How are Self Regulatory Organizations like FINRA financially sustained?

UPDATE - Found FINRA's Form 990's at the IRS:

Last year available is 2018:

https://apps.irs.gov/pub/epostcard/cor/521959501_201812_990O_2020060917183283.pdf

TOTAL REVENUE: 818M

TOTAL EXPENSES: 664M

NET INCOME: 154M

NET ASSETS: -101M

TLDR; "Fees & Fines"

FINRA is a purportedly not-for-profit membership based organization but their Revenue and Expenses are not easily discernible, at least not in public sources like CharityNavigator:

https://www.charitynavigator.org/ein/521959501

FINRA likely generates the vast majority of its income from membership fee's that include a percentage of funds placed through the member firm. It's easy to guess that Goldman Sachs is the largest contributor here and your average funding portal is not.

We could probably get a good guesstimate based on the number of member firms, states registered in, and the public bragging FINRA does about the fines it levies, though the vast majority of those fines are likely procedurally levied and privately not disclosed unless you scoured the public accounting of the member firms and see if they reported them in their expenses.

FINRA also manages the Central Registration Depository or CRD (aka brokercheck) and likely gets some funding from federal and state regulators to prop it up. Ironically the OTC reporting facility is managed by NASDAQ, thus forcing firms to pay a minimum of $500/month to a "competitor" for the privilege of supplying trade data to FINRA.

Expenses could also likely be surmised based on the number of locations

https://www.finra.org/about/locations

likely rents and on the number of employees (3,600) and the average salary information which is disclosed in their rotating job posts that constantly need filling due to the high turn over rates. See Glassdoor for former employee sentiment:

https://www.glassdoor.com/Reviews/FINRA-Reviews-E108071.htm

With the year over year decline for over a decade in the number of registered reps and broker-dealers it is just a matter of time before the organization will be forced to downsize, as it is now there are more employees at FINRA than there are firms to monitor:

Your average funding portal contributes about $2,200 per year and napkin math based on the number of registered portals in good standing suggests that they probably all combined contribute a maximum of $250,000 year to the top line -- even if we generously doubled it to $500K it is clear that funding portal operations is likely losing money for the organization based on the composition and likely compensation of that group.

It is certainly true of the vast majority of broker-dealers of which some numbers suggest that up to 90% of the membership base are "small member firms" which has lead some current and former members suggesting that you'll get better treatment at your DMV than you will as an average member firm.

Most of the problems FINRA has it creates for itself, and could likely be solved with two simple changes to their operating and membership agreements:

1. Provide Model Documents for their member firms, and

2. Establish Service Level Agreements

Things I have long publicly advocated.

There is certainly room for a competitor SRO in the US, and one likely based on a cooperative model where the actual costs of operations are disclosed and fee's apportioned to members based on actual usage. Your local power company, for example, is ALSO a licensed monopoly but must obtain approval from the granting authority to set or raise rates.

At the end of the day, the SEC cannot simply offer us "choice" in the form of "do you want it or not" -- especially given the arbitrary and capricious manner in which FINRA unequally enforces the rules. The two items I called out above would go a long way to curing that and improving member relations.

-dvd

UPDATE - Found FINRA's Form 990's at the IRS:

Last year available is 2018:

https://apps.irs.gov/pub/epostcard/cor/521959501_201812_990O_2020060917183283.pdf

