CrowdInvesting doesn't mess up your captable.

The only down side of having your mom, 8 auntie, 30 cousins and 3000 second cousins or customers on your captable is VC hate it when they can't dilute you down to an employee. That is the real reason VCs don't want a quote-unquote "messy" crowdfunding captable. It makes it harder for them to push a co-founder on you and claim 3 board seats so that in 18 months they can push you out of your company. Typically VCs reserve this treatment for women Founders but alas, greed is almost free of sexism...almost.

However, I digress. Because seriously, Sharks are sharks and you've sorta gotta expect that kind of behavior from an industry and practitioners who call themselves Sharks, right? I mean the only ones you've really got to keep an eye out for are the "Angels''. Swear to g-d the best trick the Devil ever did was pivot into investing into early stage startups. What's one soul when you can claim the upside of an entire industry? Know what I mean?

Again, apologies I got a little off course. Originally I had written out a well laid out explanation of why 3k - 30k+ Investomers on your captable was a beautiful thing and not messy at all. Instead I decided to go the classic, "Yo mama" route. Mainly because you want your mom on your captable because you need your mom on your captable. Its not just your mom you need on your captable its every last single one of your community members, customers and fans who are going to go H.A.M cheerleading for your business.

H.A.M = Hard As A MutherF*

VCs don't go HAM for your business. Ever heard of your product going viral with VCs? Na, I didn't think so. Products only go viral with customers. VCs aren't your business' customers. Hence why VCs don't go HAM for your business. VC expects you to bring home the bacon, 10,000x over, and then feed them first. Where as your mom, friends and family and 3K to 30K+ customers? They love your products, services and business so much they're the ones who make it successful. Real talk, who makes VCs rich AF? Your customers do. You're just the passthrough from Customers to VCs. If VCs could make a 10,000X return by connecting directly to customers they would. Alas, they need you and your business to do all the hard work of turning their $100k into $1B. BTW - do you know the average check size of a VC? The ugly truth is most Founders have been sacrificing their infant aged businesses to Sharks for pennies on the value. And don't even get me started on Accelerators and Incubators. #BabySharksWithTeeth

