Not all “Crowdfunding” is Created Equal: Navigating a Terminology Maze and the Oculus Case Study

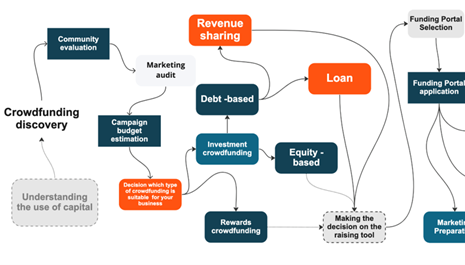

In the dynamic realm of crowdfunding, different models have emerged to cater to different fundraising needs. However, a common pitfall lies in the tendency to conflate "donations crowdfunding," "rewards crowdfunding," and "regulated investment crowdfunding." While these models share a common term - “crowdfunding” - they are very different and serve distinct purposes.

Donations Crowdfunding is typified by platforms like GoFundMe and involves raising funds for personal causes without an obligation to provide a product. Someone has a hospital bill and they appeal to donors. “Donors” not “Investors.” In other words, there is not the expectation or obligation of a “return” of any kind with donations crowdfunding.

Rewards Crowdfunding is a popular model exemplified by platforms like Kickstarter and Indiegogo and it allows creators to pre-sell a product or service to backers. “Backers” not “Investors.” In other words, contributors or backers receive tangible rewards in return for ...more

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

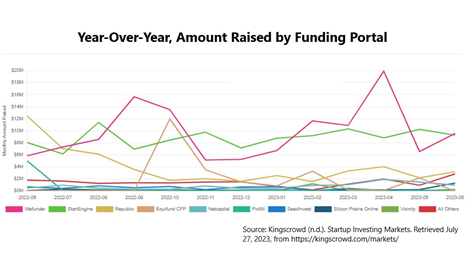

Our industry is broke

Dear colleagues at Crowdfunding Professional Association and beyond. We all love saying that the industry is doing great.

Math says "that's bs; CF industry is broke and dealflow is the problem." I am using funding portal data because transparency is forced upon these intermediaries.

Please don't shoot the messenger. I would like to be proven otherwise.

There are 70,000 startups in the United States within 33,000,000 small businesses. How many active Regulation Crowdfunding deals are there right now? 450.

Let's say that the average salary for a portal employee is $75,000 ($6 250 per month). Sounds like an OK living in the U.S. (unless you are in New York, San Francisco, Los Angeles, etc).

I went onto each of their LinkedIn pages and counted the number of employees. I assumed - rather generously - on average, only 50% of these "employees" are paid. The rest are advisors, investors, partners, etc.

I tried to count how much money each of the platforms will have left after receivi...more

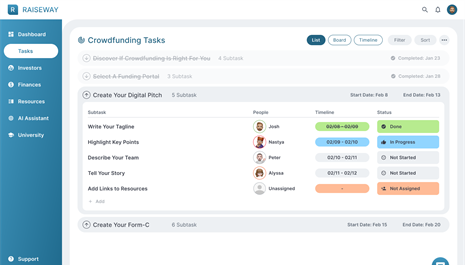

CfPA Commuity's thoughts on RaiseWay's Crowdfunding Campaign Management Toolkit

Posted at 3/28/2023

Hi everyone! Together with my co-founder - Josh McSorley - and we are building a tool to make investment crowdfunding easy for businesses raising capital.

In this 3-min Loom Video I cover our task manager view.

What do you think? Thank you so much to everyone who shares their thoughts! In the next videos we can cover:

- AI Campaign Assistant

- Investor Relationship Manager

- Funding Portal Selector

Click here to join the early access waitlist here - alpha version shall be released on April 15th!

I would sincerely appreciate it if you shared this with any business looking to raise capital with crowdfunding on a tight budget.

Thank you,

Co-Founder & CEO of RaiseWay

Member of BoD of CfPA

...more

Is it time to upset the VC applecart?

We’re living in the post-FTX crypto era and everything has changed. Just to showcase that fact, a recent article in TechCrunch cites a class action lawsuit against Sequoia, Paradigm and Thoma Bravo for pumping FTX resulting in retail investors losing money. The lawsuit is being spearheaded by the law firm Robbins Geller Rudman & Dowd of San Diego.

Here’s the article: If Sequoia, Paradigm and Thoma Bravo settle a new lawsuit, it could upend VC; here’s why

The TechCrunch writer asks “Is such promotion a crime? If it is, the entire industry is guilty of it. VCs see part of their ‘value add’ as helping to extend the brand of the startups they fund. They’ve been ‘talking their book’ since the industry got off the ground many decades ago. With the advent of social media, it only became much more annoying.”

I'm sorry to upset the apple cart for my VC friends, but they should be accountable and bear some responsibility for hyping their crypto portfolio firms and the whole spac...more

Introducing the CfPA Ecosystem's ChatGPT BOT -- Power to the People?

In the past week, the public release of OpenAI’s ChatGPT, an artificial intelligent "bot" has garnered a lot of press and attention. As with many leaps forward in technology, people are struggling to understand the impact it will have on society and in some cases, on their very own lives or livelihoods.

If you ask ChatGPT whether or not AI could have an impact on the field of investment crowdfunding, it will tell you:

"Yes, it is possible that AI could have an impact on the field of investment crowdfunding. AI can be used to process large amounts of data quickly and accurately, which could be useful for analyzing potential investment opportunities and making predictions about their success. Additionally, AI could be used to automate many of the tasks involved in managing a crowdfunding campaign, such as identifying potential investors and tracking progress toward fundraising goals. However, it is also important to consider the potential drawbacks of using AI in this contex...more

When it Comes to Investment Crowdfunding - Compliance Matters!

What to Know Before You Take the Plunge

The investment crowdfunding marketplace is growing faster than ever before, and is projected to grow by $196.36 billion from 2021 to 2025.

Unfortunately, industry watchers have observed an alarming level of non-compliance with the most basic rules of Regulation Crowdfunding by both companies raising capital and the platforms hosting the campaigns.

Non-compliance can result in regulatory enforcement action and/or investor lawsuits. So if you’re considering dipping a toe into the crowdfunding world, compliance should be at the top of your list.

In 2016, the SEC completed its rulemaking process for Regulation Crowdfunding. It suddenly became possible for a business to list an investment offering on a platform, and anyone in the United States could invest in the offering. But before doing that, the business, as well as the platform, must comply with some basic rules of the road.

According to a recent analysis, only a small minority ...more

Communications and publicity by issuers prior to and during a Regulation CF offering

The idea behind crowdfunding is that the crowd — family, friends and fans of a small or startup company, even if they are not rich or experienced investors — can invest in that company’s securities. For a traditionally risk-averse area of law, that’s a pretty revolutionary concept.

In order to make this leap, Congress wanted to ensure that all potential investors had access to the same information. The solution that Congress came up in the JOBS Act with was that there had to be one centralized place that an investor could access that information — the website of the funding portal or broker-dealer that hosts the crowdfunding offering (going forward we will refer to both of these as “platforms”).

This means (with some very limited exceptions that we’ll describe below) most communications about the offering can ONLY be found on the platform. On the platform, the company can use any form of communication it likes, and can give as much information as it likes (so long as it’s not misleadin...more

Raiseway

Raiseway

CrowdCheck, Inc.

CrowdCheck, Inc.