- Home

- Q&A

-

Who has a better chance at raising funds under investment crowdfunding - a company with a single founder or a company with co-founders?

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by ... more

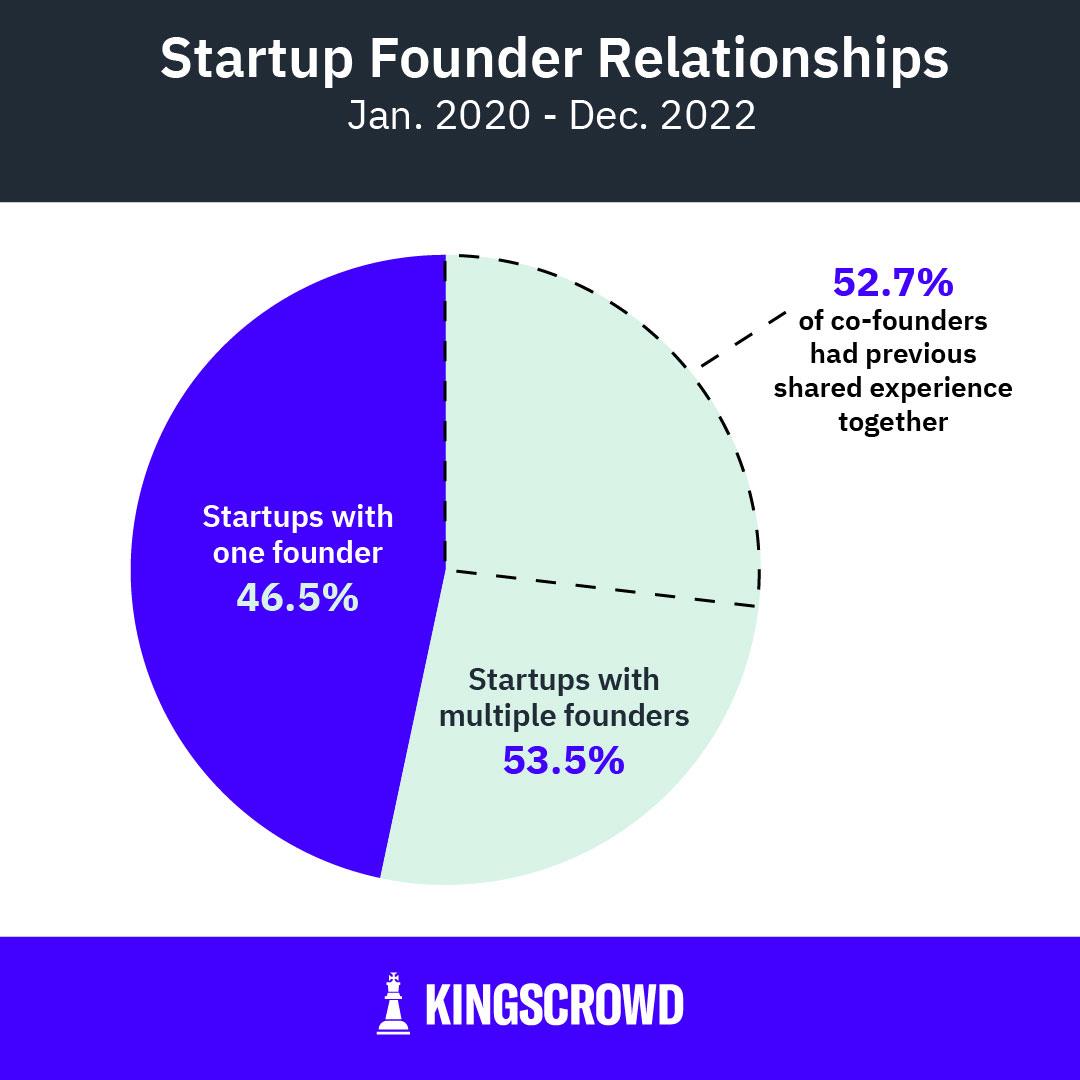

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by solo founders, while the other 53% had two or more co-founders.

With that perspective, let's look at some thinking around whether or not single founders or co-founders are more successful at raising funds.

