Is Reg D Suitable for My Company?

Regulation D (Reg D) is a set of rules established by the U.S. Securities and Exchange Commission (SEC) that allows companies to raise capital without registering their securities for public sale and is related to, but different than other JOBS Act regulations. Reg D also establishes certain disclosure requirements that companies must comply with when selling securities under this type of offering and offers several advantages for companies seeking to raise capital, these include:

- Ability to raise capital from accredited and some nonaccredited investors

- Reduced disclosure requirements, and faster access to capital

- No limits on offering sizes

However, there are also certain drawbacks associated with Reg D. For example, companies must comply with state regulations that may require disclosure of notices of sale or the names of those who receive compensation in connection with the sale. Additionally, the benefits of Reg D only apply to the issuer of the securities, not to affil...more

Is it time to upset the VC applecart?

We’re living in the post-FTX crypto era and everything has changed. Just to showcase that fact, a recent article in TechCrunch cites a class action lawsuit against Sequoia, Paradigm and Thoma Bravo for pumping FTX resulting in retail investors losing money. The lawsuit is being spearheaded by the law firm Robbins Geller Rudman & Dowd of San Diego.

Here’s the article: If Sequoia, Paradigm and Thoma Bravo settle a new lawsuit, it could upend VC; here’s why

The TechCrunch writer asks “Is such promotion a crime? If it is, the entire industry is guilty of it. VCs see part of their ‘value add’ as helping to extend the brand of the startups they fund. They’ve been ‘talking their book’ since the industry got off the ground many decades ago. With the advent of social media, it only became much more annoying.”

I'm sorry to upset the apple cart for my VC friends, but they should be accountable and bear some responsibility for hyping their crypto portfolio firms and the whole spac...more

What are the costs for a RegCF Issuance?

Raising capital is necessary for many companies, but it comes with a price tag. This is why we often receive questions from companies seeking to understand how to budget for the fundraising process. With Regulation Crowdfunding (Reg CF) issuances becoming increasingly popular in the United States, understanding the costs associated with these offerings is essential to successful capital raising.

To shed a light on this topic, we have worked with our KorePartners to research the estimated budget for a Reg CF offering. However, this estimated budget is based on a variety of factors that can influence the total cost of capital raising. Thus, this information will not apply to all companies but is a general guide to the expenses involved in a Reg CF raise.

Visit our blog to learn the end-to-end details.

...moreWould you like to learn more about safely online investing?

The year of trust and compliance is here and we, at KoreConX, are more than happy to share with you what innovations we bring to the market. We will walk you through topics such as cybersecurity, investing online, and how to be sure you are doing it safely and compliantly inside a regulated environment.

Our CRO, Peter Daneyko, has a lot to share about KoreID - with some surprises coming up, with our communications coordinator, Rafael Gonçalves.

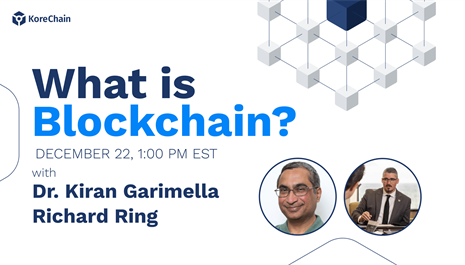

Do you understand blockchain?

There is a general understanding that crowdfunding, tokenization, and some other concepts are tightly connected. But do you understand what blockchain is? It is important to understand how it works to help us all understand Online Capital Formation.

Follow our Spotify Channel and welcome aboard.

...moreOnline Capital Formation

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes Kickstarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online and people can contribute based on a variety of rewards listed on a website. But that is far from being a regulated entity.

RegCF helps companies turn investors into shareholders. Companies and product makers are not selling their stories anymore. They are selling their stock. And that is why we feel the word “crowdfunding” doesn’t encompass the whole idea behind it.

That is why we put together our KorePartners, like Sara Hanks (CEO...more

Online Capital Formation beyond Crowdfunding

The JOBS Act reached its tenth anniversary in 2022. We celebrated the date with the launch of our Podcast, KoreTalkX, recently mentioned by Spotify as in the top 10% of the most shared shows globally. But the regulations that brought a lot of novelties to the capital raising process still face some misconceptions, especially regarding Crowdfunding. We are introducing Online Capital Formation and why you have to understand it.

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes Kickstarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online and pe...more

Introducing the CfPA Ecosystem's ChatGPT BOT -- Power to the People?

In the past week, the public release of OpenAI’s ChatGPT, an artificial intelligent "bot" has garnered a lot of press and attention. As with many leaps forward in technology, people are struggling to understand the impact it will have on society and in some cases, on their very own lives or livelihoods.

If you ask ChatGPT whether or not AI could have an impact on the field of investment crowdfunding, it will tell you:

"Yes, it is possible that AI could have an impact on the field of investment crowdfunding. AI can be used to process large amounts of data quickly and accurately, which could be useful for analyzing potential investment opportunities and making predictions about their success. Additionally, AI could be used to automate many of the tasks involved in managing a crowdfunding campaign, such as identifying potential investors and tracking progress toward fundraising goals. However, it is also important to consider the potential drawbacks of using AI in this contex...more

KoreConX

KoreConX