- Home

- Q&A

-

What is the average amount that issuers spend on investor acquisition (for a Reg CF deal?)

This is a great question! @Brian Belley recently told me that the average investment via Reg CF is about $750. That suggests there is some room to budget for marketing. On the other hand, investors plopping down $100 leave very little room. I hear ranges of from 10 to 30% for marketing budgets. Usin... more

This is a great question! @Brian Belley recently told me that the average investment via Reg CF is about $750. That suggests there is some room to budget for marketing. On the other hand, investors plopping down $100 leave very little room. I hear ranges of from 10 to 30% for marketing budgets. Using 20% against the average of $750 would suggest the cost of investor acquisition is $150--far more than a common $100 minimum investment. I hope Brian or others can add more color to this conversation.

less -

Hi Sara, you come recommended as a real expert in this field. I have a question that I'm hoping you can answer. During the Testing The Waters phase, is it possible to solicit feedback from a pool of potential investors on deal terms that would appeal to them in order to determin

Thanks!

Yes, you can solicit as to what terms people might find attractive, including valuation. I would generally include a disclaimer of some kind saying that just because something has been suggested it doesn't mean that will be reflected in the deal terms if you eventually make an offering.

&nbs... more

Thanks!

Yes, you can solicit as to what terms people might find attractive, including valuation. I would generally include a disclaimer of some kind saying that just because something has been suggested it doesn't mean that will be reflected in the deal terms if you eventually make an offering.

Sara

less2 -

Hi, I have been investing through seedinvest, wefunder and republic etc. i can check my portfolio in their websites. - Is there any way i can request physical copies to prove the ownership? Or in other words, who is the guarantor for shares as i heard there can be an escro

Hi - You should contact the applicable funding portal with your request. You can find their contact information on the site and in their terms of service.

0 -

How are Self Regulatory Organizations like FINRA financially sustained?

TLDR; "Fees & Fines"

FINRA is a purportedly not-for-profit membership based organization but their Revenue and Expenses are not easily discernible, at least not in public sources like CharityNavigator:

https://www.charitynavigator.org/ein/521959501

FINRA likely generates the vast majority ... more

TLDR; "Fees & Fines"

FINRA is a purportedly not-for-profit membership based organization but their Revenue and Expenses are not easily discernible, at least not in public sources like CharityNavigator:

https://www.charitynavigator.org/ein/521959501

FINRA likely generates the vast majority of its income from membership fee's that include a percentage of funds placed through the member firm. It's easy to guess that Goldman Sachs is the largest contributor here and your average funding portal is not.

We could probably get a good guesstimate based on the number of member firms, states registered in, and the public bragging FINRA does about the fines it levies, though the vast majority of those fines are likely procedurally levied and privately not disclosed unless you scoured the public accounting of the member firms and see if they reported them in their expenses.

FINRA also manages the Central Registration Depository or CRD (aka brokercheck) and likely gets some funding from federal and state regulators to prop it up. Ironically the OTC reporting facility is managed by NASDAQ, thus forcing firms to pay a minimum of $500/month to a "competitor" for the privilege of supplying trade data to FINRA.

Expenses could also likely be surmised based on the number of locations

https://www.finra.org/about/locations

likely rents and on the number of employees (3,600) and the average salary information which is disclosed in their rotating job posts that constantly need filling due to the high turn over rates. See Glassdoor for former employee sentiment:

https://www.glassdoor.com/Reviews/FINRA-Reviews-E108071.htm

With the year over year decline for over a decade in the number of registered reps and broker-dealers it is just a matter of time before the organization will be forced to downsize, as it is now there are more employees at FINRA than there are firms to monitor:

Your average funding portal contributes about $2,200 per year and napkin math based on the number of registered portals in good standing suggests that they probably all combined contribute a maximum of $250,000 year to the top line -- even if we generously doubled it to $500K it is clear that funding portal operations is likely losing money for the organization based on the composition and likely compensation of that group.

It is certainly true of the vast majority of broker-dealers of which some numbers suggest that up to 90% of the membership base are "small member firms" which has lead some current and former members suggesting that you'll get better treatment at your DMV than you will as an average member firm.

