion disagreed vehemently with these figures. So, what follows is a simple breakdown of typical expenses incurred in raising money via not only via Reg D but also JOBS ACT Reg CF and Reg A/A+ crowdfunding. Because it turns out that it still takes money to make money.

The Sunk Costs of Raising Capital

“A sunk cost is a cost that has already been incurred and cannot be recovered.”

There are numerous sunk costs in raising capital. For the entrepreneurs out there who will actually cut the checks here are the cold hard facts.

Reg D

Raising money via Reg D is the easiest and cheapest way to raise money if:

- You have an established business that is current

When it Comes to Investment Crowdfunding - Compliance Matters!

What to Know Before You Take the Plunge

The investment crowdfunding marketplace is growing faster than ever before, and is projected to grow by $196.36 billion from 2021 to 2025.

Unfortunately, industry watchers have observed an alarming level of non-compliance with the most basic rules of Regulation Crowdfunding by both companies raising capital and the platforms hosting the campaigns.

Non-compliance can result in regulatory enforcement action and/or investor lawsuits. So if you’re considering dipping a toe into the crowdfunding world, compliance should be at the top of your list.

In 2016, the SEC completed its rulemaking process for Regulation Crowdfunding. It suddenly became possible for a business to list an investment offering on a platform, and anyone in the United States could invest in the offering. But before doing that, the business, as well as the platform, must comply with some basic rules of the road.

According to a recent analysis, only a small minority ...more