- Home

- Q&A

-

Crowd funding is awesome for retail investors! One challenge I would see with crowdfunding are following. How do we mitigate these? - Start up founders are more and more getting greedy with valuations with no product/proof of concept in hand. A lot of tooling is needed to provid

Both valid comments, there are a few quick answers to make the severity of these problems perhaps less worrisome:

1) the average investment in a successful crowdfunding campaign is only $96. So, the real risk vis a vis the founder's self-proclaimed valuation is not only mitigated by this avera... more

Both valid comments, there are a few quick answers to make the severity of these problems perhaps less worrisome:

1) the average investment in a successful crowdfunding campaign is only $96. So, the real risk vis a vis the founder's self-proclaimed valuation is not only mitigated by this average, but there are also caps on how much a retail investor can invest annually in crowdfunding. For instance, anyone earning under $107,000 annually, can only commit $2200 or so. 5% of their annual income. I'd say there are far more dangerous "investments" people make with far more predictably bad outcomes (hamburgers?).

2) as to how to know if other, potentially better, candidates for your money are making similar solutions available to investors, that's always hard to say, but I'd say you might reconcile "Caveat Emptor" dictates responsibility in both of these questions: "the principle that the buyer alone is responsible for checking the quality and suitability of goods before a purchase is made."

So, do your homework. I mean, you' wouldn't buy a house sight-unseen without looking over the neighborhood, checking out the schools, etc.

Great questions. Keep em comin'

less -

Hi, I have been investing through seedinvest, wefunder and republic etc. i can check my portfolio in their websites. - Is there any way i can request physical copies to prove the ownership? Or in other words, who is the guarantor for shares as i heard there can be an escro

Hi - You should contact the applicable funding portal with your request. You can find their contact information on the site and in their terms of service.

0 -

When i login to dealmaker , it doesn’t show any active/live companies to invest. Currently it shows only one company that invested. Am I missing something? Or is it by design that we always need to start from the startup company website. As deal maker is very popu, i am suspecting that i might be missing something while accessing the website. When i login to dealmaker , it doesn’t show any active/live companies to invest. Currently it shows only one company that invested. Am I missing something? Or is it by design that we always need to start from the startup company website. As deal maker is very popu, i am...

Hi - thanks so much for reaching out! We are not a 'Marketplace' where investors can shop - so that's why you don't see a variety of deals. Our SaaS is a white-labeled platform that allows a brand to raise capital on their own site - similar to how Shopify provides an eCommerce solution to bra... more

- Reg A+ Fundraising Platform

- Cap Table Management

- White Label Portal Software

-

How are Self Regulatory Organizations like FINRA financially sustained?

TLDR; "Fees & Fines"

FINRA is a purportedly not-for-profit membership based organization but their Revenue and Expenses are not easily discernible, at least not in public sources like CharityNavigator:

https://www.charitynavigator.org/ein/521959501

FINRA likely generates the vast majority ... more

TLDR; "Fees & Fines"

FINRA is a purportedly not-for-profit membership based organization but their Revenue and Expenses are not easily discernible, at least not in public sources like CharityNavigator:

https://www.charitynavigator.org/ein/521959501

FINRA likely generates the vast majority of its income from membership fee's that include a percentage of funds placed through the member firm. It's easy to guess that Goldman Sachs is the largest contributor here and your average funding portal is not.

We could probably get a good guesstimate based on the number of member firms, states registered in, and the public bragging FINRA does about the fines it levies, though the vast majority of those fines are likely procedurally levied and privately not disclosed unless you scoured the public accounting of the member firms and see if they reported them in their expenses.

FINRA also manages the Central Registration Depository or CRD (aka brokercheck) and likely gets some funding from federal and state regulators to prop it up. Ironically the OTC reporting facility is managed by NASDAQ, thus forcing firms to pay a minimum of $500/month to a "competitor" for the privilege of supplying trade data to FINRA.