Most of the problems FINRA has it creates for itself, and could likely be solved with two simple changes to their operating and membership agreements:

1. Provide Model Documents for their member firms, and

2. Establish Service Level AgreementsThings I have long publicly advocated.

There is certainly room for a competitor SRO in the US, and one likely based on a cooperative model where the actual costs of operations are disclosed and fee's apportioned to members based on actual usage. Your local power company, for example, is ALSO a licensed monopoly but must obtain approval from the granting authority to set or raise rates.

At the end of the day, the SEC cannot simply offer us "choice" in the form of "do you want it or not" -- especially given the arbitrary and capricious manner in which FINRA unequally enforces the rules. The two items I called out above would go a long way to curing that and improving member relations.

-dvd

less -

What are the type of securities used on the top Reg CF platforms?

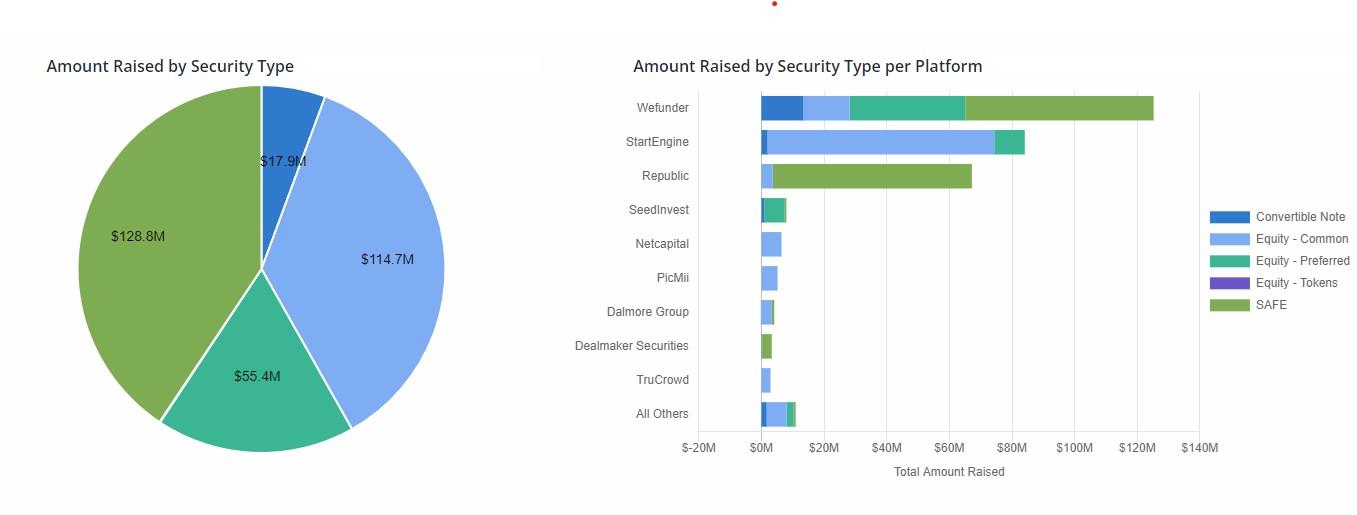

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. E... more

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

less -

Do you think DAOs could replace the funding portals and investment crowdfunding?

Yes to funding portals (and probably should) and no to replacing investment crowdfunding. Rather, DAOs will most likely use investment crowdfunding to fund its projects.

-

How much does it cost for a company to run a Reg CF or Reg A+ campaign?

This is a great question!

You should expect to spend about 10 percent of the money you raise on the costs of the offering, excluding marketing. I'd caution against spending money on marketing but remember it will take a lot of work.

Some legal and accounting costs will have to be paid before you can... more

This is a great question!

You should expect to spend about 10 percent of the money you raise on the costs of the offering, excluding marketing. I'd caution against spending money on marketing but remember it will take a lot of work.

Some legal and accounting costs will have to be paid before you can begin raising money. That would typically be at least $5,000 and could easily total 3 to 5 percent of the offering, depending on your circumstances.

The portal will also charge fees. They vary in structure and size but expect to pay 5 percent or more.

less -

What are key differences between a Crowdfunding SAFE and a "Traditional" SAFE?