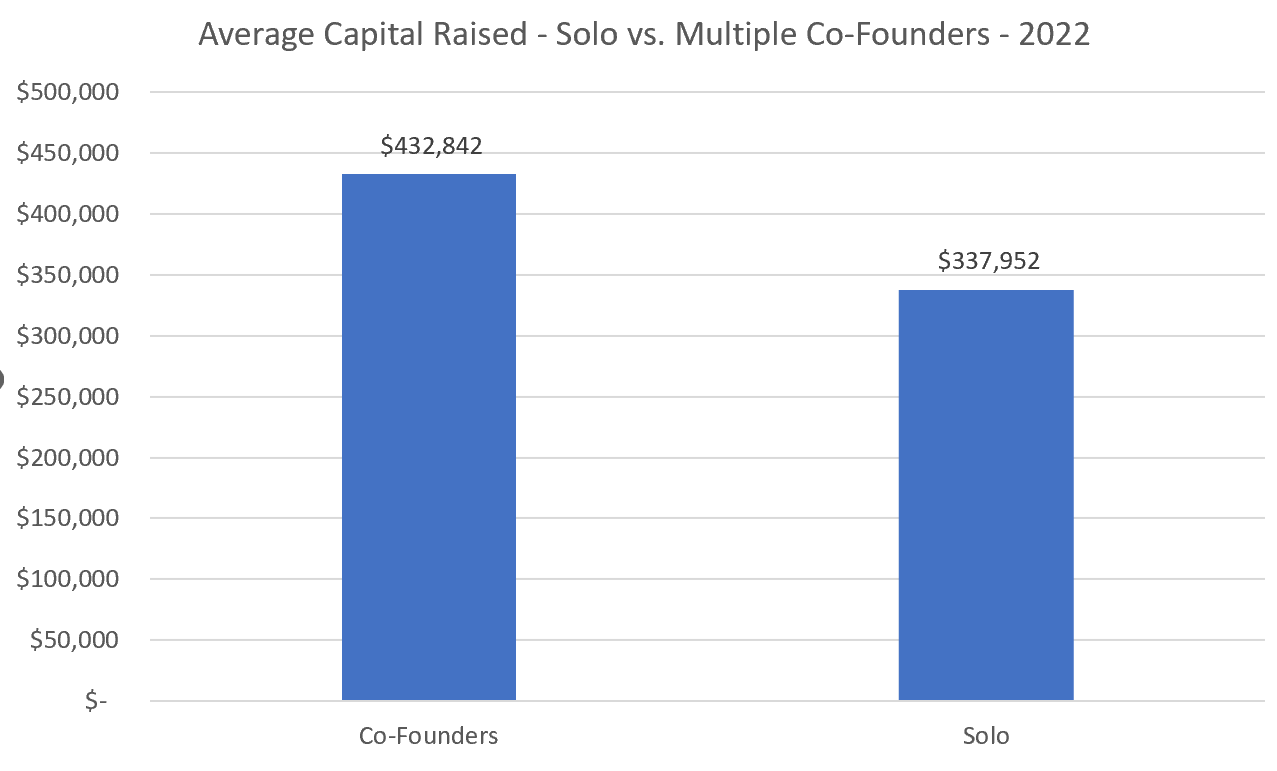

Looking at 2022 data from KingsCrowd for raises that closed in 2022, here are the average amounts raised for Reg CF campaigns (equity and debt crowdfunding):

The data shows that companies with 2 or more founders raised $433k on average, while companies with solo founders raised $338k on average. That being said, there have still been some very successful campaigns run by solo founders, so this is by no means a hard rule.

There could be reasons in the data that skewed a higher average towards companies with co-founders. For example, it could be that later-stage companies (those with revenue that tend to raise more money on average) may have been around for longer and potentially recruited additional founders to the founding team, vs. those founders who are just getting started out.

However, there could be other reasons that lead investors to invest more in companies with co-founders.

A company with co-founders may be a signal to investors that the product and mission are something that isn't just in the mind of a single individual, but something that has the potential to capture the passion of multiple founders. This could also indicate potential about one (or more) of the founders' abilities to sell the vision and the business potential to others.

Multiple founders may also be looked upon favorably by investors as a system of redundancy. Life happens and startups are hard, and it could be more reassuring to know that there are multiple founders on a team providing support to one another and encouraging each other to continue with the going gets tough.

Co-founders can also use their combined network of contacts to seek out and establish relationships with investors, which provides greater access to potential funding opportunities than if a single founder was pitching alone. Finally, many large investor groups prefer investing in companies with more than one founder because they feel it reduces risk by providing more oversight and management than an individual leader can provide on their own.