TOTAL REVENUE: 818M

TOTAL EXPENSES: 664M

NET INCOME: 154M

NET ASSETS: -101M

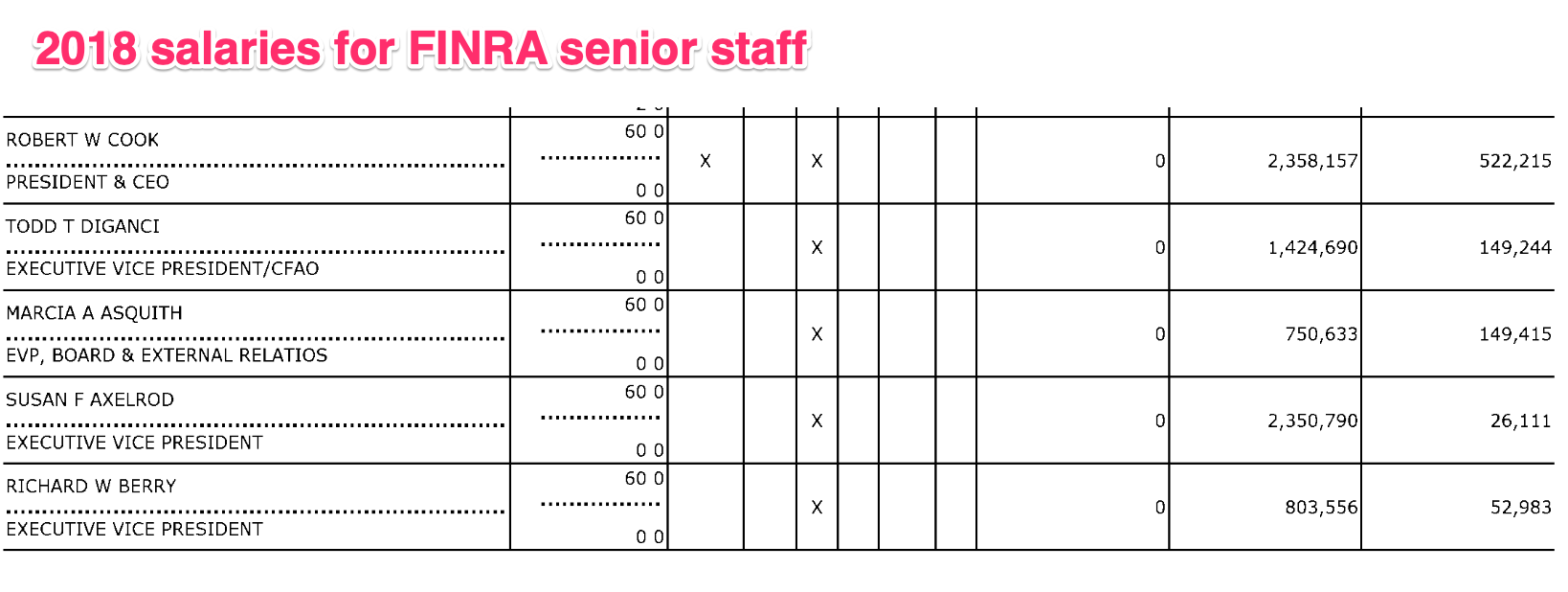

Always interesting to see the salary scale of "non-profit" organizations where the comp of the CEO is nearly $3 million / year.

Do you think a new SRO could assess fees on participating portals in the form of: "the greater of $X (e.g. $2,500) or 0.5% of aggregate volume of funds raised"?

In other words, Portal A has no transactions for the year and will pay $2,500 maintenance fee to NewSRO.

Portal B has issuers that have collectively raised $100 million and pays NewSRO $500k. Ultimately, the fees are paid by issuers who raise money on the platforms and it is passed along to the portal operators who pay to newSRO.

What does it take for a newSRO to be recognized by the SEC and given licensing authority (to operate a portal)?

Thanks for asking. I did some digging a while back and found the requirements to setup an NSA or RSA:

https://www.law.cornell.edu/uscode/text/15/78o-3

Given that FINRA is sitting on a $2B war chest of cash according to the last annual report we found (and can someone explain to us why they need this?) -- it is entirely possible and indeed PROBABLE that some of those funds could be disgorged to the new SRO given the de facto monopoly status it has "enjoyed" since it would be pretty straightforward to demonstrate the anti-trust claims investors could likely bring.

Frankly I think investors should opt into some kind of membership / insurance program like "Triple A" roadside assistance. Indeed they could ALSO be members of the new SRO having a stake in the oversight process and being able to speak for themselves regarding what is ACTUALLY harmful instead of the echo-chamber self-flagellation most regulators indulge in whipping themselves up in a frenzy on THEORIES of harm, all the while ignoring the fact that grandma is getting screwed by her family, friends, and neighbors around the kitchen table.

Just like we have FDIC insurance for main street banks and the NCUA self-insures the credit unions, and given that SIPC is a dinosaur relic, a new SRO could ALSO add in the insurance component for its members.

Given the calls for a new regime to manage the blockchain based distributed ledger economy this could be the moment to give FINRA a run for its money...

-dvd

If we narrowed the scope to just the Reg CF world + portals, what do think the staffing requirement would be to operate such an organization / this new SRO?

I think for any CF portal to survive long term they will have to either become registered as a baby broker-dealer so that they can earn commissions on REG-D and REG-A/A+ deals -- or the rules get relaxed on allowing CF portals to host those other exemptions AND collect variable success fees based on the funds raised.

Therefore I think having the membership include small firms would be of significant benefit to a new SRO.

Fundamentally the organization should be managed by its actual members, under some kind of "tour of duty" with "term limits" in place. It doesn't need a physical location per se and could be virtualized and distributed. Everyone at FINRA seems to be working from home these days :-)

Decisions, including what the consequences are for not following the rules can and should be decided by the members directly with every member having direct representation and most decisions could require a super-majority vote to pass.

In this case, a holacracy could be informative, but under the rubric of a cooperative:

https://www.techtarget.com/whatis/definition/holacracy

You bring the cash or you bring the cool. By volunteering at the SRO your firm could enjoy lower fees potentially.

-dvd

Personally I think a cooperative (COOP) model would be ideal, and have most of the functions fulfilled by a kind of "mandatory tour of duty" by the actual members.

Look no further than the way the US Navy manages knowledge transfer on it's "floating cities" where there is a nearly 100% staff turnover every 18-24 months! See Rochlin et al in:

"The Self-Designing High-Reliability Organization: Aircraft Carrier Flight Operations at Sea"

You temporarily lost me with the 18 page doc "The Self-Designing High-Reliability Organization: Aircraft Carrier Flight Operations at Sea" but after skimming it, I understand where you're going with the analogy. There's definitely room to create an innovative managerial mechanism for regulation by an SRO.

Regarding the member-run SRO, I think ongoing governance and the rule-setting (and revision) process can take place as a member-wide effort but for day-to-day staffing which is responsible for monitoring and enforcement, you need independent full time people (or a designated outside org) that are not employees of any single member / firm.

Separately, I wonder if there's a mechanism to create a SRO levy (e.g. .1% of issuer funds raised) that portals would automatically collect and pass along to the independent SRO? That's easily auditable and it provides a predictable (non-enforcement) revenue stream by which the SRO could operate.

RE: "allowing CF portals to host other exemptions AND collect variable success fees based on the funds raised." Do you think that would require a change in law or could the SEC make it happen? @Sara Hanks