What’s the Differences Between Regulations A, CF, D, and S?

When it comes to raising capital, there are various ways you can raise money from investors. And while they all have their own specific compliance requirements, they all share one common goal: to protect investors while still providing them with opportunities to invest in private companies. Let’s look at the four most popular types of equity crowdfunding; through Regulation A, CF, D, or S.

Regulation A+ (RegA+)

Offering size per year: Up to $75 million

Number of investors allowed: Unlimited, as long as the issuer meets certain conditions.

Type of investor allowed: Both accredited and non-accredited investors.

SEC qualification required: Reg A+ offerings must be qualified by the SEC and certain state securities regulators and must also file a “Form 1-A”. Audited financials are required for Tier II offerings.

This type of crowdfunding is popular because it allows companies to raise up to $75 million per year in capital and is open to accredited and non-accredited investors. Offering...more

What You Need to Know About Reg A+

If you are an entrepreneur looking to raise funds, you may have heard of Regulation A+, often referred to simply as Reg A+. This alternative to traditional venture capital, private equity, or other funding sources allows companies to sell securities to the public without going through the lengthy and costly process of registering with the SEC. Since it was expanded in 2012 with the JOBS Act, Reg A+ continues to evolve, facilitating increased capital formation for companies within the private capital market.

What is Reg A+?

The goal of Reg A+ is to make it easier and less expensive for small businesses to access capital while still providing investors with the protection of an SEC-qualified offering. The offering is exempt from complete SEC registration, allowing companies to raise up to $75 million in capital, with certain restrictions and requirements. To qualify for this exemption, a company must file an offering statement (Form 1-A) with the SEC that includes all pertinent in...more

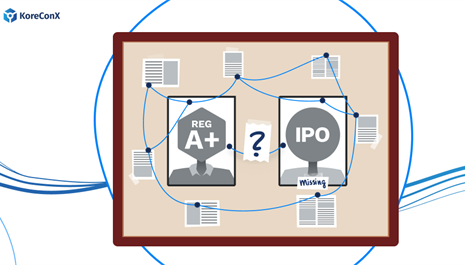

Has RegA+ Killed the IPO?

Has RegA+ Killed the IPO?

Regulation A+ gives issuers the ability to raise $75 million in crowdfunding while remaining private. With RegA+ benefiting both companies and investors, does this mean the death of IPOs?

RegA+, part of the JOBS Act, allows companies to raise funds through the general public, not just accredited investors. With more and more IPOs delayed, unprecedented access to private capital is available to all organizations. With RegA+, anyone can invest in private companies, making it increasingly popular with companies seeking capital, primarily since they can raise a significant amount of funding.

The regulatory and monetary hurdles that come with entering an IPO in addition to RegA+ have led to delays in initial public offerings. Since the JOBS Act was passed in 2012, funding opportunities for private companies have improved, especially with the allowance of not-accredited investors opening up a previously untapped pool of prospective investors. Additionally, the secon...more

Online Capital Formation And Why You Have To Understand It

The JOBS Act reached its tenth anniversary in 2022. We celebrated the date with the launch of our Podcast, KoreTalkX, recently mentioned by Spotify as in the top 10% of the most shared shows globally. But the regulations that brought a lot of novelties to the capital raising process still face some misconceptions, especially regarding Crowdfunding. We are introducing Online Capital Formation and why you have to understand it.

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes KickStarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online ...more

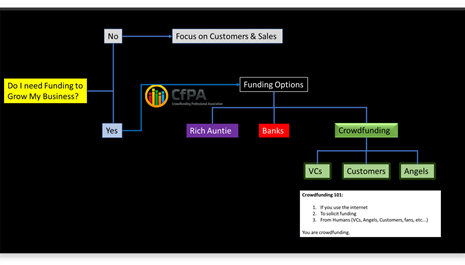

How to determine your funding options

To crowdfund or not to crowdfund?

The biggest paradigm shift in capital formation, post pandemic, is that every level of Investor and Founder has pivoted head on into #crowdfunding.

COVID19 forced Angels, VCs and Institutions online, ushering in a new era of FinTech adoption within capital formation. What was that fintech adoption? Platforms.

While the platforms have different regulatory requirements depending on the type of Crowd they're pursuing, they've all moved to digital platforms to facilitate funding.

GPs crowdfund for Funds from LPs on social media and private platforms, very similar to how Founders crowdfund for startup funds on social media using RegCF funding portals.

As Founders this is important for you to be aware of because regardless of The Crowd you're pursuing (VC, Angels, or Retail Investors) you'll be doing that online. So! If you have to pitch and pitch on online platforms, don't just pitch to a small audience. Pitch to the largest crowd you can get!

And that is t...more

$5M reason to go small -The Future of Investment Crowdfunding.

The buzz in the investment crowdfunding industry these days is all about when will the SEC increase the funding limit of JOBS Act Crowdfunding (aka equity crowdfunding) from $1.07M dollars to $5M. Rumor has it that there has been a flood, a FLOOD, of RegCF platform applications in anticipation of the $5M limit increase. Why is raising the maximum that a business can raise under RegCF rules to $5M so important? It’s not.

I know you’re busy so I’ll leave you to consider the following reasons why a $5M limit is misleading and the basis for the most abusive bit of narrative economics within the crowdfunding industry, the random investor limits on retail investors.

By “increasing” the limit to $5M it reinforces the idea of unaccredited vs accredited investors. Meaning, “unaccredited” and “accredited” investors are randomly manufactured designations that predate nearly everyone reading this except Irwin Stein, t...more

- 1

KoreConX

KoreConX