- Home

- Q&A

-

What is a good way to find impact investment opportunities that are currently crowdfunding?

Thanks for the great question. With nearly 90 FINRA regulated funding portals and thousands of broker dealers all eligible to facilitate issuers for their crowdfunding raises, you aren't alone in looking for deals that meet certain characteristics (e.g. impact investments). Luckily, there do exist a... more

Thanks for the great question. With nearly 90 FINRA regulated funding portals and thousands of broker dealers all eligible to facilitate issuers for their crowdfunding raises, you aren't alone in looking for deals that meet certain characteristics (e.g. impact investments). Luckily, there do exist aggregators that collect data about live offerings and sort them into categories.

KingsCrowd is one such aggregator and you can find companies with live offerings that they've sorted as having "Social Impact" by clicking on this link: https://kingscrowd.com/companies/search/?social_impact=true&status=Active I believe they have a team of analysts that tag issuers with certain labels to make them easier to sort.

Another place where you can learn more generally about companies operating at the intersection of impact investing and crowdfunding is at the SuperCrowd conference where companies, including impact companies with live offerings, pitch, present, and discuss case studies. It's a major gathering of leaders in this sector and you can find more info here: https://thesupercrowd.com

#impactinvesting #socialimpact @Devin Thorpe @Brian Belley

less -

Meseret (Messi) Warner answered 3/17/2023

What is the potential for crowdfunding in Africa?

Crowdfunding in Africa is in its infancy stage of development. Just like in the U.S., donation and reward-based crowdfunding has been trying to take hold in the market for the last several years. That said, equity crowdfunding is springing around since 2015/16 with its potential being recognized by ... more

Crowdfunding in Africa is in its infancy stage of development. Just like in the U.S., donation and reward-based crowdfunding has been trying to take hold in the market for the last several years. That said, equity crowdfunding is springing around since 2015/16 with its potential being recognized by governments and the development/donor community including ours (https://igniteinvestment.com/) launched in September 2022.

With over 80% of African businesses being Small and Medium Enterprises (SMEs) facing a critical lack of access to finance because of collateralized debt financing, the potential for crowdfunding is estimated to reach over 2 Billion in sub-Sahara Africa by just 2025. I also know that Wefunder and Republic have been eyeing around the African equity crowdfunding market. In fact, I actually participated in one of Republic's Twitter spaces event talking about how African company fundraised on their platform.

Hope this help and have a look at these two articles that may give you some more information: https://www.un.org/africarenewal/magazine/july-2022/crowdfunding-emerging-financing-source-african-entrepreneurs#:~:text=Forecasts%20now%20show%20that%20crowdfunding,cent%20of%20the%20global%20market.

https://link.springer.com/chapter/10.1007/978-3-030-46309-0_14

less -

What is the attitude toward private market access by the author of the following statement?

The Commission should examine ways to expand their access to capital, but it should do so in a way that mitigates the risks posed by offering investors fewer or no protections.

The author of this statement has a critical attitude towards private market access. They argue that retail investors lack th... moreThe Commission should examine ways to expand their access to capital, but it should do so in a way that mitigates the risks posed by offering investors fewer or no protections.

The author of this statement has a critical attitude towards private market access. They argue that retail investors lack the bargaining power and resources to access the same investments as venture capitalists, and they caution against expanding market access without better protections for investors. They ultimately advocate for increased access to capital, but argue that it must be done in a way that reduces risk for investors. less2 -

Why are VCs considered gatekeepers?

VCs, or venture capitalists, are considered gatekeepers because they play a significant role in determining which startups and entrepreneurs receive funding and support. VCs typically have significant financial resources and expertise in evaluating the potential success of new businesses.

Startups o... more

VCs, or venture capitalists, are considered gatekeepers because they play a significant role in determining which startups and entrepreneurs receive funding and support. VCs typically have significant financial resources and expertise in evaluating the potential success of new businesses.

Startups often rely on funding from VCs to get their businesses off the ground and to scale their operations. VCs are known for providing more than just financial support, often offering advice, guidance, and mentorship to the entrepreneurs they fund.

Because of their significant role in the startup ecosystem, VCs have the power to act as gatekeepers, controlling access to funding and resources that can be crucial to the success of a startup. This means that entrepreneurs may need to meet certain criteria, such as having a certain level of experience or connections, in order to gain access to VC funding.

Additionally, VCs often prioritize investments in certain industries or types of startups, which can further limit access to funding for entrepreneurs in other sectors or with different business models. This has led to criticism that VCs may not always invest in the most innovative or diverse startups, and may instead favor those that fit within their existing investment strategies and portfolios.

less- Unclassified

-

3

-

Who has a better chance at raising funds under investment crowdfunding - a company with a single founder or a company with co-founders?

