Web3 ...

there’s so much hype around a term that has a hazy definition -- it calls to mind the parable of the blind men and the elephant.

Man 1: Web3 is about blockchain and decentralization, you know, a DAO (decentralized autonomous organization).

Man 2: No, it’s DeFI and getting away from BigTech or around regulation by CentralGov.

Man 3: I think it’s all about cryptocurrencies and non-fungible tokens (NFTs).

Man 4: It’s definitely about self-sovereign identities and getting people paid in a creator economy.

Man 5: It’s beyond the creator economy, it’s the new OWNERSHIP economy.

Me: It’s about giving VCs and casino capitalists some new concepts to feed into the hype & hope machine which will allow them to raise ever larger amounts of LP money tied to their age old “2 + 20” business model.

Yes, I’m the cynic among the blind men and sorry, there are no women in the blind men and elephant parable.

The massive amounts of investment flowing into this grand new era of web3 experimentation suggests that some useful companies will eventually come from it. There are plenty of pundits that point to capital loss in prior bubbles and claim “that’s what it takes to get the next Amazon and Facebook or Netflix …”

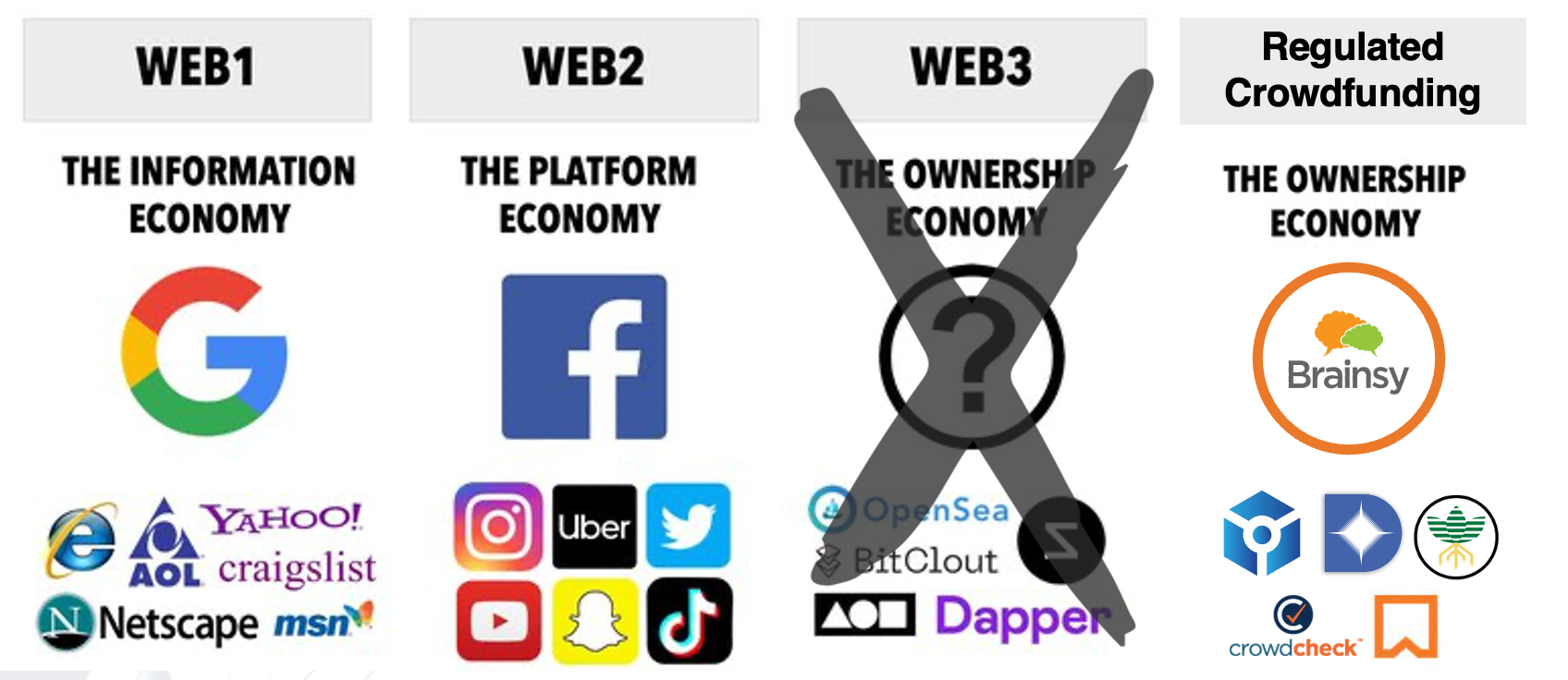

In the US, many of the concepts these web3 idealogues want to accomplish can actually be done today with plain ole “Web 2.0” tech + an emerging ecosystem of players in the regulated world of investment crowdfunding that was birthed by the passage of the JOBS Act in 2012.

Sounds boring, right -- “Regulated Investment Crowdfunding”?

Perhaps, but right there in plain sight exist a host of companies and entrepreneurs innovating in the crowdfunding ecosystem and accomplishing things that Web3 devotees are still trying to figure out.

Want to give people a way to invest (and make money) in a company that hasn’t yet reached the public markets? Check

Want to decentralize and broaden ownership opportunities? Check.

Want to put securities on the blockchain? Check.

Want to reward the community with ownership for their labor? Check.

And the best thing about Regulated Investment Crowdfunding is that, in the US, it’s legal. It’s not always easy, but it’s legal. (Yes, I realize that some will say getting away from the US or any central government is a key selling point of Web3. But the devil is in the details and many “web3” projects aren’t true innovations but instead, semantic obfuscations around bad legal practices).

So let’s create a buzzworthy acronym for “Regulated Investment Crowdfunding” – say “RIC” and see if we can help it get the attention it deserves among the world of #Web3, #DeFi, #DAOs, #NFTs, #Crypto, #blockchain, #BTC -- and now #RIC.

The next time someone comes to you with an idea about the next new tech trend and how it’s going to revolutionize everything, take a second look at the growing ecosystem of platforms and companies working in RIC and see if there isn’t already someone or some company addressing the core needs driving the latest trend.

Register for FREE to comment or continue reading this article. Already registered? Login here.

3

Great thoughts, Brian. I remain excited about Blockchain technology and believe its highest and best use is for tokenizing a Reg CF offering to make ownership of shares in a startup easier to protect, track and ultimately sell.

NFTs have tremendous potential to help us track ownership of real stuff but this demands so much more regulation than we have. I fear an NFT, absent regulation and legal means of enforcement, approach worthlessness.

It seems that even the buyer at the Christie's auction that spent $69 MILLION on Beeple's first 5000 days NFT could agree with you.

https://markets.businessinsider.com/news/currencies/beeple-69-million-everydays-nft-buyer-metakovan-vignesh-sundaresan-copies-2021-11

"The buyer, Vignesh Sundaresan, who's also known as MetaKovan, told Bloomberg he'd be happy if everyone downloaded a copy of the multi-million dollar non-fungible token, "Everydays: The First 5,000 Days."

"Instead of giving the importance to that copy of the file, it kind of gives importance to something else big. The idea that some person supported an artist at some time and this was the memorabilia," he told Bloomberg.

In April, Sundaresan said investing in NFTs is "even crazier than investing in crypto" and said the asset class wouldn't hold the hype forever. Instead, he said high-value items would be limited with an infinite number of low-value items. "