Here are seven charts that sum up key findings:

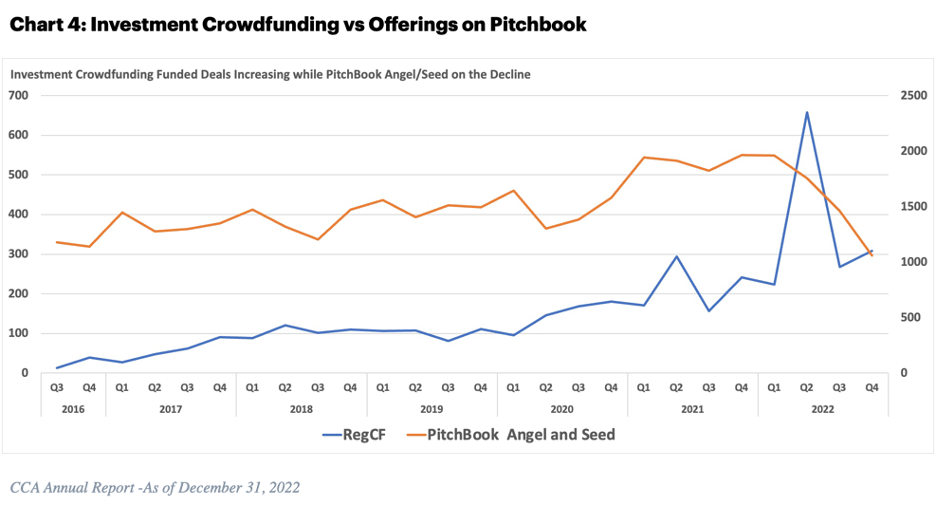

Pitchbook Angel/Seed Deals are Trending Down. Investment Crowdfunding Deals are Trending Up and Hit Record Highs

The Valley of Death is Dead Thanks to Investment Crowdfunding

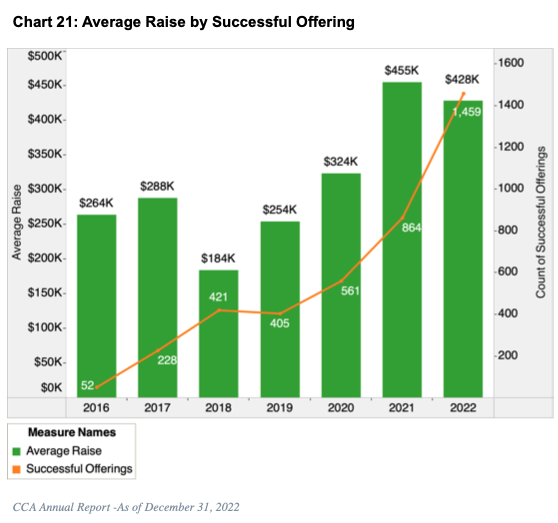

Much has been written about the Valley of Death. It refers to a crucial early phase of a new venture when work has begun, but a company hasn’t generated sufficient revenue to support its growth. In this case, outside capital is a necessity that either comes from an entrepreneur’s savings or access to credit. After seven years of Investment Crowdfunding experience and the growth in average raises, we can officially announce that the ‘Valley of Death’ is dead. The average raise since the industry launched has grown to $365K, expanding beyond where the Valley existed previously; $25K to $250K. With the maximum issuers can raise now at $5 million, there is much room for successful issuers to perform follow-on raises to not only get them through the Valley of Death but beyond it.

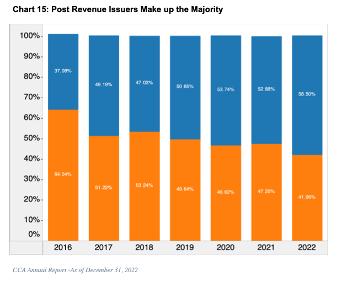

Naysayers be Damned. Investment Crowdfunding Issuers Appear Less Risky

The profile of the average successful investment crowdfunding issuer is changing. The data finds that most of them can be seen as less risky. They tend to be older, are post-revenue, and have average revenues over $1 million. Investors see the logic. The more established issuers raised more money and had more investors than their startup counterparts. As larger, more established issuers come online, this will further derisk investment in this space.

Investment Crowdfunding has Proven its Ability to Democratize Access to Capital

It used to be that if you wanted to access Venture capital, you needed to reside in or near Silicon Valley, New York, or Boston. However, thanks to Investment Crowdfunding, we see that it has successfully been able to democratize access to capital across the country. Even more importantly, the data shows that women and minority entrepreneurs (that routinely struggle to access capital) have had greater success within Investment Crowdfunding and are raising up to 50% of the capital. Show us where else the private capital markets have been able to accomplish that!

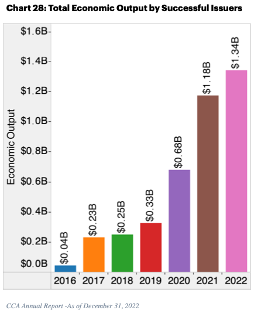

Investment Crowdfunding is the Economic Engine we Envisioned

Issuers successful with Investment Crowdfunding are scaling startups and small businesses. They create products and services. Pay business, sales, and payroll taxes. And are massive consumers of local and regional products and services. Investment Crowdfunding issuers are responsible for pumping more than $4 billion into our economy since the industry launched in 2016. All of this capital is going into over 1,600 communities across the USA. This is a local economic stimulus unlike we’ve ever seen. If our government officials are looking for ways to promote economic development, they should focus their attention on Investment Crowdfunding issuers.