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by ... more

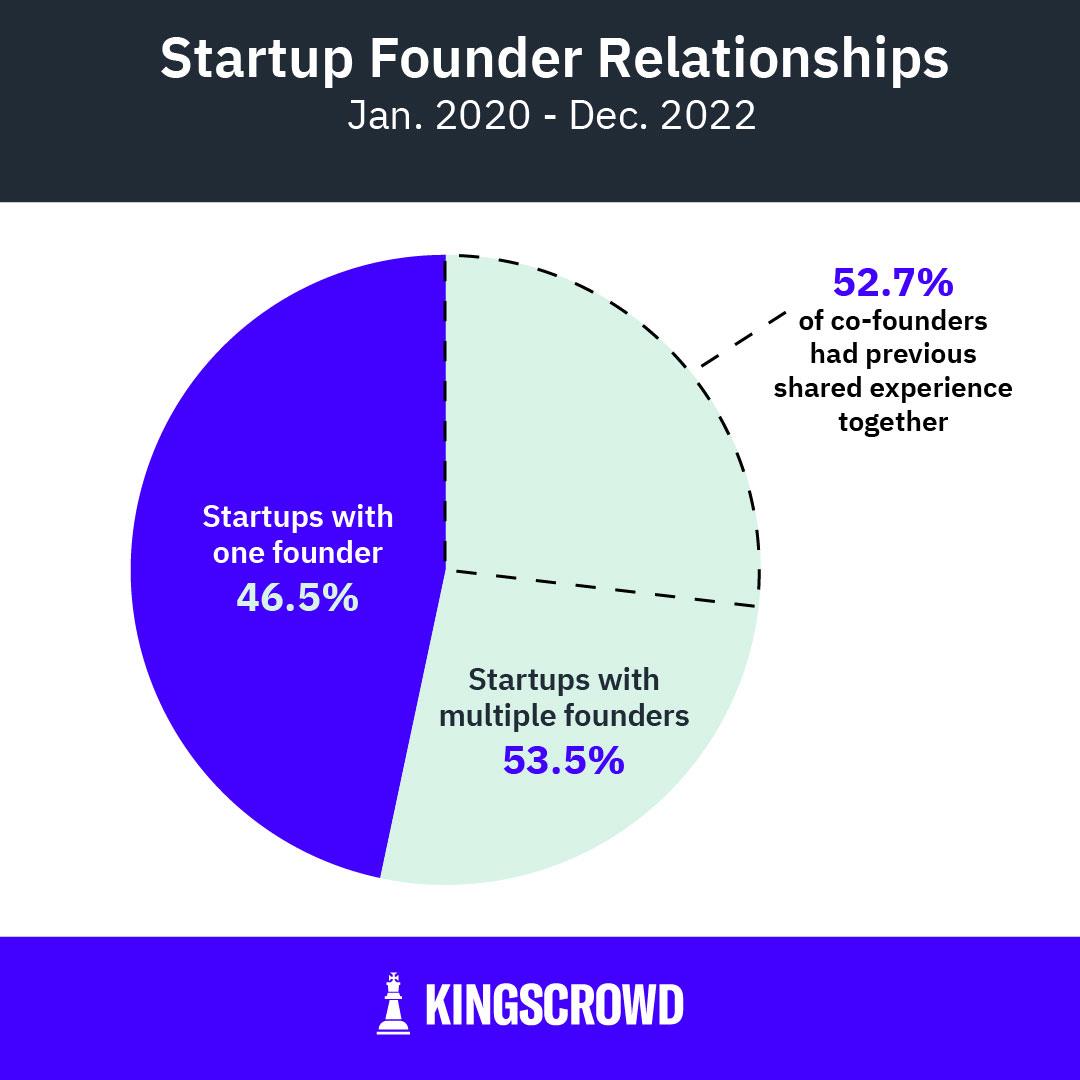

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by solo founders, while the other 53% had two or more co-founders.

With that perspective, let's look at some thinking around whether or not single founders or co-founders are more successful at raising funds.

