CfPA's Statement Opposing the Offering of Republic Mirror Tokens under Regulation Crowdfunding

In recent months, investment platform Republic has announced plans to offer “Mirror Tokens” - digital instruments that track the economic performance of private companies such as SpaceX, Anthropic, Epic Games, Ramp, Canva, and Databricks. These tokens, like rSpaceX, do not provide ownership or voting rights, but instead offer a contractual claim tied to future liquidity events (e.g., IPOs or acquisitions). Marketed under Regulation Crowdfunding (Reg CF) with minimum investments starting at $50, Mirror Tokens enable retail investors to gain "exposure" to companies that are typically off-limits. As of early August 2025, Republic has listed 24 Mirror Tokens, with four currently open for reservations - raising pressing questions about how such synthetic products align with Reg CF’s purpose and its framework for investor protections (Crowdfund Insider, Axios).

Industry reporting and analysis offer a mixed yet critical picture:

-

ValueTheMarkets emphasizes that while Mi

The Best Way to Raise $5M Under Reg CF in 12 Months Starting with Virtually Nothing

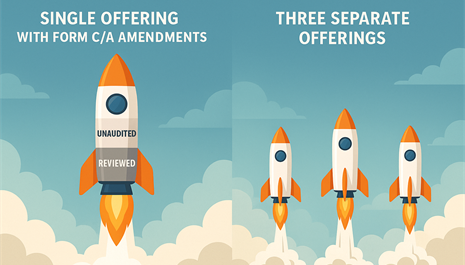

In recent months, I've been giving thought to the best way to do a $5 million Reg CF campaign, starting with very little upfront spend. It seems to me, there are two possible paths. Path one is to begin with a small (under $124,000) raise with a low initial closing threshold, say, $25,000, and later amend the Form C, using funds from the initial raise to fund legal, accounting and marketing expenses for rolling forward. The alternative path would be to do a series of independent raises, the first one very small and building, still with the goal of raising $5 million in 12 months.

I tasked Google Gemini with a deep research project to compare and contrast the regulatory and best practices for the two approaches. Here is the full report. Below is an executive summary. I'm curious now to get the opinions of experts like @Brian Christie, @Jenny Kassan, @Craig Denlinger and @Sara Hanks on this topic, but eagerly welcome feedback from everyone.

Executive Summary

This report evaluates tw...more

Meet The Member Interview Series: A Conversation with Andrew Field

As a venue for industry networking, the Crowdfunding Professional Association (CfPA) occasionally highlights the participation or biography of our association members. CfPA membership is designed to be inclusive and open to individuals and organizations sharing a professional interest in the field of Regulated Investment Crowdfunding.

Interview With Andrew Field

CfPA: Can you tell us a little about your background and your interest in the field of regulated investment crowdfunding?

Andrew: I’ve spent much of my career at the intersection of innovation, entrepreneurship, and finance - with a particular focus on how technology can democratize access to capital. My current role is with a crowdfunding technology provider (Dacxi Chain) but I have joined the CfPA in my capacity as Steering Committee Lead for the Global Equity Crowdfunding Alliance (GECA) which brings that all together. GECA exists to connect stakeholders across borders and drive ...more

25 Reasons to Invest Through Regulated Investment Crowdfunding for Social Impact

I’ve spent years immersed in the world of impact investing, and if I sound a little fired up today, it’s because I am. The traditional capital markets continue to overlook brilliant, diverse entrepreneurs—especially those working in and for their communities. That’s why I’m passionate about regulated investment crowdfunding (Regulation Crowdfunding or Reg CF, particularly). It’s not perfect, but it’s the most promising tool we have to democratize access to capital, empower underrepresented founders, and reshape our economy from the ground up. Here are just a few of the reasons I believe so deeply in this movement:

-

Democratization of Capital

Reg CF breaks down barriers that historically excluded all but the wealthy from investing in private ventures. -

Access to Overlooked Founders

Traditional VC overlooks diverse founders; Reg CF helps level the playing field by allowing the crowd to support talent the system ignores. -

Rooted in Community

Reg CF enables investment in local businesses a

Why I love Crowdfunding Portals

I love regulated investment crowdfunding and the portals that participate in the space. I’ve got gripes and complaints, but overall, I’m their biggest fan. They are fundamentally essential to the ongoing success of the industry—and its future growth.

