- Home

- Q&A

-

How could SEC Commissioner Peirce's sketch of an idea for a potential exemption from registration to allow firms to use DLT to issue, trade, and settle securities potentially impact regulated investment crowdfunding?

SEC Commissioner Hester Peirce’s sketch of a potential exemption from registration to allow firms to use distributed ledger technology (DLT) to issue, trade, and settle securities could have significant implications—both positive and disruptive—for regulated investment crowdfunding (Reg CF). Here's ... more

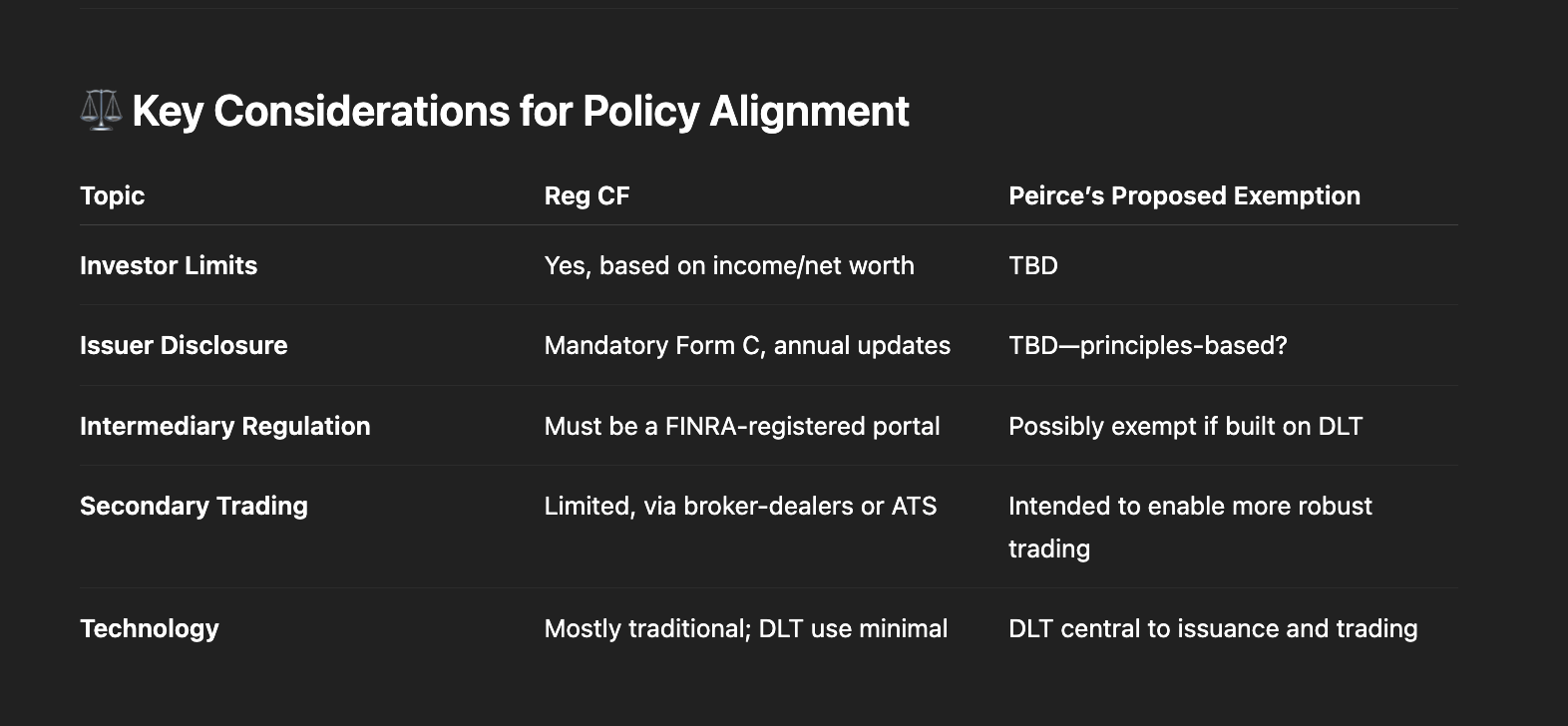

SEC Commissioner Hester Peirce’s sketch of a potential exemption from registration to allow firms to use distributed ledger technology (DLT) to issue, trade, and settle securities could have significant implications—both positive and disruptive—for regulated investment crowdfunding (Reg CF). Here's a breakdown of the potential impacts:

