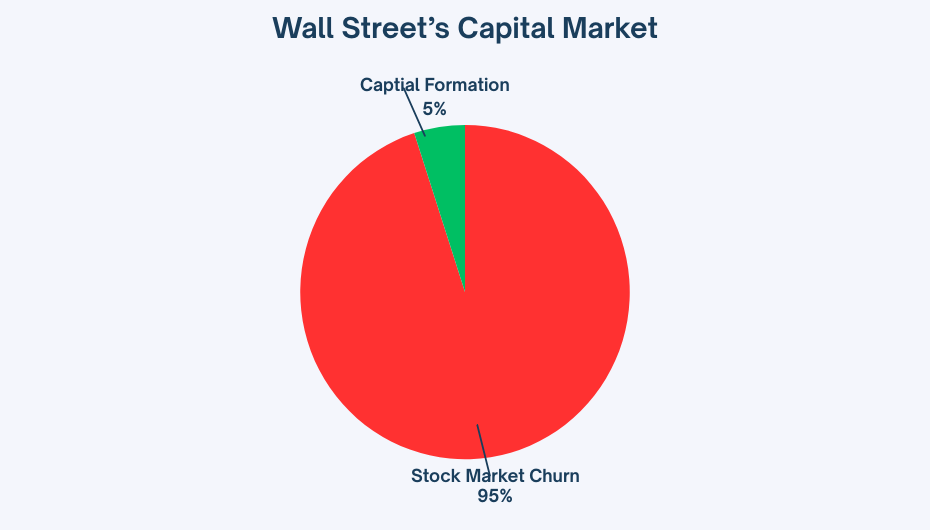

We Call The Stock Market A "Capital Market" When Only 5% Of Activity Is Actual Capital Formation.

The other 95%? Just churn. Trading that funds nothing.

$43 trillion in retirement accounts circulating through secondary markets. Zero dollars flowing to companies.

Take a look at Reg CF, the only public market where 100% of invested capital actually funds businesses creating value.

And what are we doing?

95% equity.

We're importing Wall Street's structure into the only market that's actually about capital formation.

Think about what equity actually is - it's perpetual:

▪️No lifecycle (exists forever)

▪️No return mechanism without exit or trading

▪️Becomes speculative the moment secondary markets open

▪️Drives perpetual growth pressure

Perpetual equity wasn't designed for our Reg CF productive market. It was designed for speculation.

Speculation combined with perpetual growth creates the conditions for algorithmic optimization and portfolio concentration. It's how we got the 'Magnificent Seven' dominating every major ETF.

Companies that can't or won't grow perpetually either get acquired (Ben & Jerry's → Unilever) or get displaced by those that will extract at any cost.

This is why perpetual equity drives extraction, pollution, and exploitation - even when nobody wants that outcome.

The structure demands it.

We're using investment vehicles designed for the 18th century in the 21st century.

We have the internet. We have blockchain. We can now think outside the box.

And we're defaulting to perpetual equity because "that's what everyone does."

Next up: The Securities We Should Be Using Instead

Part 1 in a 3-part series on productive market securities

Register for FREE to comment or continue reading this article. Already registered? Login here.

4

Bravo. A great way to frame productive vs speculative financial activity. RegCF as a core driver of real economic growth (invested dollars directly reach operating businesses) while capital markets largely revolve around secondary trading and wealth transfer. Sure, price discovery in the secondary markets is important, but RegCF driven growth can lead to shared prosperity. Thanks for putting some concrete numbers to this, Paul.