Today, I’d like to enumerate some of my favorite things about portals operating under Regulation Crowdfunding:

9 Things I Love About Portals

-

Pre-Screening Investments: We all rely on portals to screen the offerings they host. They all use different criteria, but they are all required to exclude companies associated with “bad actors”—people who have been in trouble with the SEC in the past.

-

Regulatory Compliance: Having run a FINRA-member, SEC-registered broker-dealer, I know how hard it is to comply with the regulations. That is a big reason I don’t run a portal today! I’m grateful that they have made the effort to comply with the rules. These sometimes impose on us minor inconveniences, but the net effect is a safe and

Registration now open for the 2025 Regulated Investment Crowdfunding Summit!

Registration is NOW OPEN!

Join us for the 2025 Regulated Investment Crowdfunding Summit

October 21–22, 2025

Washington, DC

This is the must-attend event for anyone in the Reg CF and Reg A ecosystem.

Connect with industry leaders, policymakers, regulators, and innovators from across the public and private sectors. Hear from top thought leaders driving the future of regulated investment crowdfunding - and gain insights you won’t find anywhere else.

From policy to practice, this summit builds on the growing momentum of a rapidly evolving industry.

✅ Register now to get the early bird rate and to secure your spot.

More details coming soon—but don’t wait!

Day 1 (10/21): Advocacy Visits - on the Hill and with Regulators

Day 2 (10/22): Conference Summit

National Union Building

918 F St NW, Washington, DC 20004

###

...moreCfPA Presents Case for Nuanced Reg CF Reform at SEC Small Business Forum

On April 10, 2025, the Crowdfunding Professional Association (CfPA) had a significant opportunity to advocate for crucial regulatory improvements at the SEC’s 44th Annual Small Business Forum in Washington, D.C. Representing the CfPA on the “Out of the Blocks: Strategies and Trends in Early-Stage Capital Raising” panel, I presented key insights and policy recommendations aimed at enhancing Regulation Crowdfunding (Reg CF) for the entire ecosystem – issuers, investors, intermediaries, and service providers alike.

The State of Reg CF and the Need for Evolution

Since its 2016 launch, Regulation Crowdfunding has undeniably opened doors, enabling over 8,700 campaigns to raise more than $2.2 billion from millions of investors. It's a testament to the power of democratizing capital formation. However, as the industry matures, it's clear the current framework requires refinement to unlock its full potential.

As the leading association representing professio...more

A Call to Modernize Crowdfunding Laws -- and Why We Need You to Join the Movement!

At the Crowdfunding Professional Association (CfPA), we are proud to represent the voice of the regulated investment crowdfunding industry—a sector that has become a powerful engine for innovation, entrepreneurship, and inclusive economic growth across the United States.

In response to the House Financial Services Committee’s recent request for feedback on capital formation, we submitted a comprehensive letter outlining key reforms urgently needed to modernize Regulation Crowdfunding (Reg CF) and related exemptions. These reforms are critical to ensure that crowdfunding continues to thrive as a competitive, accessible, and transformative force in U.S. capital markets.

Since Reg CF was introduced through the JOBS Act of 2012, it has grown from a bold experiment into a proven success:

-

Over 8,500 securities offerings

-

$2.2 billion raised from more than 2 million Americans

-

$7.5 billion in economic impact

-

Nearly 400,000 jobs created

-

$80 billion in estim

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

CfPA 2025 Summit

CfPA 2025 Summit