Expenses could also likely be surmised based on the number of locations

https://www.finra.org/about/locations

likely rents and on the number of employees (3,600) and the average salary information which is disclosed in their rotating job posts that constantly need filling due to the high turn over rates. See Glassdoor for former employee sentiment:

https://www.glassdoor.com/Reviews/FINRA-Reviews-E108071.htm

With the year over year decline for over a decade in the number of registered reps and broker-dealers it is just a matter of time before the organization will be forced to downsize, as it is now there are more employees at FINRA than there are firms to monitor:

Your average funding portal contributes about $2,200 per year and napkin math based on the number of registered portals in good standing suggests that they probably all combined contribute a maximum of $250,000 year to the top line -- even if we generously doubled it to $500K it is clear that funding portal operations is likely losing money for the organization based on the composition and likely compensation of that group.

It is certainly true of the vast majority of broker-dealers of which some numbers suggest that up to 90% of the membership base are "small member firms" which has lead some current and former members suggesting that you'll get better treatment at your DMV than you will as an average member firm.

Most of the problems FINRA has it creates for itself, and could likely be solved with two simple changes to their operating and membership agreements:

1. Provide Model Documents for their member firms, and

2. Establish Service Level AgreementsThings I have long publicly advocated.

There is certainly room for a competitor SRO in the US, and one likely based on a cooperative model where the actual costs of operations are disclosed and fee's apportioned to members based on actual usage. Your local power company, for example, is ALSO a licensed monopoly but must obtain approval from the granting authority to set or raise rates.

At the end of the day, the SEC cannot simply offer us "choice" in the form of "do you want it or not" -- especially given the arbitrary and capricious manner in which FINRA unequally enforces the rules. The two items I called out above would go a long way to curing that and improving member relations.

-dvd

less -

Are founders putting themselves at risk if they reveal their fundraising plans on a public forum like Twitter?

Yes! It is amazing how common it is for founders to publicly pitch investments in their companies. This is not always illegal. There are some securities exemptions under which this is allowed (e.g. Regulation Crowdfunding (but with some limitations) and Rule 506(c)). But most... more

Yes! It is amazing how common it is for founders to publicly pitch investments in their companies. This is not always illegal. There are some securities exemptions under which this is allowed (e.g. Regulation Crowdfunding (but with some limitations) and Rule 506(c)). But most founders have not consciously chosen a securities exemption so they may inadvertently be breaking the law.

less -

What are the type of securities used on the top Reg CF platforms?

