Who has a better chance at raising funds under investment crowdfunding - a company with a single founder or a company with co-founders?

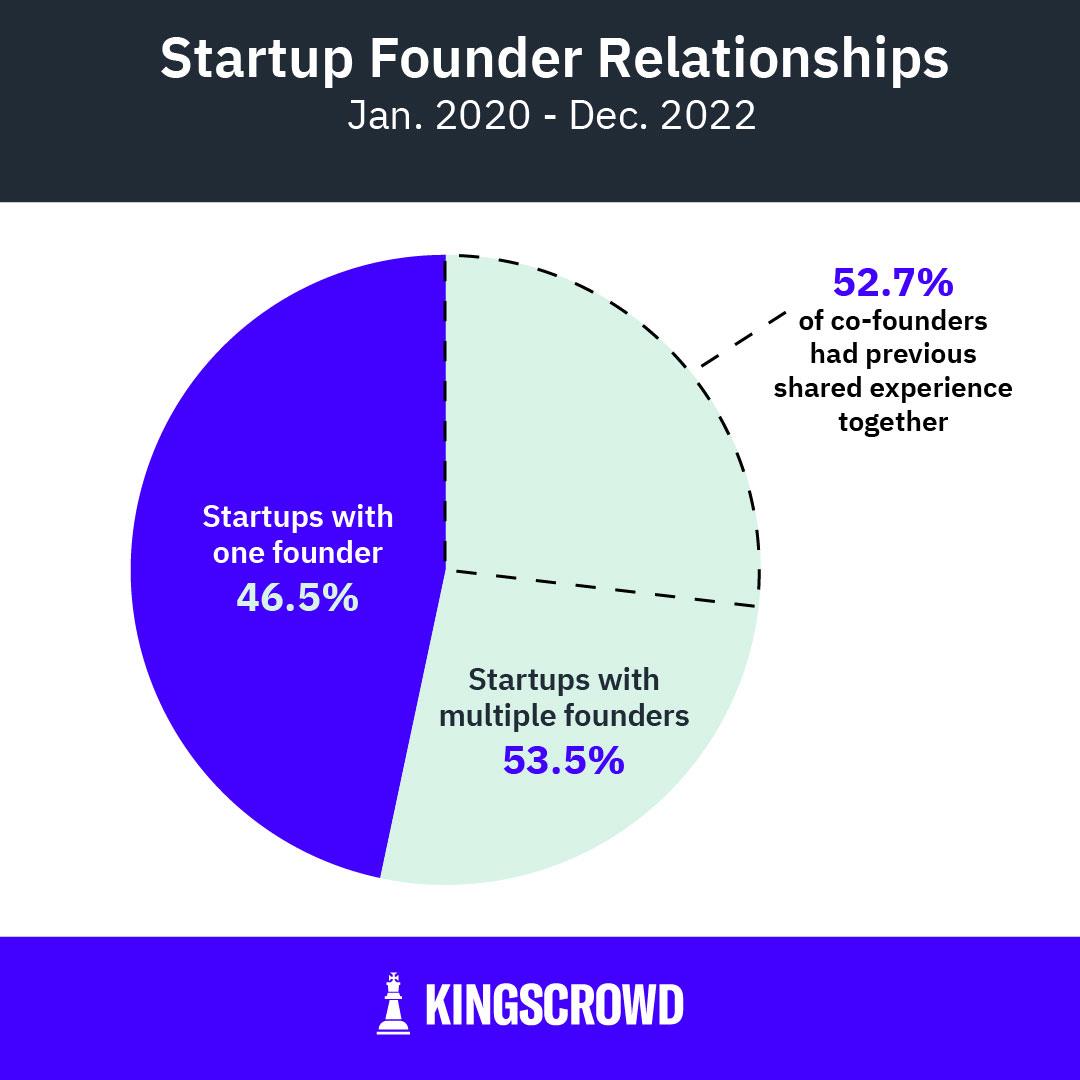

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by solo founders, while the other 53% had two or more co-founders.

With that perspective, let's look at some thinking around whether or not single founders or co-founders are more successful at raising funds.