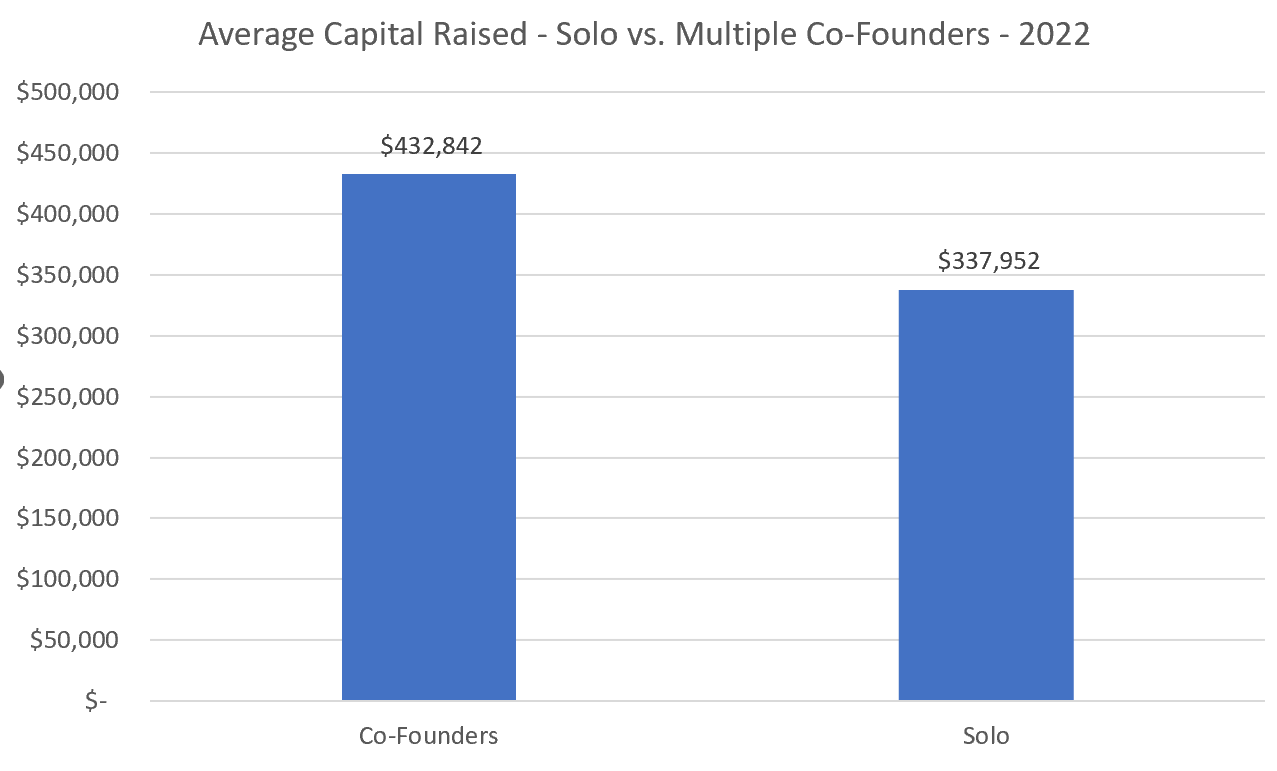

Looking at 2022 data from KingsCrowd for raises that closed in 2022, here are the average amounts raised for Reg CF campaigns (equity and debt crowdfunding):

The data shows that companies with 2 or more founders raised $433k on average, while companies with solo founders raised $338k on average. That being said, there have still been some very successful campaigns run by solo founders, so this is by no means a hard rule.

There could be reasons in the data that skewed a higher average towards companies with co-founders. For example, it could be that later-stage companies (those with revenue that tend to raise more money on average) may have been around for longer and potentially recruited additional founders to the founding team, vs. those founders who are just getting started out.

However, there could be other reasons that lead investors to invest more in companies with co-founders.

A company with co-founders may be a signal to investors that the product and mission are something that isn't just in the mind of a single individual, but something that has the potential to capture the passion of multiple founders. This could also indicate potential about one (or more) of the founders' abilities to sell the vision and the business potential to others.

Multiple founders may also be looked upon favorably by investors as a system of redundancy. Life happens and startups are hard, and it could be more reassuring to know that there are multiple founders on a team providing support to one another and encouraging each other to continue with the going gets tough.

Co-founders can also use their combined network of contacts to seek out and establish relationships with investors, which provides greater access to potential funding opportunities than if a single founder was pitching alone. Finally, many large investor groups prefer investing in companies with more than one founder because they feel it reduces risk by providing more oversight and management than an individual leader can provide on their own.

Therefore, while companies with single founders may have success in raising funds through investment crowdfunding platforms, co-founded companies may have a slight advantage when it comes to this form of fundraising.

less -

Why is regulated investment crowdfunding so difficult?

Regulated investment crowdfunding, also known as equity crowdfunding, is the process of raising money from a large number of investors, often through online platforms, in exchange for equity in a company. While it can be an attractive way for startups and small businesses to access capital, there ar... more

Regulated investment crowdfunding, also known as equity crowdfunding, is the process of raising money from a large number of investors, often through online platforms, in exchange for equity in a company. While it can be an attractive way for startups and small businesses to access capital, there are several reasons why it can be difficult to navigate the regulatory environment surrounding investment crowdfunding.