Therefore, while companies with single founders may have success in raising funds through investment crowdfunding platforms, co-founded companies may have a slight advantage when it comes to this form of fundraising.

less -

What is the role for blockchain in crowdfunding?

Great question! While we feel like we are about to enter into a heightened regulatory environment (due to FTX and similar), blockchain, crypto, NFTs and CBDCs will definitely innovate the space. Possibly not quite in 2023, but soon.

Because securities have heavy regulatory oversight (and that oversi... more

Great question! While we feel like we are about to enter into a heightened regulatory environment (due to FTX and similar), blockchain, crypto, NFTs and CBDCs will definitely innovate the space. Possibly not quite in 2023, but soon.

Because securities have heavy regulatory oversight (and that oversight has country borders) our prediction is that the focus will be on CBDCs (Central Bank Digital Currencies) as they act as a country's 'digital currency'. As more and more Equity Crowdfunding deals look to have global investors, these could play a key role.

What are CBDCs?

Central Bank Digital Currencies (CBDCs) are digital tokens, similar to cryptocurrencies that are essentially the digital equivalent of the country’s currency. Over 100 countries are currently experimenting with CBDCs, and some have even implemented them.

Essentially, CBDCs can play a key role in draining unnecessary intermediaries from the existing financial system into the digital realm. Besides reducing economic friction by reducing counterparties needed in payments, trade, and banking, the technology can slash financial services costs for consumers and enterprises alike by facilitating trusted, direct connectivity between transacting parties.

There is less risk when compared to NFTs or crypto, where almost anyone with a computer can build a 'coin' and add it to a wallet.

less4 -

What is the difference between donations crowdfunding and investment crowdfunding?

Donations-based crowdfunding and investment crowdfunding are two different types of crowdfunding. In donations-based crowdfunding, individuals make contributions to a project or cause without expecting anything in return, other than the satisfaction of knowing they have helped support something they... more

Donations-based crowdfunding and investment crowdfunding are two different types of crowdfunding. In donations-based crowdfunding, individuals make contributions to a project or cause without expecting anything in return, other than the satisfaction of knowing they have helped support something they care about. In investment crowdfunding, individuals invest money in a project or venture with the expectation of receiving a financial return on their investment. *Written by OpenAI's ChatGPT*

less -

Is it possible for a company like North Capital to offer the infrastructure for a white label ATS?

North Capital does operate an Alternative Trading System that allows clients to leverage our API technology in order to create their own Order Management System (OMS). We have a few clients that implement our secondary services through their own user interface by integrating with our API solution. Y... more

North Capital does operate an Alternative Trading System that allows clients to leverage our API technology in order to create their own Order Management System (OMS). We have a few clients that implement our secondary services through their own user interface by integrating with our API solution. You can always reach out to a North Capital representative in order to discuss in more detail.

less2 -

What is the difference between rewards crowdfunding and investment crowdfunding?

Rewards-based crowdfunding and investment crowdfunding are two different ways that people can use crowdfunding platforms to raise money for a project or venture. In rewards-based crowdfunding, backers of the project receive a reward, such as a product or service, in exchange for their support. In in... more

Rewards-based crowdfunding and investment crowdfunding are two different ways that people can use crowdfunding platforms to raise money for a project or venture. In rewards-based crowdfunding, backers of the project receive a reward, such as a product or service, in exchange for their support. In investment crowdfunding, backers receive equity in the company or a financial return on their investment.

*Written by OpenAI's ChatGPT*

less0 -

Where should I incorporate a benefit corporation?

@Brian Belley, @Jenny Kassan and @Sara Hanks, I wonder if you have thoughts about where to incorporate a benefit corp.

... more@Brian Belley, @Jenny Kassan and @Sara Hanks, I wonder if you have thoughts about where to incorporate a benefit corp.

less -

Hi Brian, Thanks for helping the community by answering questions. Based on your personal experience with 200+ startup investments, how do you pick a startup with the limited data available and without understanding other competitors? I know there is no crystal clear...

Thanks for the question. Quick disclaimer: this is just my own personal preference and experience, this is not to be construed as investment advice! Each investor has their own reasons and criteria when investing, so you need to determine what that looks like for you.

