Crowdfunding ECO Town Hall Ask to Join

Register and request to join to see more.

Information shared (by SEC employees) at CfPA's 2021 CrowdInvest Summit

Employees of the SEC (in their individual capacity) were in the house today for the CfPA's CrowdInvest Summit. The fireside chat was moderated by Sara Hanks of CrowdCheck and the following links were posted as a resource by Jenny Riegel.

Our small business video gallery is here: https://www.sec.gov/page/oasb-videos

The crowdfunding resources that Jennifer mentioned are on this page: https://www.sec.gov/smallbusiness/exemptofferings/regcrowdfunding

The EDGAR guidance that Jennifer discussed is here: https://www.sec.gov/corpfin/announcement/staff-guidance-edgar-filing-form-c

Compliance and Disclosure Interpretations (often called CDIs by the staff) for crowdfunding are here https://www.sec.gov/divisions/corpfin/guidance/reg-crowdfunding-interps.htm

CfPA note: Some great Q&A lives at this link. For example ...

Rule 100: Crowdfunding exemption and requirements

Question 100.01

Question: What information can an issuer disseminate prior to filing the Form C with the Commission and providing it to the relevant intermediary?

Answer: Information not constituting an offer of securities may be disseminated by an issuer prior to the commencement of a Regulation Crowdfunding offering. For example, factual business information that does not condition the public mind or arouse public interest in a securities offering is not an offer and may be disseminated widely. The Commission has interpreted the term “offer” broadly and has explained that “the publication of information and publicity efforts, made in advance of a proposed financing which have the effect of conditioning the public mind or arousing public interest in the issuer or in its securities constitutes an offer…” Securities Offering Reform, Release No. 33-8591 (July 19, 2005). See also Securities Act Rule 169 and Securities Act Rule C&DI 256.25. Regulation Crowdfunding, however, does not provide an exemption for the dissemination of information that constitutes an offer of securities by an issuer prior to the issuer filing a Form C with the Commission and providing it to the relevant intermediary. [May 13, 2016]

Question 100.02:

Question: Are non-natural persons that invest in Regulation Crowdfunding offerings subject to investment limits?

Answer: Yes. The investment limits in Rule 100(a)(2) of Regulation Crowdfunding apply to all investors. Instead of calculating investment limits based on annual income and net worth, a non-natural person calculates the limits based on its revenue and net assets (as of its most recent fiscal year end). [May 13, 2016]

Jenny Riegel: Please reach out to us at smallbusiness@sec.gov! We look forward to continuing the conversation!

###

CfPA Virtual CrowdInvest Summit (May 17th) @ 11:00 AM EST

https://www.eventbrite.com/e/cfpa-virtual-crowdinvest-summit-tickets-146513007349

Last chance to register and join 30+ leading experts at the CrowdInvest Summit (CfPAsummit.org) later today.

See the list of speakers here: https://cfpasummit.org/#speakers

If you're not already a CfPA member, you can use code CFPASUMMITPARTNER for 70% off.

Attend this event and become part of the investment crowdfunding movement.

###

Event (Wed) March 17 at 1pm ET: #Crowdfunding for Investors and Entrepreneurs

SVC and ASBC invite you to join us Wednesday, March 17 at 1pm ET for a NEXT Economy LIVE on Crowdfunding for Investors & Entrepreneurs featuring Jenny Kassan (Opportunity Main Street and CrowdFund Main Street), Samson Williams (Crowdfunding Professional Association), and Adie Akuffo-Afful (Wefunder).

Click here to register: https://us02web.zoom.us/webinar/register/WN_K8qpHRs6SBqd2xDycdjXcg

Democratizing investing through investor crowdfunding. What is it? How do the new SEC regulations make crowdfunding more attractive? How investors can be champions? How can entrepreneurs set up successful campaigns? In this session, we will hear from industry experts, successful entrepreneurs, and engaged funders.

CfPA Webinar: How to plan and launch a Reg CF campaign

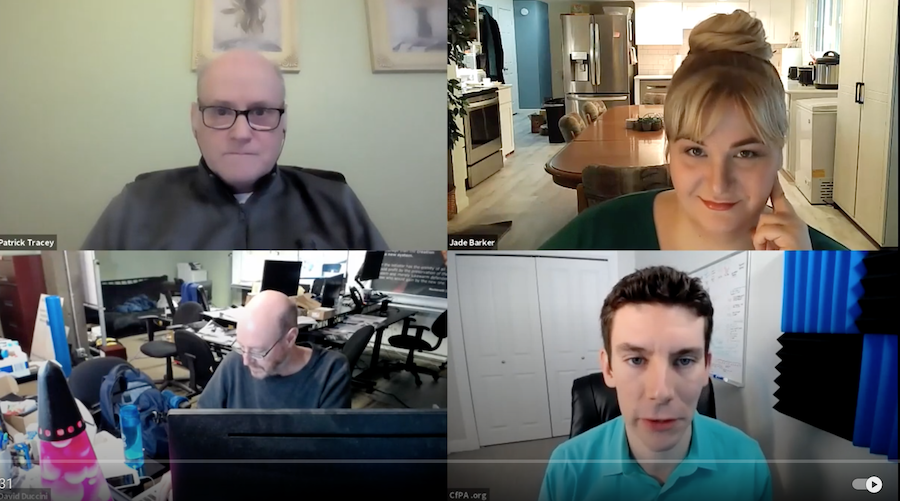

A sincere thanks goes out to David Duccini and Jade Barker from Silicon Prairie Portal and Exchange for spending their afternoon with CfPA and webinar attendees and for sharing their wealth of knowledge and experience.

Webinar: How to plan and launch a Reg CF campaign

The webinar recording can be found here.

The slides from the presentation can be found here.

The CfPA will be holding more upcoming webinars and events, many of which will be exclusively for CfPA members. To join the CfPA to get these benefits and more, you can sign up here.

D...@...o J...@...o

CfPA Letter to Biden Administration on Crowdfunding Limit Updates

Letter to Biden Administration on Crowdfunding Limit Updates

President Biden released a regulatory freeze notice last week that may stop the new Regulation Crowdfunding (Reg CF) and Regulation A (Reg A) rules from going into effect March 15, 2021.

These are the rules that, among other adopted exempt offering framework updates, will change the cap for Reg CF from $1M to $5M and for Reg A from $50M to $75M.

View the CfPA letter to President Biden and those that supported it: CfPA letter to Biden Administration – 01/28/2021