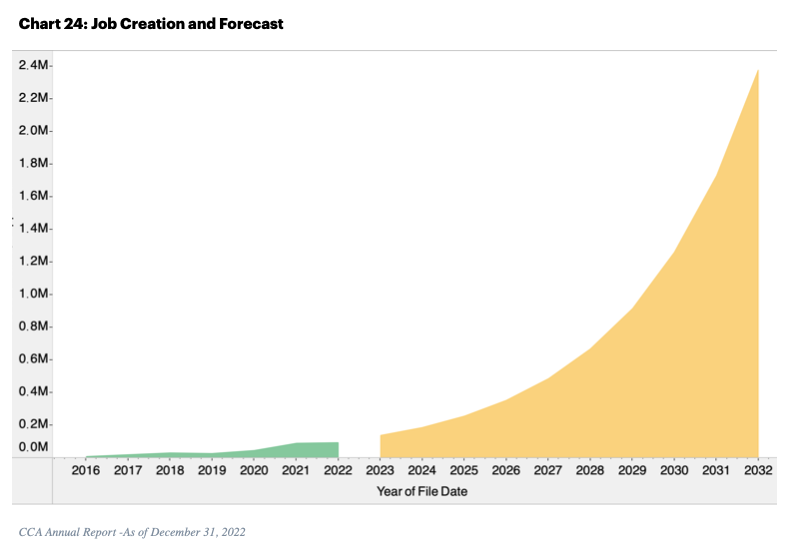

Investment Crowdfunding Makes its Namesake, “The JOBS Act,” Proud

Since Investment Crowdfunding began, Issuers successful with Investment Crowdfunding are responsible for supporting over 226,000 jobs. We believe this is an underestimate because it doesn’t take into account issuers that reported no full-time employees but either have grown to support them or outsource jobs altogether. Either way, we went to Washington, DC, and promised jobs. And one can see the industry is delivering on it! Whoever came up with the acronym “The JOBS Act” deserves an award!

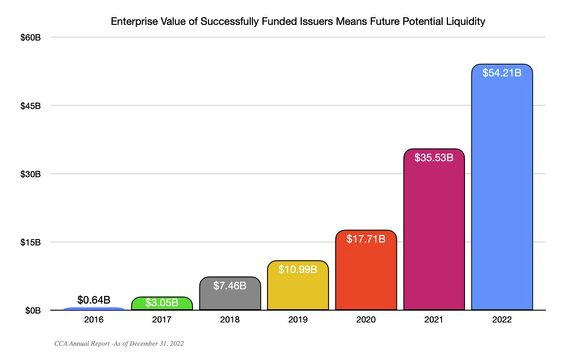

Investment Crowdfunding Will Make Some Average American Investors Millionaires

Liquidity is the Holy Grail for private company investors. Why would investors pour billions of dollars into Private Equity or Venture funds if not? Investment Crowdfunding allowed the average American to play the role of mini-VC and invest in pre-IPO startups that they believe in for the first time in history. A small percentage of these will most likely go on to phenomenal exits. If and when that happens, many millionaires will be made, and they will be your next-door neighbor. Over $54B of value is currently sitting inside successful Investment Crowdfunding issuers. Only $1.6 billion has been invested to date by Investment Crowdfunding investors. You do the math. Someone is going to get rich …

And this scratches the surface. In the report, we list all million-dollar-plus raises from 2022. We analyze what would have happened if someone had just invested in all million-dollar-plus deals. And much more! Don’t wait; download your copy now!

Register for FREE to comment or continue reading this article. Already registered? Login here.

2

Regulated investment crowdfunding can be beneficial in helping startups and early-stage companies overcome the "Valley of Death" challenge, which is a crucial early phase in the life of a new venture where outside capital is necessary to support growth. In the past, this funding gap was a major obstacle for many entrepreneurs, as they struggled to secure funding from traditional sources such as banks or venture capitalists.

Investment crowdfunding offers a new source of capital that can help bridge this gap. By allowing a large number of investors to contribute smaller amounts of money, investment crowdfunding can provide startups with the capital they need to grow and reach profitability, without having to give up equity or control of their company.

The growth in the average size of crowdfunding raises is also an encouraging sign that this new funding model is gaining traction and becoming a viable option for startups. The ability to raise up to $5 million through investment crowdfunding, combined with the potential for successful issuers to perform follow-on raises, provides even more opportunities for startups to access the capital they need to scale their business.

In addition to helping startups overcome the Valley of Death, investment crowdfunding can also provide benefits to investors, such as the opportunity to invest in early-stage companies that they believe in, and the potential for high returns if the company is successful. However, it is important to note that investment crowdfunding carries risks, and investors should carefully evaluate the risks and potential rewards before making any investment decisions.