When personally picking a compa... more

Thanks for the question. Quick disclaimer: this is just my own personal preference and experience, this is not to be construed as investment advice! Each investor has their own reasons and criteria when investing, so you need to determine what that looks like for you.

When personally picking a company to invest in, for me, it comes down to two primary things:

1. Does it match my investment thesis (e.g. my "why" for investing - whether it's a company I am passionate about, a market I think will be huge, a technology that I believe could change the world), and

2. Due diligence - e.g. are there any red flags? Are the deal terms fair? etc.

For point one: I recommend investors reflect on the reasons they are investing and what they want to achieve. Are you only looking to maximize financial returns? Do you care about social impact? Are you trying to support local small businesses?

For point two: personally, I follow a "5 T's" approach to due diligence. Due diligence is a topic that could fill volumes by itself, but you can read more about due diligence in two articles I wrote and videos I made:

Due Diligence Part 1 - https://crowdwise.org/crowd-investing-101/due-diligence-101-overview-for-crowdfunding-investors-part-1/

Due Diligence Part 2 - https://crowdwise.org/crowd-investing-101/due-diligence-101-part-2-the-1-reason-why-startups-fail-and-how-to-screen-deals/

There are also services out there that will aggregate and review deals to help investors scale their due diligence, such as KingsCrowd (disclaimer: I am currently VP of Product at KingsCrowd).

And ultimately, you should always go to the campaign page and read all the details, including all deal terms. Another gem of information on these pages are the investor Q&A sections. You can not only post your own questions to be answered by the founder, but you can read other insightful questions from potential investors of all backgrounds.

I always read the Q&A. You can learn a lot about the company and how they communicate and handle tough questions.

Happy investing!

less3 -

Hi, I have been investing through seedinvest, wefunder and republic etc. i can check my portfolio in their websites. - Is there any way i can request physical copies to prove the ownership? Or in other words, who is the guarantor for shares as i heard there can be an escro

Hi - You should contact the applicable funding portal with your request. You can find their contact information on the site and in their terms of service.

0 -

What are the type of securities used on the top Reg CF platforms?

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. E... more

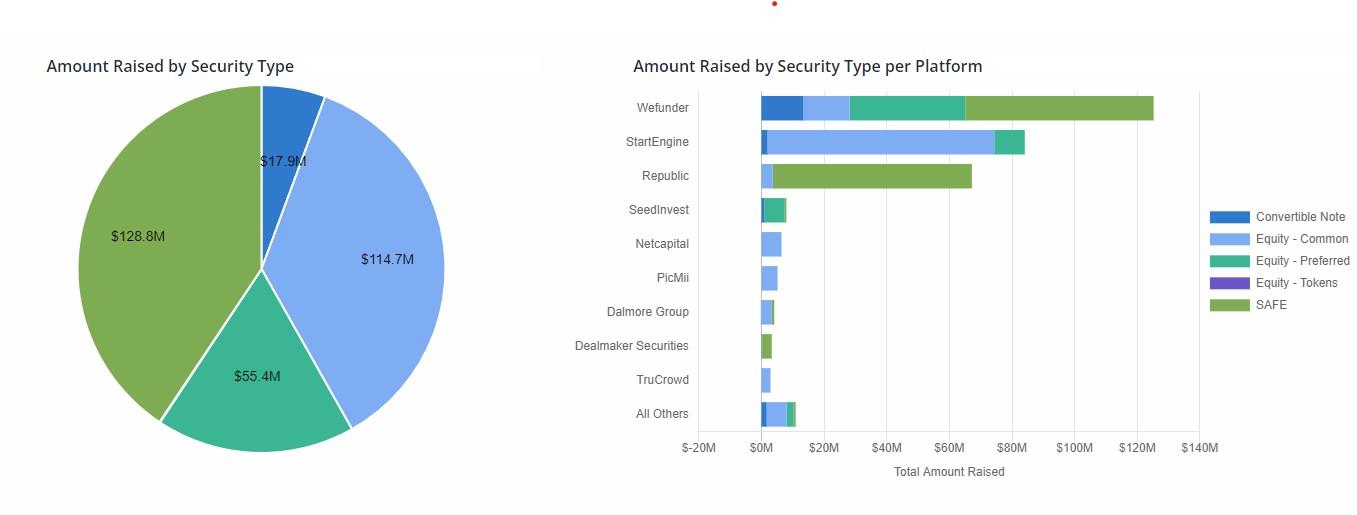

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

less