Marketing Strategies for Raising Capital

When a company is looking to raise capital, there are many marketing strategies to get the word out. With any method, the primary goal is to convey what your company does and inform investors about the potential opportunities that their investment will create. Marketing strategies for raising capital are important to all companies and issuers.

Creating a Compelling Opportunity Set

The first step in any marketing strategy is creating a compelling opportunity set, which should position the company as a subject matter expert. A white paper can do it, which should answer all the “whys” for potential investors. It’s important to provide this information clearly and concisely, as potential investors will likely have a lot of questions. This document can serve as a launching pad for further content like blogs or videos. By providing all the relevant information upfront, companies can set themselves apart from the competition and make it more likely that potential investors will take the time ...more

Reg CF and Reg A Industry Summary - April 2023

In April 2023, the online startup investing market (Reg CF and Reg A) experienced a slight downturn, with a total of $48.3 million committed across equity and debt deals, compared to $82 million in March. Wefunder maintained its position as the top platform for dollars invested, with $20.2 million coming from equity Regulation Crowdfunding (Reg CF) offerings.

The most popular industry for the month was Business Services, Software, and Applications, which attracted $8.2 million from Reg CF equity offerings. A total of 243 equity deals closed in April, consisting of 238 Reg CF deals and five Regulation A deals.

However, the number of new deals going live saw a decline, with only 103 new deals in April, down from 146 in March. Despite this slowdown, online startup investing remains an essential avenue for businesses to secure funding and for investors to discover promising opportunities.

For detailed monthly analytics covering the Reg CF and Reg A markets, check out KingsCrowd's market an...more

Show Me the Money: How JOBS Act Investment Crowdfunding Will Shape the NIL Era for Minors, Agents and College Sports Programs

By Maureen Murat. Esq. and Samson Williams

ABSTRACT. In 2016, President Obama introduced the Jumpstart Our Businesses & Startups (JOBS) Act. Now, via the JOBS Act Regulated Crowdfunding (Reg CF) exemption, existing companies, startups and founders can raise up to $5M from retail investors in a 12-month period. In the year 2022 alone, over $494M in investment dollars was raised from 394,000 people or entities, most of which are retail investors, over 1407 offerings on Reg CF investment crowdfunding platforms, with an average investment check of $1,256.00 dollars. An additional $431M was raised from 107,000 investors using the Reg A+ exemption rules. Under the Reg A+ exemption, startups, founders and existing businesses can raise up to $75M per offering from retail investors in a 12-month period. Into this mix of startup capital we add the nuances of Name, Image & Likeness (NIL). How will Reg CF and Reg A+ investment crowdfunding impact the ecosystem of “studen...more

World Tree to Receive Super Crowd Impact Crowdfunder of the Year Award

JACKSONVILLE, FLORIDA, USA, April 12, 2023/EINPresswire.com/ -- The Super Crowd, Inc., a public benefit corporation, will present World Tree with the Super Crowd Impact Crowdfunder of the Year Award in recognition of the money raised via their Regulation Crowdfunding success and the impact on reversing climate change and fighting poverty. The award will be presented on May 10 at SuperCrowd23.

World Tree is fighting the climate emergency by planting fast-growing empress splendor trees that mature in a single decade. With support from small individual investors, the company has planted over 5000 acres, each of which could sequester over 15 metric tons of carbon annually. World Tree has raised about $4 million using Regulation Crowdfunding.

“We are thrilled to receive the award on behalf of the thousands of individual investors who have shown their belief in our model by investing their hard-earned money in World Tree’s Eco-Tree program,” said Wendy Burton, founder and C...more

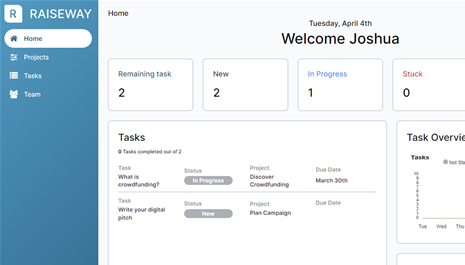

Request for Comment: Crowdfunding Task Database

Dear members of CfPA community,

What you see above is a screenshot from the pre-release draft of our system for entrepreneurs that want to go through the crowdfunding process.

We'd love to hear your feedback on it & the data sheet below, with a list of tasks involved in the Equity Crowdfunding Process. Would you be open to scheduling a time to speak to us and share your thoughts?

We'd love to hear your thoughts about & chat about potentially working together - here's the Calendly link to meet. During the call I'll show you the database. Will gladly hear your thoughts about how to make the tool better.

Best,

Peter

CfPA BoD

CEO & Co-Founder of RaiseWay

...moreYou can't stop progress. Could an industry self-regulating organization (SRO) to govern the use of AI be funded through regulated investment crowdfunding?

Part 1:

You can't stop progress. Just like our ancestors couldn't put the genie back in the bottle once they learned how to use fire, we can't slow down the adoption of Artificial Intelligence (AI). It's like trying to hold back a tidal wave with a single sandbag.

Sure, some folks might be scared of AI, just like they were scared of fire. And you can't blame them even if they ironically call themselves the "Future of Life." New things can be scary. But the truth is, we're living in a world where AI is already all around us. From our phones to our cars to our homes, it's already a part of our daily lives. And with NLP becoming more accessible every day, entrepreneurs are seeking ways to deploy it in every aspect of their businesses.

And let's face it, AI has the potential to do a lot of good. It can help us solve problems, make our lives easier, and even save lives. While some billionaires make claims that “population collapse” is a greater threat to humanity than even climate chan...more

Investment Crowdfunding Is a Powerful Tool for Building Local Capital

This post was originally shared on Superpowers for Good.

Regulated investment crowdfunding is a powerful tool for building local capital in your neighborhood or town.

There are three perspectives I’ll discuss here:

-

Investor perspective

-

Entrepreneur perspective

-

Community leader perspective

For clarity, whenever I talk about crowdfunding today, I’ll be referring to the regulated investment crowdfunding on websites like Wefunder, Republic and Start Engine—and dozens of others. I’m not talking about GoFundMe or even the popular rewards crowdfunding sites Kickstarter and Indiegogo.

That said, there may be no better way for an entrepreneur to prepare for an investment crowdfunding round than to conduct a rewards campaign. We’ll talk about that another day.

Investor Perspective on Building Local Capital Via Crowdfunding

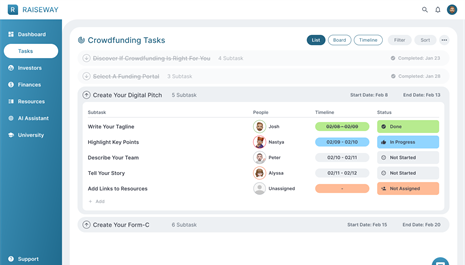

...moreCfPA Commuity's thoughts on RaiseWay's Crowdfunding Campaign Management Toolkit

Hi everyone! Together with my co-founder - Josh McSorley - and we are building a tool to make investment crowdfunding easy for businesses raising capital.

In this 3-min Loom Video I cover our task manager view.

What do you think? Thank you so much to everyone who shares their thoughts! In the next videos we can cover:

- AI Campaign Assistant

- Investor Relationship Manager

- Funding Portal Selector

Click here to join the early access waitlist here - alpha version shall be released on April 15th!

I would sincerely appreciate it if you shared this with any business looking to raise capital with crowdfunding on a tight budget.

Thank you,

Co-Founder & CEO of RaiseWay

Member of BoD of CfPA

...more

KoreConX

KoreConX

KingsCrowd

KingsCrowd

Devin Thorpe

Devin Thorpe