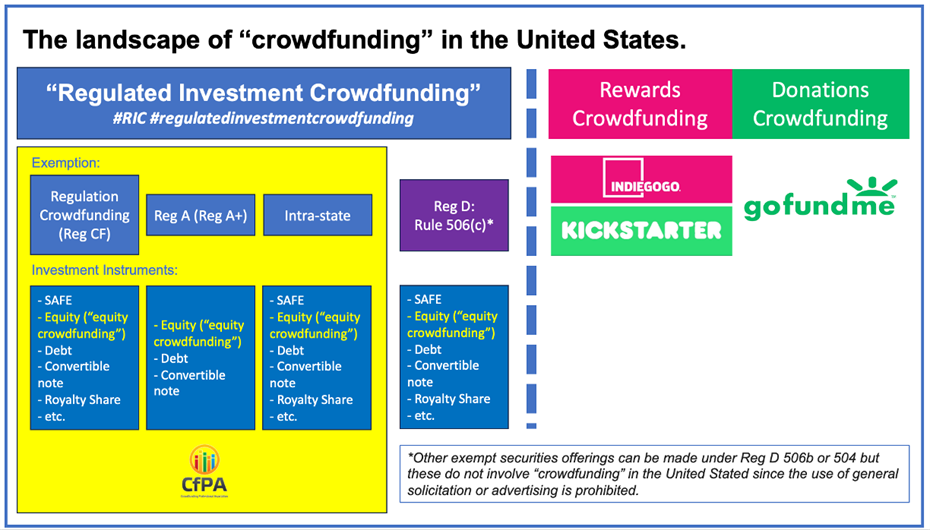

Crowdfunding Professional Association (CfPA)

Posts (15)

In recent months, investment platform Republic has announced plans to offer “Mirror Tokens” - digital instruments that track the economic performance of private companies such as SpaceX, Anthropic, Epic Games, Ramp, Canva, and Databricks. These tokens, like rSpaceX, do not provide ownership or voting rights, but instead offer a contractual claim tied to future liquidity events (e.g., IPOs or acquisitions). Marketed under Regulation Crowdfunding (Reg CF) with minimum investments starting at $50, Mirror Tokens enable retail investors to gain "exposure" to companies that are typically off-limits. As of early August 2025, Republic has listed 24 Mirror Tokens, with four currently open for reservations - raising pressing questions about how such synthetic products align with Reg CF’s purpose and its framework for investor protections (Crowdfund Insider, Axios).

Industry reporting and analysis offer a mixed yet critical picture:

-

ValueTheMarkets emphasizes that while Mi