🔍 How the DLT Exemption Could Affect Reg CF1. Creates a Competing Capital Formation Pathway

If the exemption enables issuers to raise capital and trade tokenized securities more flexibly than under Reg CF, it could:- Draw issuers away from Reg CF, especially those seeking lower compliance burdens or faster execution

- Undermine the utility of funding portals that have invested in compliance infrastructure under Reg CF/Reg A

2. Erodes Investor Protections If Not Carefully Calibrated

Reg CF includes robust investor caps, disclosures, and portal oversight:

- If DLT-based exempt offerings don't include equivalent protections, retail investors may be exposed to higher risks without adequate guardrails.

- This could weaken confidence in retail-facing investment markets broadly

3. Undermines Level Playing Field for Intermediaries

Funding portals must:

- Register with the SEC and FINRA

- Implement anti-fraud procedures

- Adhere to strict communication guidelinesIf a DLT-based venue is exempt from similar obligations, it may function like a funding portal or ATS without having to comply with equivalent rules—creating an unfair regulatory asymmetry

4. Tokenization Could Be a Tool—Not a Threat—If Integrated

If the exemption framework evolves to support tokenized Reg CF securities, it could:

- Enable faster settlement and secondary liquidity for crowdfunding investors

- Enhance investor engagement through programmable assets, wallet integration, and smart contracts

- Lower custody costs and improve capital stack transparency

🧭 Strategic Implications for the Regulated Crowdfunding Industry

If Not Integrated:

- Funding portals may lose deal flow to lightly regulated DLT venues

- Investor confusion could rise as new platforms emerge without clear SEC/FINRA alignment

- Reg CF infrastructure could be marginalized, despite years of ecosystem-building

If Proactively Integrated:

- Portals that embrace DLT for post-issuance management or settlement could lead innovation

- Reg CF rules could evolve to explicitly allow for tokenized securities, with safe harbor language

- SEC could require exempt DLT platforms that target retail to meet Reg CF-like protections

✅ Recommendations for Industry Stakeholders and Policymakers1. Advocate for Harmonization:

Ensure any DLT exemption includes equivalent investor protection standards as Reg CF.

2. Push for Tokenized Reg CF Pathways:

Encourage the SEC to issue guidance or no-action relief for DLT use within Reg CF, especially around custodial tokens, secondary transfers, and smart contract-based compliance.

3. Monitor Market Fragmentation Risk:

Prevent two-tier markets—one regulated (Reg CF), one not—by ensuring oversight parity.

4. Participate in Public Comment:

As the SEC considers exemptive relief, funding portals, investor advocates, and Reg CF issuers should engage directly with the Crypto Task Force’s process.

🔗 In SummaryPeirce’s DLT exemption sketch is forward-looking and pro-innovation—but it may unintentionally disrupt the fragile progress of regulated crowdfunding unless protections and standards are aligned. The future could be synergistic, but only with clear boundaries and deliberate coordination.

Note: Commissioner Peirce's thoughts are outlined here: https://www.sec.gov/newsroom/speeches-statements/peirce-iismgd-050825

less -

Can you comment on Paul S. Atkins Sworn In as SEC Chairman based on the SEC Press Release and from the perspective of the crowdfunding industry? https://www.sec.gov/newsroom/press-releases/2025-68

From the perspective of the regulated investment crowdfunding (Reg CF and Reg A) industry, the appointment of Paul S. Atkins as SEC Chairman raises both opportunities and questions.

