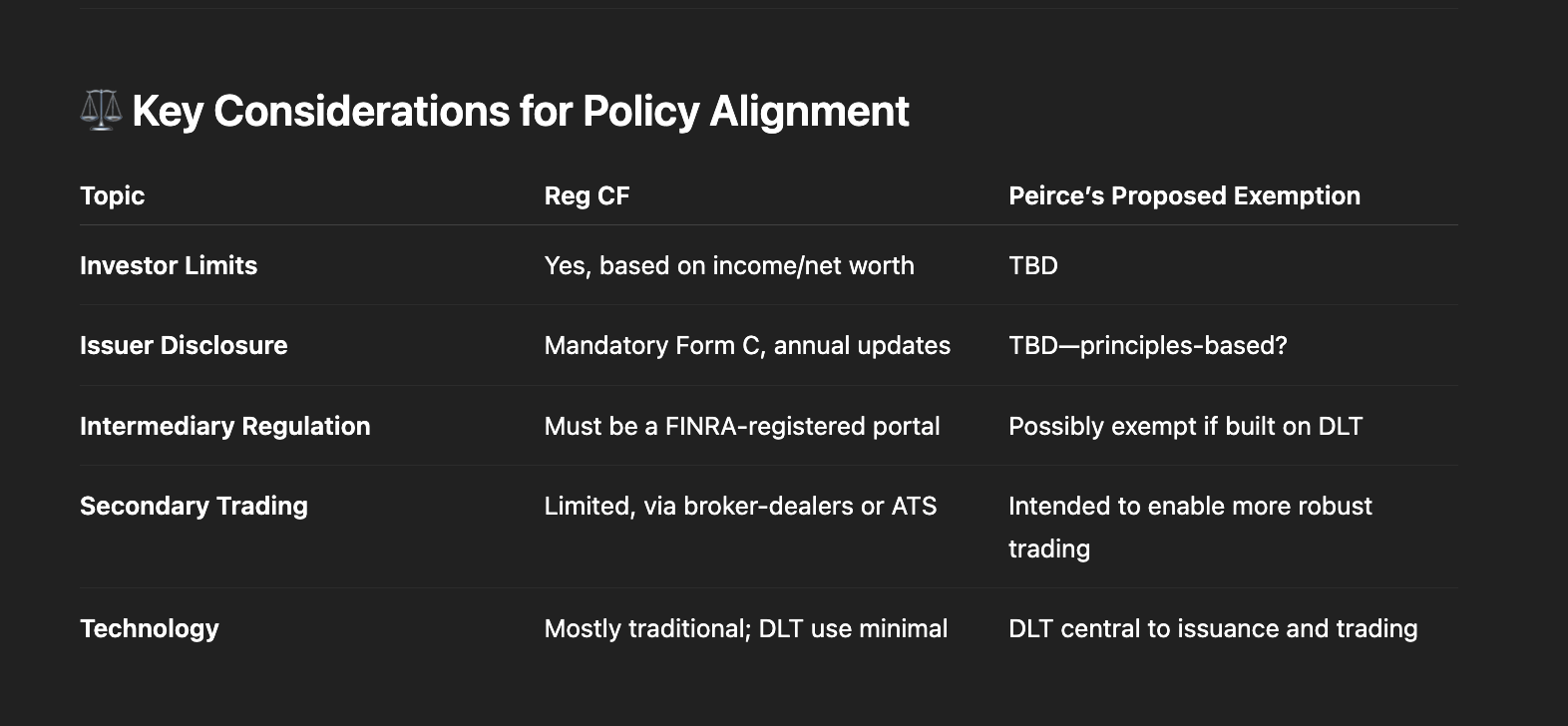

How could SEC Commissioner Peirce's sketch of an idea for a potential exemption from registration to allow firms to use DLT to issue, trade, and settle securities potentially impact regulated investment crowdfunding?

SEC Commissioner Hester Peirce’s sketch of a potential exemption from registration to allow firms to use distributed ledger technology (DLT) to issue, trade, and settle securities could have significant implications—both positive and disruptive—for regulated investment crowdfunding (Reg CF). Here's a breakdown of the potential impacts:

🔍 How the DLT Exemption Could Affect Reg CF

1. Creates a Competing Capital Formation Pathway

If the exemption enables issuers to raise capital and trade tokenized securities more flexibly than under Reg CF, it could:

- Draw issuers away from Reg CF, especially those seeking lower compliance burdens or faster execution

- Undermine the utility of funding portals that have invested in compliance infrastructure under Reg CF/Reg A

2. Erodes Investor Protections If Not Carefully Calibrated

Reg CF includes robust investor caps, disclosures, and portal oversight:

- If DLT-based exempt offerings don't include equivalent protections, retail investors may be exposed to higher risks without adequate guardrails.

- This could weaken confidence in retail-facing investment markets broadly

3. Undermines Level Playing Field for Intermediaries

Funding portals must:

- Register with the SEC and FINRA

- Implement anti-fraud procedures

- Adhere to strict communication guidelines

If a DLT-based venue is exempt from similar obligations, it may function like a funding portal or ATS without having to comply with equivalent rules—creating an unfair regulatory asymmetry

4. Tokenization Could Be a Tool—Not a Threat—If Integrated

If the exemption framework evolves to support tokenized Reg CF securities, it could:

- Enable faster settlement and secondary liquidity for crowdfunding investors

- Enhance investor engagement through programmable assets, wallet integration, and smart contracts

- Lower custody costs and improve capital stack transparency

🧭 Strategic Implications for the Regulated Crowdfunding Industry

If Not Integrated:

- Funding portals may lose deal flow to lightly regulated DLT venues

- Investor confusion could rise as new platforms emerge without clear SEC/FINRA alignment

- Reg CF infrastructure could be marginalized, despite years of ecosystem-building

If Proactively Integrated:

- Portals that embrace DLT for post-issuance management or settlement could lead innovation

- Reg CF rules could evolve to explicitly allow for tokenized securities, with safe harbor language

- SEC could require exempt DLT platforms that target retail to meet Reg CF-like protections

✅ Recommendations for Industry Stakeholders and Policymakers

1. Advocate for Harmonization:

Ensure any DLT exemption includes equivalent investor protection standards as Reg CF.

2. Push for Tokenized Reg CF Pathways:

Encourage the SEC to issue guidance or no-action relief for DLT use within Reg CF, especially around custodial tokens, secondary transfers, and smart contract-based compliance.

3. Monitor Market Fragmentation Risk:

Prevent two-tier markets—one regulated (Reg CF), one not—by ensuring oversight parity.

4. Participate in Public Comment:

As the SEC considers exemptive relief, funding portals, investor advocates, and Reg CF issuers should engage directly with the Crypto Task Force’s process.

🔗 In Summary

Peirce’s DLT exemption sketch is forward-looking and pro-innovation—but it may unintentionally disrupt the fragile progress of regulated crowdfunding unless protections and standards are aligned. The future could be synergistic, but only with clear boundaries and deliberate coordination.

Note: Commissioner Peirce's thoughts are outlined here: https://www.sec.gov/newsroom/speeches-statements/peirce-iismgd-050825

This scares the crap out of me.

Putting small issuers now using regulated investment crowdfunding into the crypto world with virtually no oversight makes them targets for fraud while exposing investors to a crazy mix of fraud, stupidity and serendipity. I will not be a player in that space.

If we can execute on the Brian Christie vision, subjecting digital assets to regulated investment crowdfunding rules, we're in business!