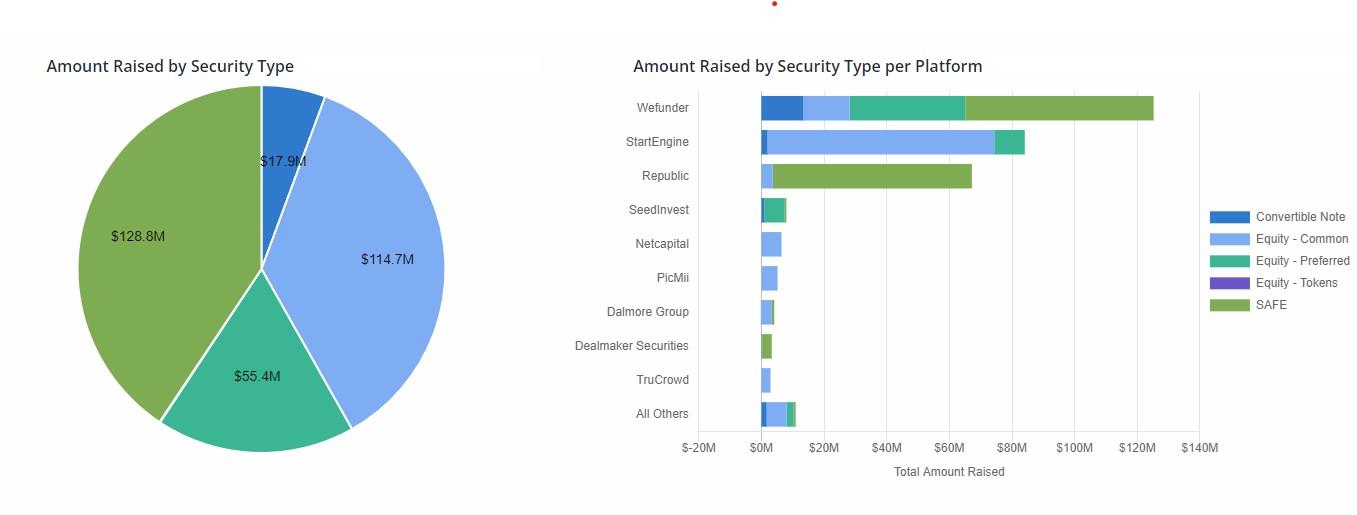

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. E... more

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

less -

Are there any helpful crowdfunding events coming soon?

Glad to learn of your interest in regulated investment crowdfunding (#RIC).

Yes, there are a few upcoming events in the space ...

SuperCrowd22 will include a Who's Who in regulated crowdfunding and will examine the intersection of crowdfunding and impact investing. It is a web-based event bein... more

Glad to learn of your interest in regulated investment crowdfunding (#RIC).

Yes, there are a few upcoming events in the space ...

SuperCrowd22 will include a Who's Who in regulated crowdfunding and will examine the intersection of crowdfunding and impact investing. It is a web-based event being co-hosted by the Crowdfunding Professional Association (CfPA), Brainsy, and many other impactful organizations September 15-16 (registration link is here: https://www.supercrowd22.com/httpssupercrowd22comtextandpercent20otherpercent20experts-register-joinpercent20thepercent20supercrowd ) For more info, follow up with Devin Thorpe

Equity Crowdfunding Week is another event that takes place a week later in person in LA (September 21-23) or online - https://www.startupstarter.co/ecw For more info, follow up with Etan Butler

Silicon Prairie Crowdfunding often hosts webinars on Wednesdays on various topics related to crowdfunding (for beginners to experienced hands) and you can see a list of their events at: https://www.meetup.com/silicon-prairie-fundraising For more info, follow up with David Duccini

Stay tuned on the CfPA ECO as CfPA often hosts events or promotes the events of members organizations.

less -

Form C-TR question on timing of filing.

Answering a question with a question: how would engaging a transfer agent reduce the number of holders of record?

-

Do you think DAOs could replace the funding portals and investment crowdfunding?

Yes to funding portals (and probably should) and no to replacing investment crowdfunding. Rather, DAOs will most likely use investment crowdfunding to fund its projects.

-

How would you define impact crowdfunding?

Great question!

Impact crowdfunding is what is happening at the intersection of investment crowdfunding and impact investing.

As you know, investment crowdfunding was authorized by the bipartisan 2012 JOBS Act. It was initially implemented in 2016 with a $1 million cap, which was increased to $5 mil... more

Great question!

Impact crowdfunding is what is happening at the intersection of investment crowdfunding and impact investing.

As you know, investment crowdfunding was authorized by the bipartisan 2012 JOBS Act. It was initially implemented in 2016 with a $1 million cap, which was increased to $5 million last year. The space is mushrooming quickly.

Impact investing is less well known to our community but is a bigger global phenomenon dominated by wealthy families and institutions. They invest money for a financial return and a social mission. For instance, a venture capitalist backing Tesla in the early days would describe herself as an impact investor. She got a huge financial return and radically accelerated a transition to electric vehicles.

Investment crowdfunding allows for impact investing in the crowdfunding space. I call that impact crowdfunding.

SuperCrowd22 is a conference we're holding on September 15-16, 2022, to help everyone learn more about the space, both from an investor standpoint and from a social entrepreneur standpoint.

Don't miss it!

http://SuperCrowd22.com

less