🔎 Perspective from the Crowdfunding Industry:

1. Pro-Market, Pro-Business Philosophy Could Mean Support for Capital F... more

From the perspective of the regulated investment crowdfunding (Reg CF and Reg A) industry, the appointment of Paul S. Atkins as SEC Chairman raises both opportunities and questions.

🔎 Perspective from the Crowdfunding Industry:

1. Pro-Market, Pro-Business Philosophy Could Mean Support for Capital Formation. Chairman Atkins has long championed capital formation and reduced regulatory burden, particularly through cost-benefit analysis. This mindset aligns well with the goals of the crowdfunding sector, which seeks to democratize capital access for startups and small businesses. His background suggests he may be open to expanding access to capital for both issuers and investors through mechanisms like Reg CF and Reg A+.

2. Track Record of Favoring Innovation—Positive for Fintech and Digital Asset Integration

Atkins’ role in developing best practices for the digital asset sector suggests he’s not afraid to engage with new technologies.

This could bode well for:

- Tokenized securities

- Blockchain-based cap tables

- Smart contract-based compliance —all areas that the crowdfunding industry is beginning to explore.3. Potential for Regulatory Rollbacks or Modernization

Atkins has previously pushed for greater consistency and simplification in regulation. That could open the door to:

- Raising Reg CF investment and offering limits

- Reducing duplicative state filing burdens

- Streamlining ongoing disclosure requirements

- Allowing more flexible use of SPVs and follow-on offerings4. Investor Protection vs. Market Access

However, Atkins' emphasis on cost-benefit analysis and industry flexibility may worry some investor advocates who want stronger safeguards in crowdfunding. There is a delicate balance here. The crowdfunding industry—especially responsible funding portals and associations like CfPA—will need to proactively demonstrate that investor protection and market growth can co-exist.

5. A Chance for Dialogue

Given his extensive experience across SEC leadership roles and international regulatory forums, Atkins is likely to be receptive to policy engagement. This is a valuable opening for the crowdfunding industry to:

- Push for rule modernization

- Advocate for new exemptions or refinements

- Collaborate on digital compliance infrastructure

📣 Final Thought:The appointment of Paul S. Atkins could signal a more business-friendly, innovation-minded SEC. The crowdfunding industry should engage early and often, presenting data, success stories, and constructive proposals to shape a regulatory environment that protects investors without stifling innovation. If navigated well, this could be a turning point for scaling regulated crowdfunding in the U.S. capital markets.

#regulatedinvestmentcrowdfunding

less2 -

The crypto industry talks a lot about "regulation by enforcement" in the context of the SEC? How different is that from enforcement of regulations?

The phrase "regulation by enforcement" is a critique often used in the crypto industry (and other sectors) to describe a regulatory approach where the SEC (or another agency) enforces laws and rules through lawsuits and penalties rather than through clear, proactive rulemaking. This differs from "en... more

The phrase "regulation by enforcement" is a critique often used in the crypto industry (and other sectors) to describe a regulatory approach where the SEC (or another agency) enforces laws and rules through lawsuits and penalties rather than through clear, proactive rulemaking. This differs from "enforcement of regulations" in significant ways:

1. Regulation by Enforcement

No Clear Rules in Advance: Critics argue that the SEC does not provide explicit guidelines on how crypto firms should comply with securities laws.

Legal Actions Instead of Rulemaking: Rather than issuing tailored regulations or engaging in formal rulemaking processes (such as public comment periods), the SEC takes action by suing companies or imposing fines.

Uncertainty for Businesses: Companies may not know they are violating the law until they face enforcement actions, creating uncertainty and chilling innovation.

Retroactive Punishment: This approach may penalize companies for actions they took before clear guidance existed.

2. Enforcement of Regulations

Based on Established Rules: In a traditional regulatory framework, enforcement follows well-defined rules that were developed through legislation or a formal rulemaking process.

Predictability & Compliance Pathways: Businesses know the compliance requirements in advance, allowing them to operate within a clear legal framework.

