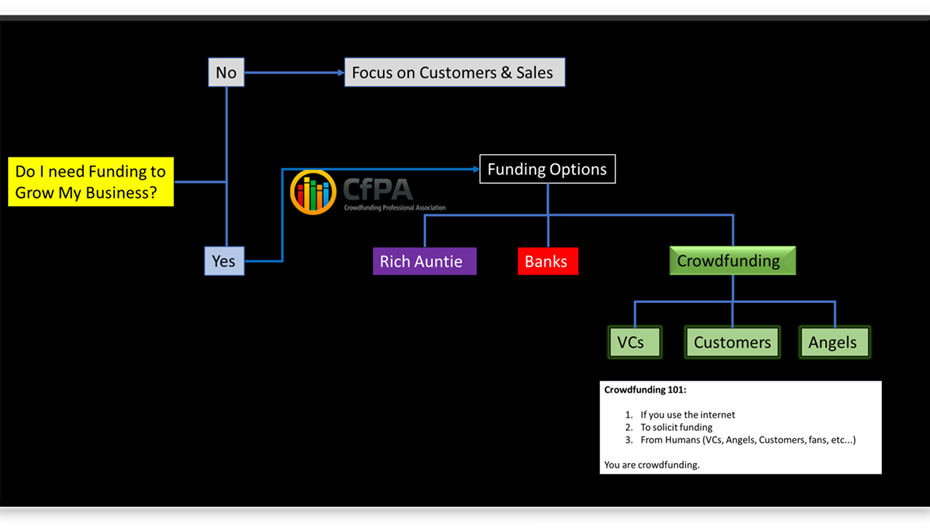

To crowdfund or not to crowdfund?

The biggest paradigm shift in capital formation, post pandemic, is that every level of Investor and Founder has pivoted head on into #crowdfunding.

COVID19 forced Angels, VCs and Institutions online, ushering in a new era of FinTech adoption within capital formation. What was that fintech adoption? Platforms.

While the platforms have different regulatory requirements depending on the type of Crowd they're pursuing, they've all moved to digital platforms to facilitate funding.

GPs crowdfund for Funds from LPs on social media and private platforms, very similar to how Founders crowdfund for startup funds on social media using RegCF funding portals.

As Founders this is important for you to be aware of because regardless of The Crowd you're pursuing (VC, Angels, or Retail Investors) you'll be doing that online. So! If you have to pitch and pitch on online platforms, don't just pitch to a small audience. Pitch to the largest crowd you can get!

And that is the beauty of JOBS Act Regulated Crowdfunding options of RegCF ($5M), RegA+ ($75M) and RegD (unlimited $$$). They empower Founders to pitch to EVERYONE, while enabling Investors to see the deals that have traction from every level of investor: VC, Sharks, Angels, Retail Investors.

Good luck and may the odds and the algorithms forever be in your favor!

Samson Williams,

President, CfPA

PS - If you're not already a member of the www.CfPA.org, join today. After all, there are benefits to being part of a crowd of professionals.

Register for FREE to comment or continue reading this article. Already registered? Login here.

1