Three steps to improve your fundraising odds by using Triangle Financing & Investment Crowdfunding.

By Samson Williams & George Pullen

Raising money for any business is hard. Raising money for Space / Aerospace businesses is even more challenging. Even when you have the investor network, stellar product and the stars in your favor, things can still go - well as things go in entrepreneurial endeavors. Despite the difficulties in raising money, new and emerging ways of finding, tapping into and receiving funding have emerged, not only for Space based ventures but also the terrestrial based ones. What are these new ways of raising money? Well, outside of Venture Capital, Private Equity and Banks what are your funding options when you want to:

- Start a business

- Scale an existing business

- Run a profitable business

Whether you think of yourself as an Entrepreneur, Small Business Owner, Founder or just a woman with a dream, you face four basic problems in business:

- How do you start a business, grow a business and make that business profitable?

- If you’ve already started a business, great. How do you grow it?

- If you have a growing business, how do you make it profitable?

- If you have paid the blood, sweat, tears and emotional currency to have a profitable business, how do you keep profit sustainable?

Well, what follows is an introduction to investment crowdfunding and how the Triangle Financing Method leverages JOBS Act equity and debt crowdfunding to simplify your capital needs.

“How does this make me money?”

We’re going to skip right to what you care about, “How does this make me money?” First a definition: “Investment crowdfunding works just like SharkTank. The “sharks” are the crowd who invests in your business.” No, that isn’t the official definition of Jumpstart Our Businesses & Startups (JOBS) Act, Title III, Regulation Crowdfunding. But for the moment, think SharkTank, where everyone of your customers and potential customers could be an investing “shark”. Depending on what SEC crowdfunding exemption is used, your business can crowdfund up to $1M using RegCf, $50M using RegA/RegA+ or unlimited funds using RegD. There are many more details to investment crowdfunding. However, now that you’re aware this option exists, you can at least consider it.

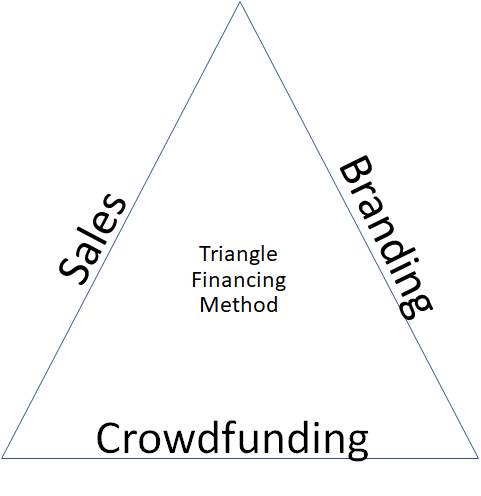

Now that you have an idea of what investment crowdfunding is, what is the Triangle Financing Method and how does it solve the four business problems you have?

- You don’t know how much starting a business costs.

- You don’t realize that you’ll spend 60-70% of the money you raise on customer acquisition.

- Raised money is not earned. You have to pay it back.

Triangle Financing Method

The starting sticker price for starting a business is $208k.

As a first time entrepreneur you’re probably thinking that this is a high number. You may even think that you can “bootstrap” it to being a unicorn. The funny part of this is that if you’ve started a startup before, you know $208k is but a drop in the bucket. After all, there is a reason that 90% of startups blow their life savings trying to start a business. In short, it's cheaper to have a $1000 a day cocaine habit ($365k per year) than it is to build a startup that on a good day has a 90%+ chance of failing in 18 months.

The price to scale a business is 100x that.

How much money do you need to start and run your startup for 18 months? Depending on where you start your startup (Silicon Valley vs the Ohio Valley) and what your business is (Satellite company vs app vs brick & mortar), you could be looking at anywhere between $208k to $4M just to start. Why such a big difference? Well, it costs a lot less to be based in Baltimore than it does to be based in New York City or San Francisco. Oh, and we should mention that this $208k - $4M means you may have a salary of $50k or less. Remember, investors are investing in starting a business not facilitating your lifestyle.

The Triangle Financing Method focuses on making businesses profitable by increasing revenue and lowering customer acquisition cost.

How much does it cost to acquire a customer? Uber spends $6B per year on customer acquisition. Why? They’re stuck in a VC funded paradigm of cash attrition and zero customer loyalty. Can your startup afford $6B a year in customer acquisition? And no, Uber is not cash flow positive. They lose about $3B a year and sometimes $5B per quarter as in June to September 2019. [March - June 2020 update: this article was originally published in Blockchain Business Magazine in December 2019. From March - June 2020 Uber lost ~$2.9B in the first quarter alone. Partially due to pandemic and partially due to zero customer loyalty]

What exactly is the Triangle Financing Method?

Step 1 - Sales. The Method focuses on ensuring the funds you’re spending on marketing, advertising and sales is used strategically. If this is your first business, you’re also going to learn that marketing, advertising and sales are three separate cost centers and that investing $60k-$80k annually on “sales” probably isn’t enough to scale your business to profitability.

Step 2 - Brand. Once you start a business, you’re committed to spending $50k-$100k on branding annually. What is your brand? That’s part of the reason you’re going to spend tens of thousands of dollars developing it. Products and services don’t sell themselves and build brand loyalty. Brands do. Brand loyalty reduces your customer acquisition cost (CAC). Your CAC is your business’ biggest unknown variable and tends to be it’s biggest cost center. Your CAC is the leading driver of why you’re not profitable and will eventually go out of business. However, a strong brand can help reduce your CAC or in some cases (e.g.: Space launches and exploration) your brand can by itself be a profit center. For instance, if you’re considering launching a satellite into low earth orbit, which brand can do that profitably, do that safely and do that reliably? Exactly, SpaceX. That is an example of how your brand can help reduce your CAC and turn your Brand into a revenue generator.