Preventative Rather Than Punitive: Regulation aims to guide compliance before violations occur rather than relying on enforcement as the primary mechanism.

Why Is This a Big Deal in Crypto?

The crypto industry argues that securities laws were not designed for digital assets, yet the SEC applies decades-old rules without providing specific new regulations tailored to crypto.Major cases, such as those against Ripple, Coinbase, and Binance, highlight how the SEC is shaping crypto regulation through litigation rather than clear rulemaking.

The SEC contends that it is simply enforcing existing securities laws, but critics say this approach forces compliance through the courts instead of creating transparent, predictable rules.

Bottom Line

less

Regulation by enforcement means creating de facto policy through lawsuits and penalties rather than formal rules, whereas enforcement of regulations implies applying already established and clearly defined legal standards. The debate is whether the SEC should issue clearer guidance or continue its current strategy of enforcement actions. -

What criteria has the SEC set for a self-regulatory organization (SRO) under Regulation Crowdfunding to oversee funding portals?

Under Regulation Crowdfunding, the Securities and Exchange Commission (SEC) has established specific criteria that a self-regulatory organization (SRO) must meet to oversee funding portals. These criteria ensure that the SRO can effectively regulate the activities of funding portals to protect inves... more

Under Regulation Crowdfunding, the Securities and Exchange Commission (SEC) has established specific criteria that a self-regulatory organization (SRO) must meet to oversee funding portals. These criteria ensure that the SRO can effectively regulate the activities of funding portals to protect investors and maintain market integrity. The key criteria include:

1. Registration with the SEC: An SRO must be registered with the SEC. This ensures that the SRO is recognized by the SEC and subject to its oversight.

2. Rulemaking Authority: The SRO must have the authority to create and enforce rules governing the conduct of funding portals. These rules should be designed to:

- Prevent fraudulent and manipulative acts and practices.

- Promote just and equitable principles of trade.

- Protect investors and the public interest.

- Facilitate capital formation.3. Compliance and Enforcement: The SRO must have the capacity to enforce compliance with its rules. This includes having procedures for monitoring the activities of funding portals, conducting investigations, and taking disciplinary actions when necessary.

4. Governance and Independence: The SRO must have a governance structure that ensures its independence from the funding portals it regulates. This includes having a board of directors or a similar governing body with a significant representation of non-industry members.

5. Transparency: The SRO must operate in a transparent manner. This includes making its rules, disciplinary actions, and other regulatory information publicly available.

6. Resources: The SRO must have adequate resources, including financial, technological, and human resources, to carry out its regulatory responsibilities effectively.

7. Conflict of Interest Policies: The SRO must have policies and procedures in place to manage conflicts of interest. This includes ensuring that the regulatory activities are not influenced by the business interests of the funding portals.

8. Record-Keeping: The SRO must maintain comprehensive records of its regulatory activities, including rulemaking, enforcement actions, and communications with funding portals and the SEC.

These criteria are designed to ensure that the SRO can provide effective oversight and maintain the integrity of the crowdfunding market, thereby protecting investors and facilitating capital formation through crowdfunding platforms.

less2 -

"Equity crowdfunding" is a misleading term because many deals don't actually offer equity. The leading industry association, the Crowdfunding Professional Association, recommends that people use the term "Regulated Investment Crowdfunding." Thoughts?

You bring up an important point about terminology in the crowdfunding industry. The term "equity crowdfunding" can indeed be misleading if it implies that all offerings provide equity stakes, when in fact, many do not. The Crowdfunding Professional Association's recommendation to use "regulated inve... more

You bring up an important point about terminology in the crowdfunding industry. The term "equity crowdfunding" can indeed be misleading if it implies that all offerings provide equity stakes, when in fact, many do not. The Crowdfunding Professional Association's recommendation to use "regulated investment crowdfunding" is a more accurate and inclusive term.

