CfPA Commuity's thoughts on RaiseWay's Crowdfunding Campaign Management Toolkit

Posted at 3/28/2023

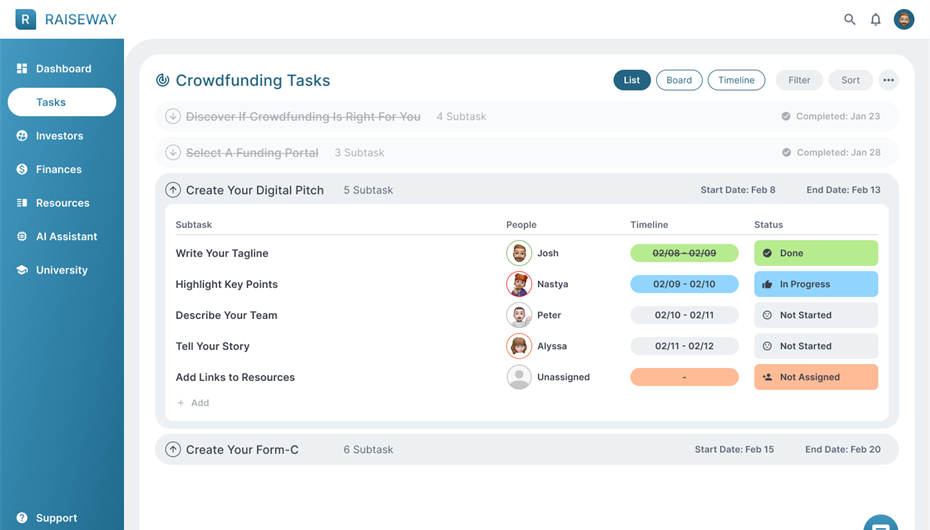

Hi everyone! Together with my co-founder - Josh McSorley - and we are building a tool to make investment crowdfunding easy for businesses raising capital.

In this 3-min Loom Video I cover our task manager view.

What do you think? Thank you so much to everyone who shares their thoughts! In the next videos we can cover:

- AI Campaign Assistant

- Investor Relationship Manager

- Funding Portal Selector

Click here to join the early access waitlist here - alpha version shall be released on April 15th!

I would sincerely appreciate it if you shared this with any business looking to raise capital with crowdfunding on a tight budget.

Thank you,

Co-Founder & CEO of RaiseWay

Member of BoD of CfPA

...more

Would you like to learn more about safely online investing?

The year of trust and compliance is here and we, at KoreConX, are more than happy to share with you what innovations we bring to the market. We will walk you through topics such as cybersecurity, investing online, and how to be sure you are doing it safely and compliantly inside a regulated environment.

Our CRO, Peter Daneyko, has a lot to share about KoreID - with some surprises coming up, with our communications coordinator, Rafael Gonçalves.

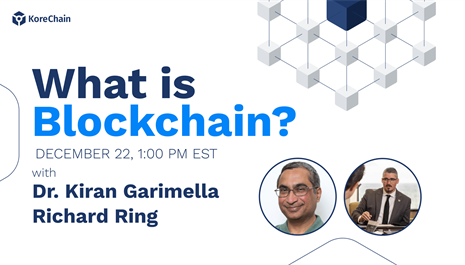

Do you understand blockchain?

There is a general understanding that crowdfunding, tokenization, and some other concepts are tightly connected. But do you understand what blockchain is? It is important to understand how it works to help us all understand Online Capital Formation.

Follow our Spotify Channel and welcome aboard.

...moreOnline Capital Formation

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes Kickstarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online and people can contribute based on a variety of rewards listed on a website. But that is far from being a regulated entity.

RegCF helps companies turn investors into shareholders. Companies and product makers are not selling their stories anymore. They are selling their stock. And that is why we feel the word “crowdfunding” doesn’t encompass the whole idea behind it.

That is why we put together our KorePartners, like Sara Hanks (CEO...more

Online Capital Formation beyond Crowdfunding

The JOBS Act reached its tenth anniversary in 2022. We celebrated the date with the launch of our Podcast, KoreTalkX, recently mentioned by Spotify as in the top 10% of the most shared shows globally. But the regulations that brought a lot of novelties to the capital raising process still face some misconceptions, especially regarding Crowdfunding. We are introducing Online Capital Formation and why you have to understand it.

We do write a lot about the democratization of capital because we believe that everyone should be able to participate and share in the benefits, whether as entrepreneurs, brand advocates, innovators, or investors (both accredited and non-accredited). What we may be missing here is that Regulation CF (RegCF) has matured over the past decade, and it is time to look at it in a more complex way.

For many individuals, the word “crowdfunding” still evokes Kickstarter as a Top of Mind idea. Entrepreneurs that need money to launch a product pitch their ideas online and pe...more

Why Reg.A is the Superior Crowdfunding Choice over Reg.D or Reg.CF

Despite being around for years now, there’s still major confusion from issuers regarding the benefits and drawbacks of Regulation A (Reg.A), Regulation CF (Reg.CF), and Regulation D (Reg.D) crowdfunding offerings. What option is right for you? In this podcast, Mike Brette, the CEO and Founder of Small Cap Equity Advisors goes over why he believes Reg.A is the superior choice in most instances, plus provides advice as to what issuers should be doing (and what they shouldn’t be doing as well) in order to achieve a successful capital raise.

Reg.A, Reg.D, Reg.CF… What’s best for you and/or your company? And how much will it all cost you? Based on the reasons Mr. Brette provides in this podcast – both pro and con, he makes a strong case that regardless of the size of your raise, you should strongly consider the Reg.A option right from the start.

Restricted stock, “dead money”, valuation determination, accreditation of investors, liquidity issues, possible advertis...more

- 1

KoreConX

KoreConX