Disclaimer: (1) the issuer is considering an exempt offering, but has not decided upon any particular exemption; (2) the issuer is not soliciting any money or other consideration and, if sent, will not be accepted by the issuer; (3) the issuer will not sell securities or accept commitments to purchase securities until the issuer decides on which exemption it will pursue and satisfies any required filing, disclosure or qualification requirements; and (4) all indications of interest made by solicitees are non-binding.

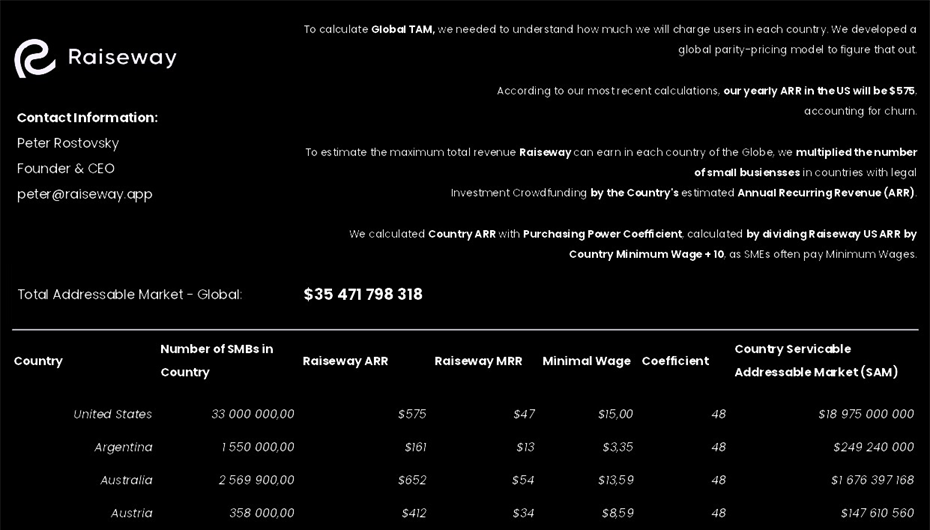

To calculate Global #TotalAddressableMarket, we needed to understand how much Raiseway will charge users in each country.

We developed a global parity-pricing model to figure that out.

According to our most recent calculations, our yearly Annual Recurring Revenue (ARR) in the US will be $575, accounting for churn.

(^This isn't exactly right, we need to update the model. When we do, the TAM numbers will move by a n million, not sure which direction. 🤡 )

To calculate Country ARR, I came up with a Purchasing Power Coefficient, calculated by (dividing Raiseway US ARR by Country Minimum Wage)+10 as SMEs often pay Minimum Wages.

That +10 thing to the coefficient is subjective. Need to think about it.

To estimate the maximum total revenue that Raiseway can earn in each country of the Globe, we multiplied the Number of Small Busiensses in countries with legal Investment Crowdfunding by the Country ARR.

It's a Work In Progress, but if you wanna know how to do global pricing parity for a software startup aiming at multiple international markerts, check this out.

Or, you know, something something testing the waters.

Register for FREE to comment or continue reading this article. Already registered? Login here.

0