Step 3 - Investment Crowdfunding. Remember what investment crowdfunding is? Where all your customers are potential investors. Have you ever asked your customers, who love your product so much they are customers, to invest in your business? Odds are you haven’t because investment crowdfunding for your customers (including retail investors / space enthusiasts) has only been legal since May 16, 2016 in the USA. You’ve probably never heard of JOBS Act Crowdfunding because why would your bank or venture capitalist want you to engage your customers in growing your business? They’d rather lend you money at 12%-36% or require you to give them 40%-60% of your company to receive their investment. The real beauty of the Triangle Financing Method for making your business profitable is that investment crowdfunding doesn’t just help you finance your business. Crowdfunding incentivizes customer loyalty, reduces your customer acquisition, marketing and advertising cost simply by letting your customers (investors) build your brand for you. Why would an investor help spread awareness of how great their business is? Brand loyalty, aka incentivized pride of ownership. As they help the business they are invested in grow, the value of their investment goes up. Which brings us to the most important question in triangle financing and investment crowdfunding: What has a greater lifetime value?

- A venture capitalist firm who invests $10M dollars into your business ($4M-$6M that will be spent on customer acquisition) for 40%-60% equity? or

- 2000 customers who have each invested $500, for 1% equity in your business?

Reducing your risk of Failing - Investment Crowdfunding

The mystery of investment crowdfunding is that along with the Triangle Financing Method it can, when properly executed, mitigate and reduce your risk of failing. How is that?

Sales - The funds spent on marketing and advertising to increase revenue, only increased revenues by X%. Mission accomplished. Because you are going to invest funds anyway in an effort to increase sales, gain new customers and gain market share.

Branding - The funds invested in building your company’s brand only increased your market footprint by X%, hence lowering your customer acquisition cost by Y%. Mission accomplished. You were going to invest that money anyway to increase brand awareness and educate consumers about your business, right?

Customer Loyalty - Investment crowdfunding isn’t about raising money for your business. Investment crowdfunding is how you engage your customers to always be your customers. The Triangle Financing Method’s goal is to lower your customer acquisition, thereby making your business more profitable. And, how do you build a sales force of customer-investors who are passionate evangelicals for “their'' business...for free? If you fail via investment crowdfunding to achieve your hard cap (the maximum amount of money you’re trying to raise), you succeed in building a small army of incentivized, customer-investor advocates.

Crowdie Advisors and Milky Way Economy, LLC spent over three years interviewing hundreds of startups, across a range of industries, to figure out the sticker price of a startup. We did this because while 90% of small businesses fail in 5 years, no one ever tells you how much it cost to start a failed business. In addition to starting a failed business, rarely do people divulge how much their failed business cost to attempt to scale and how much was spent on customer acquisition. Meanwhile, 50%-60% of investment capital and bank loans are spent trying to acquire customers because without customers, there are no sales. No Sales = No Revenue. No revenue = Failure. We did this research to help us better help you by introducing you to the concept of the Triangle Financing Method. The Triangle Financing Method isn’t about simply financing your business. Investment crowdfunding and the Triangle Financing Method is about building your business’ base of customers so loyal, they’re out selling your business while you sleep.

Crowdfunding’s role in Capitalizing Space

Every business in the Space business is early, high risk and starving for capital. SpaceX is doing a phenomenal job of helping de-risk Space ventures, especially as it pertains to launch. However, Space is still Space and inherently early stage and high risk. However, with this high risk, comes the possibility of high rewards.

With this in mind now that you are at least aware that JOBS Act investment crowdfunding exists you can further research if crowdfunding is a viable option for capitalizing your business. To help with this here are a few questions to consider:

- Does your business sell something?

- How many customers or potential customers does your business have?

- Would they be interested in not just purchasing your goods, products or services but owning a piece of the business they’re already customers of?

- How many fans does your business have?

Capitalizing Space is hard. You may in fact have a very short list of customers for your Space business because your customers are big businesses and/or government agencies. But Space is also big. There are a lot of people and investors who are interested in Space for a variety of reasons. Crowdfunding’s role in capitalizing Space is this - it gives you the option and opportunity to gauge customers, investors and “fans” interest, while building your business. Is crowdfunding easy? No. Is crowdfunding guaranteed. Absolutely not. Are there easier ways of raising money? Not unless you have a rich auntie who was going to give you the money anyway. So what should you do? We recommend more research to weigh if Investment Crowdfunding is the right option for your business. Good luck!

Note - The hardest part of anyone’s overnight success is the first 10 years. Even when using investment crowdfunding and the Triangle Financing Method your startup or business still has a 90%+ chance of failing. We recommend focusing on making an MVP (minimal viable product) that you can sell immediately to generate revenue. The hardest dollar to make is the first one. If you can’t make the first dollar don’t worry about the other nine hundred ninety-nine million, nine hundred ninety-nine thousand, nine hundred ninety-nine.

------------------------------------------------------

Investment Crowdfunding Resources:

Crowdie Advisors - Crowdfunding Simplified, Small Business Demystified. Visit www.CrowdieAdvisors.com for more information or click here to schedule an appointment.

Space & AeroSpace Research and Small Business Advice

Milky Way Economy, LLC - Demystifying the business, financing and capital of the Space Economy. www.MilkyWayEconomy.com For business inquiries email official@MilkyWayEconomy.com

Register for FREE to comment or continue reading this article. Already registered? Login here.

0