For the complete answer we drafted to answer this, please read our complete blog post on Traditional SAFE vs. Crowdfunding SAFE.

A brief summary of some of the key differences include:

1. Crowdfunding SAFEs may have optional conversions: in some crowdfunding SAFEs (such as Republic’s Crowd Safe), sh... more

For the complete answer we drafted to answer this, please read our complete blog post on Traditional SAFE vs. Crowdfunding SAFE.

A brief summary of some of the key differences include:

1. Crowdfunding SAFEs may have optional conversions: in some crowdfunding SAFEs (such as Republic’s Crowd Safe), shares convert at the next equity financing round at the discretion of the issuer (i.e the startup). While most traditional SAFEs are forced to convert at the next qualified financing round, many crowdfunding SAFEs give the company the option to either convert to equity or defer conversion until a later time.

While this may sound like a bad thing for investors at first, there are situations when investors can actually benefit from this delayed conversion (e.g. they may actually experience less dilution due to follow-on raises than other equity investors).

2. Crowdfunding SAFEs may convert to Shadow Series shares: in the Republic Crowd Safe, the SAFE may convert to shadow shares, which means the same class of shares (e.g. Common vs. Preferred) as other investors, but with limited voting and information rights.

3. Crowdfunding SAFEs Investing via an SPV: When you invest in a SAFE on Wefunder, you’ll often be investing in a Special Purpose Vehicle (SPV). While this is typical for angel investors on sites like AngelList, this means you’ll actually be investing in the SPV (e.g. “Company X, a Series of Wefunder SPV LLC”), and not be directly investing in the company itself.Investing in an SPV may have potential tax implications (because the SPV is an LLC). Furthermore, investing in an SPV may have implications in terms of the potential future liquidity of that investment due to complications when listing SPV shares on a secondary market.

4. Many Crowdfunding SAFEs are still Pre-Money: while the standard Y-Combinator SAFE was changed to convert based upon post-money valuation in 2018, many of the SAFEs used on crowdfunding sites today are still using pre-money valuation for the conversion price.

5. Some Crowdfunding SAFEs may have repurchase rights: something that most VCs and angel SAFEs would never have is a “repurchase rights” or “redemptive clause”. These terms allow the company to buyback SAFE investors at the company’s discretion, which typically happens if a later-stage VC wants to “clean up” the cap table (i.e. get more control and ownership for themselves) or when the company is doing well and wants to buy out early investors. It's my personal opinion that investors should typically avoid SAFEs with these terms. These terms put the company’s best interests at odds with that of the investors’.

The good news is that I personally have not seen any SAFEs recently with these repurchase terms (although I have seen some Common Stock offerings on some platforms with repurchase rights, so be careful!). It seems that crowdfunding portals have realized that these repurchase rights often end poorly for investors and are used by issuers who might not have their crowdfunding investors’ best interests at heart.

less4 -

Can a crowdfunding portal "curate" opportunities or must they accept any company willing to list on their portal?

A platform can set parameters for the type of company and offering it will accept. And then it can (indeed, must) deny access if it believes there is potential for fraud or if the issuer has not complied with the regs. Put those together and most platforms have the ability to filter out the types of... more

A platform can set parameters for the type of company and offering it will accept. And then it can (indeed, must) deny access if it believes there is potential for fraud or if the issuer has not complied with the regs. Put those together and most platforms have the ability to filter out the types of companies and offerings they don't want to host.

less2 -

While the regulations clearly state that an issuer can't conduct a Reg CF offering on multiple funding portals simultaneously, is there anything that would prevent a potential issuer from running a Testing the Waters campaign on multiple funding portals at the same time?

Nothing in the rules prevents it although platforms could impose their own contractual requirements (eg, if you use our platform for TTW you have to use us for the actual offering).

BTW, the SEC were not actually expecting that TTW would happen on platforms! They thought TTW would be on social media... more

Nothing in the rules prevents it although platforms could impose their own contractual requirements (eg, if you use our platform for TTW you have to use us for the actual offering).

BTW, the SEC were not actually expecting that TTW would happen on platforms! They thought TTW would be on social media or on issuers' own sites.

less2

Powered by Brainsy, Inc. (Patented and Patents Pending)