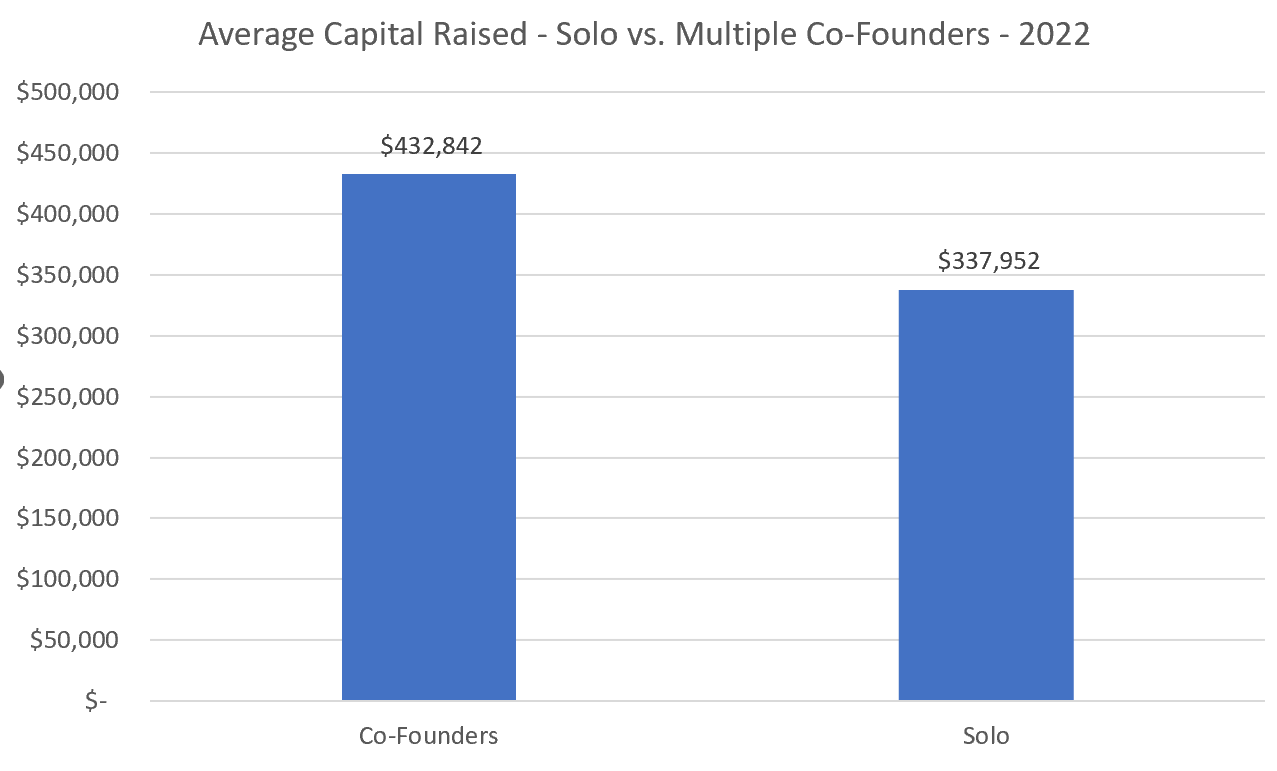

Looking at 2022 data from KingsCrowd for raises that closed in 2022, here are the average amounts raised for Reg CF campaigns (equity and debt crowdfunding):

The data shows that companies with 2 or more founders raised $433k on average, while companies with solo founders raised $338k on average. That being said, there have still been some very successful campaigns run by solo founders, so this is by no means a hard rule.

There could be reasons in the data that skewed a higher average towards companies with co-founders. For example, it could be that later-stage companies (those with revenue that tend to raise more money on average) may have been around for longer and potentially recruited additional founders to the founding team, vs. those founders who are just getting started out.

However, there could be other reasons that lead investors to invest more in companies with co-founders.

A company with co-founders may be a signal to investors that the product and mission are something that isn't just in the mind of a single individual, but something that has the potential to capture the passion of multiple founders. This could also indicate potential about one (or more) of the founders' abilities to sell the vision and the business potential to others.

Multiple founders may also be looked upon favorably by investors as a system of redundancy. Life happens and startups are hard, and it could be more reassuring to know that there are multiple founders on a team providing support to one another and encouraging each other to continue with the going gets tough.

Co-founders can also use their combined network of contacts to seek out and establish relationships with investors, which provides greater access to potential funding opportunities than if a single founder was pitching alone. Finally, many large investor groups prefer investing in companies with more than one founder because they feel it reduces risk by providing more oversight and management than an individual leader can provide on their own.

Therefore, while companies with single founders may have success in raising funds through investment crowdfunding platforms, co-founded companies may have a slight advantage when it comes to this form of fundraising.

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by solo founders, while the other 53% had two or more co-founders.

With that perspective, let's look at some thinking around whether or not single founders or co-founders are more successful at raising funds.

Looking at 2022 data from KingsCrowd for raises that closed in 2022, here are the average amounts raised for Reg CF campaigns (equity and debt crowdfunding):

The data shows that companies with 2 or more founders raised $433k on average, while companies with solo founders raised $338k on average. That being said, there have still been some very successful campaigns run by solo founders, so this is by no means a hard rule.

There could be reasons in the data that skewed a higher average towards companies with co-founders. For example, it could be that later-stage companies (those with revenue that tend to raise more money on average) may have been around for longer and potentially recruited additional founders to the founding team, vs. those founders who are just getting started out.

However, there could be other reasons that lead investors to invest more in companies with co-founders.

A company with co-founders may be a signal to investors that the product and mission are something that isn't just in the mind of a single individual, but something that has the potential to capture the passion of multiple founders. This could also indicate potential about one (or more) of the founders' abilities to sell the vision and the business potential to others.

Multiple founders may also be looked upon favorably by investors as a system of redundancy. Life happens and startups are hard, and it could be more reassuring to know that there are multiple founders on a team providing support to one another and encouraging each other to continue with the going gets tough.

Co-founders can also use their combined network of contacts to seek out and establish relationships with investors, which provides greater access to potential funding opportunities than if a single founder was pitching alone. Finally, many large investor groups prefer investing in companies with more than one founder because they feel it reduces risk by providing more oversight and management than an individual leader can provide on their own.

Therefore, while companies with single founders may have success in raising funds through investment crowdfunding platforms, co-founded companies may have a slight advantage when it comes to this form of fundraising.

Wow! We're lucky to have you and your expertise in the CfPA Ecosystem, Brian. Thank you so much!