FinTech and Automation

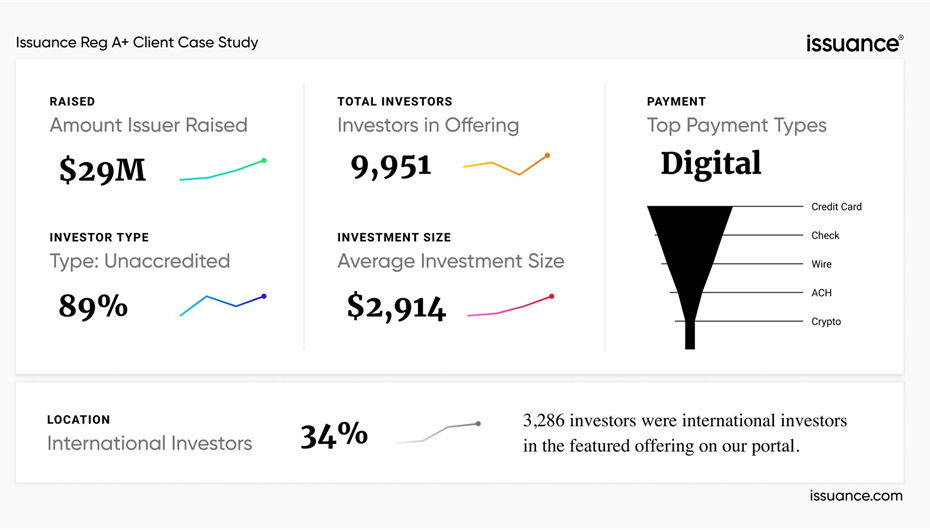

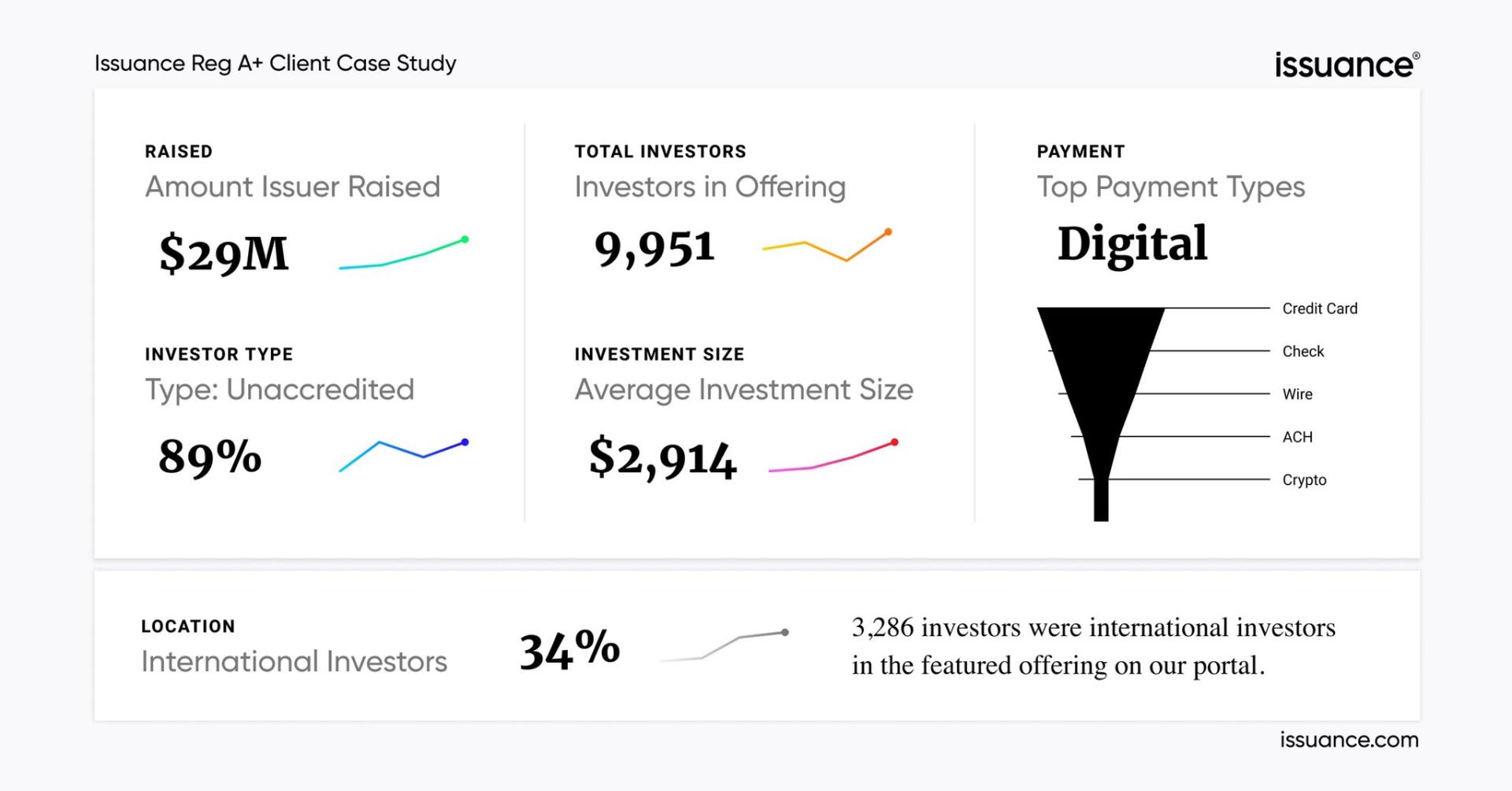

The main reason that 3K or 30K investomers (customers who invest in your business are known as Investomers) on your captable is a beautiful thing is because it means you’ve crushed your raise and raised a small army of free marketers and ambassadors for your brand and business. Go you! Too, modern regs, software and automation doesn’t give you 30k pieces of paper to track. Issuance and other investment crowdfunding platforms do a great job of automating managing communications, investors and reporting. Thats the thing about data. Once you organize it once and develop a straight through process, whether its 5 investors or 50,000 you click the same button. Its not quite as simple as sending an email to 5 people as it is to 50,000...but it is once you use software that automates the process and thats what modern investment crowdfunding portals provide. One click communications and reporting. Doubt this? Look at this dashboard below. All that data is seamlessly integrated and put together to make it easier for the Platform to enable the Founder to manage their community.

Whether its 32 Sharks, 320 “Angels”, or 3,286 Investormers they’re all on the same dashboard, captable and only one push of a button away. So, hope to see yo mama on your captable. She’ll love helping you keep the Sharks at bay.

PS - 30k investomers on your captable is a beautiful thing.

About the Author

Samson Williams is a serial entrepreneur and accidental investor. When not starting business with his enemies (“Entrepreneurship is hard. I only recommend it to my enemies.”), Samson is an Adjunct Professor at Columbia University in NYC and University of New Hampshire School of Law where he teaches on blockchain, cryptocurrencies and the Space Economy. Samson is also President of the Crowdfunding Professional Association and investor into two investment crowdfunding platforms Brite.us - CrowdInvesting Done Brite and GoingPublic.com. For more information on Samson visit www.SamsonWilliams.com and follow him on social @HustleFundBaby.

Register for FREE to comment or continue reading this article. Already registered? Login here.

1