Here’s an expanded discussion on this topic:

Equity Crowdfunding vs. Regulated Investment Crowdfunding

Equity Crowdfunding

- Traditional Definition: In its original sense, equity crowdfunding refers to a method of raising capital where investors receive shares or equity in the company in exchange for their investment.

- Misleading Aspects: The term can be misleading because not all investment crowdfunding campaigns offer equity. Some might offer other types of securities, such as debt instruments, revenue shares, or convertible notes.Regulated Investment Crowdfunding

- Broader Definition: This term encompasses all types of crowdfunding that involve regulated securities offerings, not just equity.

- Types of Securities: This can include equity, debt, revenue shares, and other forms of investment contracts.

- Regulatory Frameworks: These offerings are typically conducted under specific regulatory frameworks, such as Regulation Crowdfunding (Reg CF), Regulation A+, and Regulation D in the United States, which provide different levels of oversight and investor protection.Benefits of Using "Regulated Investment Crowdfunding"

1. Clarity and Accuracy:

- The term "regulated investment crowdfunding" accurately reflects the range of financial instruments available and the regulatory environment governing these offerings.

- It helps avoid confusion for investors who might otherwise expect equity stakes in all crowdfunding opportunities.2. Investor Education and Protection:

- Using precise terminology is crucial for investor education. It ensures that potential investors understand the nature of the securities being offered and the associated risks and returns.

- It underscores the fact that these offerings are subject to regulatory scrutiny.3. Inclusiveness:

- The broader term encompasses a wider array of investment opportunities, making it more inclusive of different types of fundraising campaigns.

- It reflects the diversity in the crowdfunding space, acknowledging that companies might choose different financial instruments based on their specific needs and strategies.Examples of Regulated Investment Crowdfunding

1. Regulation Crowdfunding (Reg CF):

- Purpose: Allows smaller companies to raise up to $5 million per year from a large number of investors through an online platform.

- Securities Offered: Can include equity, debt, and other types of securities.2. Regulation A+:

- Purpose: Enables companies to raise up to $75 million per year from the public with fewer disclosure requirements than a full public offering.

- Securities Offered: Primarily equity, but can also include debt and other securities.3. Regulation D (Rule 506(c)):

- Purpose: Allows companies to raise an unlimited amount of money from accredited investors with general solicitation and advertising.

- Securities Offered: Can include equity, debt, and other types of investment contracts.Conclusion

The shift from using "equity crowdfunding" to "regulated investment crowdfunding" is a positive development that enhances clarity, accuracy, and inclusiveness in the crowdfunding industry. This terminology better reflects the variety of financial instruments available to investors and underscores the regulatory framework that governs these offerings. By adopting this term, industry stakeholders can help ensure that investors have a clear understanding of what they are investing in, ultimately fostering a more transparent and trustworthy investment environment.

less1 -

What do you think of Chat GPT's response to my query?

There is a federal exemption for Demo Days but it is useless because it doesn't preempt state law. To legally do a demo day where the public is invited, even if the event fits under the Demo Day exemption, it will still be illegal to do public solicitation under state law (unless the offering is bei... more

There is a federal exemption for Demo Days but it is useless because it doesn't preempt state law. To legally do a demo day where the public is invited, even if the event fits under the Demo Day exemption, it will still be illegal to do public solicitation under state law (unless the offering is being done under Reg CF or Rule 506(c) in which case there is federal preemption).

less -

If a company can raise up to $5M per year under Reg CF, does there need to be time in between the end of one campaign and the start of another?

Assuming you are asking about another CF round. The cap under Regulation CF is applied to a rolling 12-month period.

Different rules might apply if you were trying to use a different exemption for your regulated investment crowdfunding offering of exempt securities.

0 -

Is the SEC or FINRA a regulator for regulated investment crowdfunding?

Yes, both the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play roles in regulating investment crowdfunding.

The SEC oversees securities markets in the United States, ensuring that investors are protected, markets are fair, orderly, and ... more

Yes, both the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play roles in regulating investment crowdfunding.

