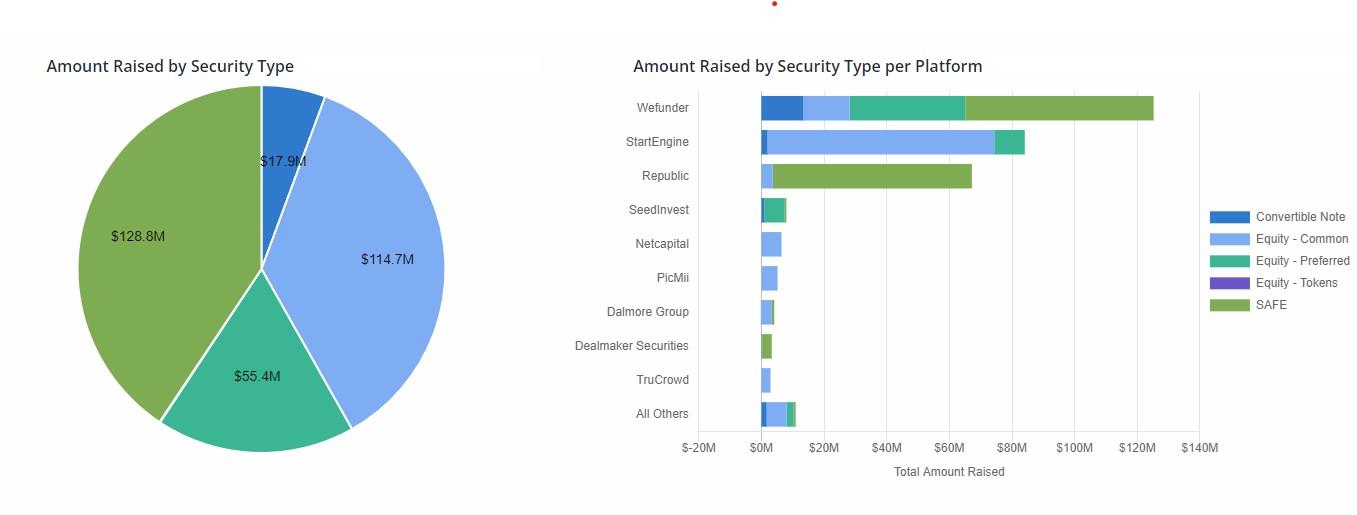

What are the type of securities used on the top Reg CF platforms?

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

Here's a direct link to the KingsCrowd source data for those interested in looking at more details around fundraising data or security types:

This is so valuable. As an investor, I'm not a big fan of SAFEs (despite having invested in several). They are a more practical version of the convertible notes that folks used before SAFEs. I do love seeing that common stock is so popular. As an issuer, I think the pitch that you get what I get makes a lot of sense!