1. Regulatory compliance: Investment crowdfunding is regulated by securities laws, which can be complex and vary by jurisdiction. Platforms that facilitate investment crowdfunding must comply with these laws, which can be difficult to navigate without legal expertise.

2. Investor protection: Securities laws are designed to protect investors from fraudulent or misleading investments. As a result, investment crowdfunding platforms must take measures to ensure that investors are adequately informed about the risks associated with the investment, and that they meet certain criteria for investing, such as income or net worth thresholds.

3. Capital raising limitations: Investment crowdfunding is subject to limitations on the amount of capital that can be raised from individual investors, as well as the total amount that can be raised through crowdfunding in a given period. These limitations can make it difficult for companies to raise the capital they need through investment crowdfunding alone.

4. Competition with other fundraising methods: Investment crowdfunding is not the only way for companies to raise capital. Other methods, such as traditional bank loans, venture capital, or angel investing, may be more attractive to some companies depending on their stage of growth, industry, or funding needs.

Overall, regulated investment crowdfunding can be a complex and challenging process due to regulatory compliance, investor protection requirements, capital raising limitations, and competition with other fundraising methods. However, it can also provide an opportunity for companies to access capital from a large pool of investors and reach a wider audience than traditional fundraising methods.

less -

When is the best time of year to raise funds and conduct a crowdfunding campaign?

According to our data Q2 tends to have the most funded deals of the year. Since most offerings last around 4 months, launching in Q4 might be smart. Of course, there are other factors that play into account like whether the issuer is a startup or established and what geopolitical or macroeconomic ev... more

According to our data Q2 tends to have the most funded deals of the year. Since most offerings last around 4 months, launching in Q4 might be smart. Of course, there are other factors that play into account like whether the issuer is a startup or established and what geopolitical or macroeconomic events are pressuring investors.

less2 -

What is the North American Securities Administrators Association (NASAA) likely position on Regulated Investment Crowdfunding?

Based on the report by the North American Securities Administrators Association (NASAA), it seems likely that they would have a cautious stance toward Regulation Crowdfunding. The report emphasizes the importance of defending public capital markets and raising concerns about efforts that expand the ... more

Based on the report by the North American Securities Administrators Association (NASAA), it seems likely that they would have a cautious stance toward Regulation Crowdfunding. The report emphasizes the importance of defending public capital markets and raising concerns about efforts that expand the incentives for staying private. This suggests that NASAA may view Regulation Crowdfunding as a potential threat to public markets and the traditional principles of securities regulation.

The report expresses concerns that legislative proposals, such as those in the JOBS Act 4.0, could erode public markets and adversely affect businesses and investors that rely on those markets to raise investment capital. NASAA also highlights opposition to proposals that would limit the role of state regulators in overseeing capital raising in the private market. This stance suggests that NASAA is likely to be cautious about expanding exemptions for private offerings and other regulatory changes that could make it easier for companies to raise capital without going through public markets.

However, NASAA does support certain proposals that could enhance investor protection and improve coordination among state and federal regulators. For example, they advocate for a comprehensive enforcement database that covers everyone convicted or held liable in criminal, civil, and regulatory actions involving financial services. They also call for stronger coordination between state and federal regulators and improved regulatory data collection, particularly on activity in the private markets.

Overall, while NASAA is likely to be cautious about Regulation Crowdfunding, they are also interested in finding ways to improve investor protection and strengthen regulatory oversight in both public and private markets.

less0 -

Are there any websites that display all live crowdfunding opportunities?

Yes, there are websites and companies that aggregate crowdfunding deals that are active (as well as other types of deals).

Some of these primary deal aggregators include:

1. KingsCrowd ("Trusted by over 475,000 investors to vet startup investments from 60+ online investment platforms")

Yes, there are websites and companies that aggregate crowdfunding deals that are active (as well as other types of deals).

Some of these primary deal aggregators include:

1. KingsCrowd ("Trusted by over 475,000 investors to vet startup investments from 60+ online investment platforms")

2. so.capital ("Equity Crowdfunding, Donation Crowdfunding, NFTs, Alternative Assets")

3. Vincent ("exempt reporting adviser in the alternative investment space")

4. CrowdLustro ("Reg CF, Collectibles, Real Estate, NFTs, & other alternative assets")

5. Alts.co ("alternative assets" -- more than just crowdfunding)

6. Sharky - ("Discover startups like a pro!")

7. Investibule - ("Investibule opens the door to community investments - aggregating opportunities across 30+ platforms.")

For those looking for deals outside the US, there are other aggregators (e.g. CrowdInvest - "Invest in promising start-ups in India from the UK"). As with any service provider, it's important to verify information listed on these sites with information on the site of the funding portal or provided by the issuer.

less