25 Reasons to Invest Through Regulated Investment Crowdfunding for Social Impact

I’ve spent years immersed in the world of impact investing, and if I sound a little fired up today, it’s because I am. The traditional capital markets continue to overlook brilliant, diverse entrepreneurs—especially those working in and for their communities. That’s why I’m passionate about regulated investment crowdfunding (Regulation Crowdfunding or Reg CF, particularly). It’s not perfect, but it’s the most promising tool we have to democratize access to capital, empower underrepresented founders, and reshape our economy from the ground up. Here are just a few of the reasons I believe so deeply in this movement:

-

Democratization of Capital

Reg CF breaks down barriers that historically excluded all but the wealthy from investing in private ventures. -

Access to Overlooked Founders

Traditional VC overlooks diverse founders; Reg CF helps level the playing field by allowing the crowd to support talent the system ignores. -

Rooted in Community

Reg CF enables investment in local businesses a

Registration now open for the 2025 Regulated Investment Crowdfunding Summit!

Registration is NOW OPEN!

Join us for the 2025 Regulated Investment Crowdfunding Summit

October 21–22, 2025

Washington, DC

This is the must-attend event for anyone in the Reg CF and Reg A ecosystem.

Connect with industry leaders, policymakers, regulators, and innovators from across the public and private sectors. Hear from top thought leaders driving the future of regulated investment crowdfunding - and gain insights you won’t find anywhere else.

From policy to practice, this summit builds on the growing momentum of a rapidly evolving industry.

✅ Register now to get the early bird rate and to secure your spot.

More details coming soon—but don’t wait!

Day 1 (10/21): Advocacy Visits - on the Hill and with Regulators

Day 2 (10/22): Conference Summit

National Union Building

918 F St NW, Washington, DC 20004

###

...moreCfPA Presents Case for Nuanced Reg CF Reform at SEC Small Business Forum

On April 10, 2025, the Crowdfunding Professional Association (CfPA) had a significant opportunity to advocate for crucial regulatory improvements at the SEC’s 44th Annual Small Business Forum in Washington, D.C. Representing the CfPA on the “Out of the Blocks: Strategies and Trends in Early-Stage Capital Raising” panel, I presented key insights and policy recommendations aimed at enhancing Regulation Crowdfunding (Reg CF) for the entire ecosystem – issuers, investors, intermediaries, and service providers alike.

The State of Reg CF and the Need for Evolution

Since its 2016 launch, Regulation Crowdfunding has undeniably opened doors, enabling over 8,700 campaigns to raise more than $2.2 billion from millions of investors. It's a testament to the power of democratizing capital formation. However, as the industry matures, it's clear the current framework requires refinement to unlock its full potential.

As the leading association representing professio...more

A Call to Modernize Crowdfunding Laws -- and Why We Need You to Join the Movement!

At the Crowdfunding Professional Association (CfPA), we are proud to represent the voice of the regulated investment crowdfunding industry—a sector that has become a powerful engine for innovation, entrepreneurship, and inclusive economic growth across the United States.

In response to the House Financial Services Committee’s recent request for feedback on capital formation, we submitted a comprehensive letter outlining key reforms urgently needed to modernize Regulation Crowdfunding (Reg CF) and related exemptions. These reforms are critical to ensure that crowdfunding continues to thrive as a competitive, accessible, and transformative force in U.S. capital markets.

Since Reg CF was introduced through the JOBS Act of 2012, it has grown from a bold experiment into a proven success:

-

Over 8,500 securities offerings

-

$2.2 billion raised from more than 2 million Americans

-

$7.5 billion in economic impact

-

Nearly 400,000 jobs created

-

$80 billion in estim

SEC Commissioner Hester M. Peirce to speak at CfPA Summit

|

CfPA Regulated Investment Crowdfunding and Leadership Summit 2024 - Detailed Agenda

Day 1 (10/22: Tues.) : Advocacy Visits & Pre-event Reception

|

10:00 AM - 5:30 Advocacy Meetings

|

Capitol Hill + Regulator visits CfPA members registered for the Summit may be eligible to attend some of the advocacy meetings. |

|

5:30-8:00 PM Cocktail Reception |

Sunset Cocktail Reception Top of the Town - Top Floor and Rooftop (1400 14th Street North, Arlington, VA) (Streaming Music by DJ Scott McIntyre)

|

Day 2 (10/23: Wed.) : Conference and Summit

Venue: Top of the Town (Top Floor 1400 14th Street North, Arlington, VA)

“One of the most magnificent views in Washington”

...more

Unlocking Community Support for Climate Tech Infrastructure Projects Through Regulated Investment Crowdfunding and Lessons of Community Ownership from Germany and Denmark

Infrastructure development in the United States, particularly in climate tech sectors like wind farms, solar plants, waste-to-energy facilities, or other First of a Kind (FOAK) projects, frequently faces substantial local opposition. This resistance, commonly referred to as "Not In My Backyard" (NIMBY), is driven by concerns over environmental impact, property values, and disruptions to daily life. The resulting delays not only stall project timelines but also threaten the U.S.'s ability to meet crucial climate goals. Slowing the growth of renewable energy projects undermines efforts to reduce carbon emissions and transition to a sustainable energy system.

However, countries like Germany and Denmark have demonstrated an effective solution: community ownership. By allowing local residents to invest directly in infrastructure projects, these nations have transformed NIMBY-driven opposition into widespread support. In the U.S., regulated investment crowdfunding (Reg CF and Reg A) presents...more

Are Current Debt and Revenue-Share Interest Rates Fair for Investors?

While many investors typically feel that debt deals are “lower-risk” than equity deals in investment crowdfunding, I’ve always wondered if that’s really the case. As investors, we have plenty of options for where to put our money — like zero-risk savings accounts at banks currently offering 4.6% or even 5% interest! So, I decided to dig into the data on debt and revenue-share offerings to see if the interest rates are actually compensating investors for the risks they’re taking.

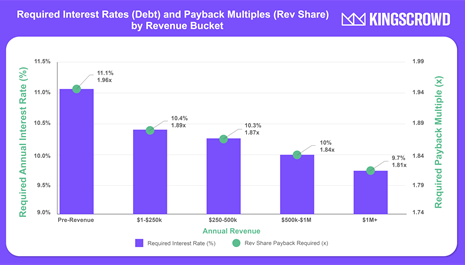

Required annual interest rates and payback multiples over 6.4 years for investors holding a diversified portfolio of debt and revenue-share Reg CF deals to break-even after accounting for failures and risks.

...moreTLDR: to adequately compensate Reg CF investors for risk and opportunity costs, we estimate that the current average debt interest rate should be roughly 11.1% on pre-revenue deals and 10.2% on post-revenue deals. For revenue share notes, the break-even payback mu

CfPA 2025 Summit

CfPA 2025 Summit

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Crowdfund Holdings Innovators (CHI)

Crowdfund Holdings Innovators (CHI)