The SEC oversees securities markets in the United States, ensuring that investors are protected, markets are fair, orderly, and efficient, and capital formation is facilitated. The SEC has established regulations for crowdfunding, which are designed to help smaller companies raise money while still providing protections for investors. These rules are part of Regulation Crowdfunding (Reg CF), which allows companies to offer and sell securities through crowdfunding.

FINRA, on the other hand, is a non-governmental organization that acts as a self-regulatory organization (SRO) for brokerage firms and exchange markets. FINRA is authorized by Congress to protect America’s investors by making sure the securities industry operates fairly and honestly. Within the context of crowdfunding, FINRA is responsible for regulating crowdfunding portals, which are online platforms that facilitate the offering and selling of securities through crowdfunding. Crowdfunding portals must register with the SEC and become a member of FINRA to operate legally.

Both organizations ensure that platforms adhere to the regulations set forth to protect investors and maintain the integrity of the securities market. This includes rules about who can invest, how much they can invest, and how companies can raise funds through crowdfunding.

less -

Why is CfPA recommending the industry standardize around the term "Regulated Investment Crowdfunding"?

Since the passage of the JOBS Act and the subsequent rulemaking, there has been massive confusion by the general and investing public who often conflate the activities of the regulated investment crowdfunding industry and those of rewards-based or donations-based crowdfunding platforms. Aside from m... more

Since the passage of the JOBS Act and the subsequent rulemaking, there has been massive confusion by the general and investing public who often conflate the activities of the regulated investment crowdfunding industry and those of rewards-based or donations-based crowdfunding platforms. Aside from marketplace confusion, there is considerable reputational risk that regulated entities, and the regulated industry as a whole, face by being mistaken for the activities happening in a less regulated environment and by unlicensed actors (e.g. GoFundMe, Kickstarter, IndieGoGo).

Furthermore, while admirable, the efforts by some industry participants to provide clarity through use of other terms (e.g. “online capital raising,” “investment crowdfunding,” or “equity crowdfunding”) are insufficient or, in some cases, potentially misleading.

By embracing ‘Regulated Investment Crowdfunding,’ we not only clarify our industry's scope but also underline the legal and regulatory frameworks that govern our operations.

less -

What is reg D crowdfunding?

Regulation D (Reg D) crowdfunding refers to a specific exemption under the U.S. Securities and Exchange Commission (SEC) regulations that allows companies to raise capital through the sale of securities without having to register those securities with the SEC. The regulation is part of the broader s... more

Regulation D (Reg D) crowdfunding refers to a specific exemption under the U.S. Securities and Exchange Commission (SEC) regulations that allows companies to raise capital through the sale of securities without having to register those securities with the SEC. The regulation is part of the broader set of rules governing private placements.

Regulation D provides three different rules (Rule 501, Rule 502, and Rule 503) that companies can use to conduct private placements, and one of these rules, Rule 506, is commonly associated with crowdfunding activities. Rule 506 has two variations: Rule 506(b) and Rule 506(c).

1. Rule 506(b): This is the traditional form of private placement under Regulation D. It allows companies to raise an unlimited amount of capital from an unlimited number of accredited investors (typically high-net-worth individuals and institutions) and up to 35 non-accredited investors who meet certain sophistication requirements. The company, however, cannot engage in general solicitation or advertising to attract investors.

2. Rule 506(c): This variation allows companies to engage in general solicitation and advertising to attract investors, but all investors must be accredited, meaning they meet specific income or net worth criteria. This rule provides greater flexibility in marketing and reaching potential investors.

It's important to note that crowdfunding under Regulation D is distinct from crowdfunding under Regulation Crowdfunding (Reg CF), which is a separate SEC regulation that allows companies to raise smaller amounts of capital from a larger number of both accredited and non-accredited investors through registered crowdfunding platforms.

In summary, Reg D crowdfunding allows companies to raise capital through the sale of securities without a full SEC registration process, primarily targeting accredited investors. The specific rules and requirements depend on whether the company chooses Rule 506(b) or Rule 506(c).

less